Big transport infrastructure spending is creating exciting possibilities for Eastern Europe-based aggregate suppliers and quarry operators, many of whom are benefiting from more efficient production. But the Russian aggregates market remains severely depressed. Guy Woodford and Eugene Gerden report.

There’s big money being poured into Eastern European transport infrastructure, with aggregate suppliers and quarry-based equipment manufacturers set to benefit.

A huge area geographically, comprising more than 20 countries of very different sizes, the major nations in terms of tonnes/year of produced aggregate include Russia, Poland, Romania, Czech Republic, Hungary, and Bulgaria. According to the UEPG (

Saso Kitanoski,

“The investment in new infrastructure is seen by many of the region’s governments as a way to swim out of the global economic crisis. The projects include new major North to South and East to West railway projects, such as improved region-wide links to the Adriatic and Black Sea ports.

“There’s been a big growth in demand for mobile equipment to work on these projects, as they are more flexible and reduce transport costs.”

Kitanoski said authorities’ determination to drive up aggregate processing production standards, including more energy efficient production, in the Central and Eastern European region had led to increased demand for new crushing, screening and other equipment. Investment in such equipment also, said Kitanoski, offers producers more energy efficient operations and greater control of final grade material. Kitanoski notes that ‘grey aggregate’ suppliers who have been successful, particularly in the sand and gravel segment, in less regulated times, will cease to exist.

“To get an operating certificate, I think quarry operators are realising they have to be very environmentally aware. However, there’s still a long way to go. The tougher operating regulations are also having an impact in terms of reducing the number of quarries, but the remaining quarries will have to increase production, lowering the production cost per tonne of material,” added Kitanoski.

Of another more recent trend in the aggregates market, he said: “In the Eastern and Central European region there are some very strong local companies that cover 75% of the aggregates market. Then there are big international groups which have traditionally focused on construction who are now diversifying into the aggregates market.”

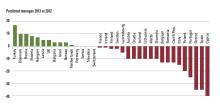

Further encouraging news for Eastern European aggregates suppliers came in the latest

An indication of the buoyancy of the Romanian aggregates market can be found in

The apparent buoyancy of the Romanian aggregates market could not be further away from the situation in Russia.

The Russian aggregates market may decline by 20% this year due to the ongoing economic crisis in the country caused by the devaluation of the ruble and the reduced purchasing power of the country’s population and businesses, according to an official spokesman for Denis Manturov, Russia’s Minister of Industry and Trade, who oversees the development of the aggregates industry in the Russian government.

Such a dire prediction has been echoed by Russia’s leading aggregate producers. Zavaly Tepsurkayev, general director of Progress, one of Russia’s largest aggregate producers, said: “The current situation in the Russian market of aggregates is very complex, which is mainly due to the current financial problems of our potential consumers, and in particular the local road building and construction companies, that do not receive sufficient funding from the federal budget. Due to this they usually ask us to provide supplies in debt, without specifying the terms of payment.

“However, the majority of Russian aggregate manufacturers often have big loans in banks, because of seasonal nature of sales of these products, so cannot simply afford long-term payment delays.”

Due to the problems highlighted by Tepsurkayev. the Russian government plans to consider a package of measures aimed at supporting the national aggregates industry. Part of these plans is the provision of state contracts for the regular supplies of aggregates for state needs, and in particular for the implementation of large-scale projects, such as building the Kerch bridge to the Crimean Peninsula and football stadiums for the World Cup in 2018. In addition, the government plans to continue subsidising the interest rates on loans provided to the country’s leading aggregate producers by Russian banks. Finally, the Russsian government plans to impose additional restrictions on the imports of aggregates to Russia, and in particular imports of those materials which are supplied from Ukraine at dumping prices.

It is planned that implementation of these measures will begin in February-March this year. According to state plans, their successful implementation should contribute to a significant improvement in the current situation of the Russian aggregates market. Time will tell if such measures will have the desired effect.

Volvo Construction Equipment is another leading quarrying and construction OEM with a strong presence in Eastern Europe.

Fredrik Gerhardsson, business director for Hub West at

“The total market in Poland had a very positive start in 2015 with a peak in June at over a third higher than the previous year. After that the positive development turned into a negative total market.”

Christian Krauskopf, another business director for Hub West at Volvo CE Sales Region EMEA, added: “We saw very good market development in the Czech Republic, Slovakia and Romania in 2015. In Hungary, however, the market has dropped from an already low level. The main driver for market growth in these countries has been EU funds – and in the Czech Republic, in particular, there has been a very good business climate with a lot of reinvestments.

“Volvo CE has performed excellently in the Czech Republic and Slovakia over the past year. Performance in Romania has also been positive, while sales in Hungary have remained flat. Volvo CE has performed especially well in the sand and gravel segment in the Czech Republic, Slovakia and Romania. Customers have been impressed by the quality of our machines as well as the level of service support available. In the Czech Republic, in particular, customers have many expectations from their machines, which are typically of a high specification. At Volvo CE we are well placed to meet these expectations.”