Given its vast size and the fact it contains more than 20 infrastructure-hungry nations, it’s easy to see the appeal of the Eastern Europe region if you are a senior executive at a leading global market building material supplier or quarrying and construction equipment manufacturer, responsible for identifying and meeting product demand in world growth markets.

Russia, Poland, Romania, Czech Republic, Hungary and Bulgaria are among Eastern Europe’s biggest aggregates producers and consumers. According to

The

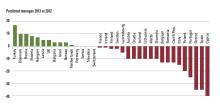

The CECE 2019 Annual Economic Report, published in March this year, noted that the Eastern European construction market grew at an ‘above-average level’ in 2018, with Russia, notably, confirming its significant increase in demand from the previous year. The positive picture in Eastern Europe was mirrored across most of the rest of Europe, with the CECE report stating that 2019 had been the strongest year for the European construction equipment since the global financial crisis in 2008/2009.

Finnish quarrying equipment giant Metso has noted that Eastern European aggregates demand is partially being fuelled by the 2017 extension into the region of roads, railways, airports and water infrastructure under the European Union’s Trans-European Transport Networks (TEN-T) projects, part of the wider Trans-European Networks (TENs), supporting the internal EU market by reinforcing economic and social cohesion.

“Most in demand are aggregates for asphalt and concrete production as well as for use as railway ballast and base material,” said Franz Zingl, aggregates sales manager, Central & Eastern Europe,

“Stationary and mobile crushing and screening units are both popular, with mobiles tending to be preferred for short-term projects. Comprehensive crushing plants are mainly used for hard rock applications, with impact crushers chosen for softer rock applications.”

Zingl said that Eastern European aggregates processing operations are reasonably sophisticated, with some exceptions linked to the level of financial investment.

Support from Eastern European national governments for their respective aggregates industries is, said Zingl, varied in terms of the number of quarrying site permissions granted and level of state-funding support.

Looking ahead, he added: “Demand for aggregates is mainly dependent on new infrastructure projects and there are a large number of projects on the table for the next decade. The financing of these projects will determine their realisation time.”

Russian aggregate producers have been working hard to help meet huge demand for raw materials to go into two of the country’s transport megaprojects.

Work on the M11, a key ₽152.8 billion (€2.08bn) 684 kilometre-highway project connecting Moscow with St Petersburg, is continuing at a decent pace. The seventh stage of the project, spanning 103km, is now opening for traffic. Building this seventh stage involved laying 7.6 million m² of asphalt and using 13 million m³ of sand. The eighth stage of the M11 highway will connect with the St Petersburg Ring Road and is around 85% complete. Should work continue to plan, the entire M11 highway was due to open to traffic in October 2019. On completion, St Petersburg will become the second city in Russia to have a highway link to Moscow, following Ufa which already has a two-lane federal highway connection to the capital.

Russia has also begun construction on a key part of the ‘New Silk Highway’. Costing around US$9.3bn to build, the 2,000km toll road will run from Russia’s Sagarchin border crossing with Kazakhstan to the border of Belarus, serving as a critical part of the keenly anticipated world-commerce game-changing China-Western Europe transport corridor.

Terex Trucks is among major articulated hauler manufacturers doing good business across the Eastern European aggregates production industry. The Motherwell, Scotland-headquartered manufacturer took on a new distributor in Russia, Moscow-based Eurasia Mining, late last year. They had previously worked as

“They’ve already taken on quite a few trucks this year,” said Paul Douglas, Terex Trucks managing director. “The Russian market is holding up.”

This magazine’s sister title, Aggregates Business International, reported in its July-August 2019 issue how the Kamchatka Peninsula in Russia’s Far East could become a hotbed for national aggregates production over the next few years. According to recent statements by several leading domestic aggregates producers and some senior officials of the Russian Ministry of Trade, the 1,250km-long peninsula would make an ideal aggregates production zone.

According to leading business market intelligence company GlobalData’s April 2019 report Construction in Poland – Key Trends and Opportunities to 2023, the Polish construction industry regained growth momentum in 2018, with output expanding by 17% in real terms - up from 6.5% in 2017. Such a rise emphasises the commercial promise for leading building material suppliers and quarrying construction equipment makers in one of Eastern Europe’s biggest countries.

Growth during the GlobalData report’s review period was said to be supported by public and private sector investment in residential, industrial, commercial and transport infrastructure projects, leading to an increase in demand for the Polish construction industry.

The industry’s output value is expected to continue to expand in real terms over the forecast period (2019-2023), driven by Prime Minister Mateusz Morawiecki and his government’s plans to upgrade the country’s transport infrastructure. A government investment of PLN40 billion (€9.18billion) is being made to develop a high-speed rail network and PLN35 billion (US$8.03bn) to construct a new hub airport under the Central Communications Port (CCP) project by 2027. Additionally, GlobalReport notes that public and private sector investments in commercial, industrial and residential construction projects are expected to support growth in the industry over the forecast period. Morawiecki’s government aims to improve energy resources and is also expected to support investment in energy infrastructure projects, which will in turn fuel growth in the industry.

Remaining in Poland, the country continues to be German building materials group giant

The group has been present in Poland, for example, since 1993. Its companies produce cement, ready-mixed concrete and aggregates, and are among the most important producers in the Polish construction and building materials market. In terms of revenue, Poland is HeidelbergCement’s largest market in Eastern Europe-Central Asia.

Górazdze Cement operates a cement plant located at Górazdze near Opole in southwest Poland, as well as a grinding plant near Katowice. The company produces a broad range of cements, both bulk and bagged, from Portland cement to various kinds of cement with slag and fly ash additives.

Górazdze is HeidelbergCement’s largest, most modern cement plant in Europe. In 2011, the clinker capacity was expanded to 3.6 million tonnes per year. In 2012, the capacity expansion project at the cement plant was completed with the commissioning of a new cement mill. The new mill is the largest ball mill in Europe and has a capacity of 1 million tonnes per year. Its cement capacity in Poland totals 6 million tonnes.

HeidelbergCement’s aggregates business in Poland operates under the brand name Górazdze Kruszywa. 18 plants located in southwest and northeast Poland supply the market with various kinds of gravel and sand. Górazdze Beton operates 61 ready-mixed concrete plants located in areas with dynamic construction sectors and potential for economic growth.

GlobalData’s May 2019 report Construction in Romania – Key Trends and Opportunities to 2023 states that construction activity in Romania was weak in 2017 and 2018, due to low public and private sector investments in construction projects, weak consumer and investor confidence and a reduction in fixed capital formation. Consequently, the construction industry contracted by 1.3% and 5.8% in real terms in 2017 and 2018 respectively.

However, on a more positive note, GlobalData expects the Romanian construction industry to recover this year, with the industry’s output expected to register a growth of 1.3% in real terms in 2019. The industry has this year got off to a good start; in the first two months of 2019, the country’s construction works index grew by 4.8% year-on-year, with new construction growing by 8.7% year-on-year.

GlobalData says this momentum is expected to continue throughout the early part of the forecast period (2019–2023), supported by a revival in public sector investments in infrastructure, coupled with financial assistance provided by the European Union (EU) to develop the country’s overall infrastructure.