The aggregates industry in Eastern Europe is once again among the front runners in global recovery, writes Julie-Anne Ryan.

Latest figures from recent years vary from country to country depending on individual organisations, but from forecasts showing a worldwide expansion through to 2017 of 5.8% a year to 53.2 billion tonnes, Eastern Europe is expected to register faster growth than many.

Business in the region is booming, driven by the shortage of living space, which is expected to nearly triple over the next 20 years in Russia alone. Put together, the markets of Eastern Europe, Western Europe and North America are projected to expand between 3-5%/year through to 2017.

The growth in demand will be driven by the general recovery from financial and fiscal crises, creating a rebound in residential, commercial and public works construction.

Eastern Europe and North America will record slightly faster growth than Western Europe during the 2012-2017 period. Among others, Heidelberg is predicting a continuing weak development of the economy and resultant demand for building materials.

The Eastern European construction materials market had total revenues of US$42.1 billion (€31 billion) in 2012, representing a compound annual growth rate (CAGR) of 0.2% between 2008-2012, according to Marketline.

The sand, gravel and others segments were the market’s most lucrative in 2012, with total revenues of $29 billion (€21.5 billion), equivalent to 68.8% of the market’s overall value. The performance of the market is forecast to accelerate, with an anticipated CAGR of 11% for the five-year period 2012 - 2017, which is expected to drive the market to a value of $71.2 billion (€52.6 billion) by the end of 2017.

The latest UEPG (

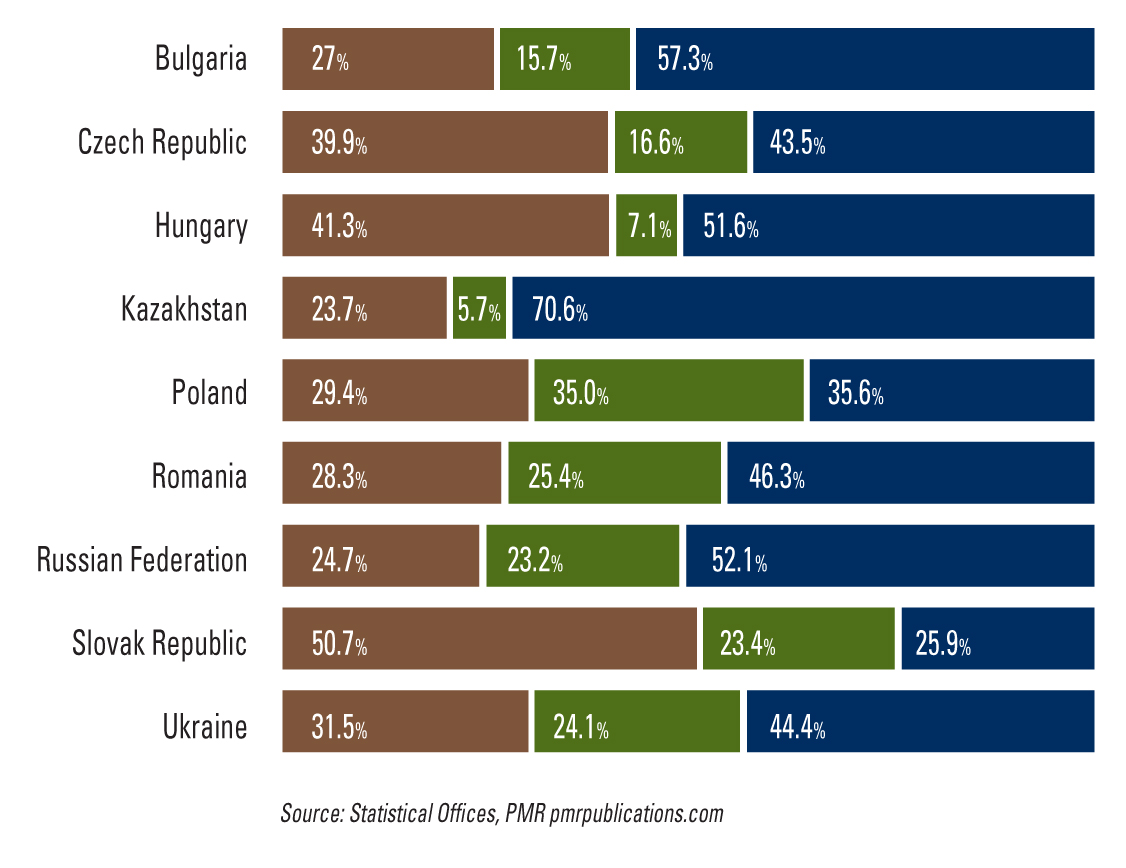

Poland produced a record total of 230 million tonnes of aggregates in 2011: commercial construction projects now have a 60% share of total aggregate consumption. Infrastructure construction accounts for 30% while 10% is held by other construction sectors. Only 4% is imported.

Major road schemes planned for the country over the next few years will push aggregates demand up by an estimated 20% for that period. Between 2012 and 2015, the construction of public roads and rail routes will use about 190 million tonnes of aggregates and 200million tonnes of earth masses, rock and other materials for embankments, access roads and driveways associated with the projects.

One of the largest reserves of raw material for the production of crushed stone, owned by DSS Group, is in Pilawa Górna in Lower Silesia. Aggregates produced by DSS are mainly used as the base material for the mass production of asphalt, foundations and concrete, and it is also one of the main suppliers of aggregates for the construction of the A1, A2 and A4 highways.

Growth is also reflected in the machinery side of the building materials industry, with demand especially strong in the emerging markets, including some countries in Eastern Europe and some of the former Soviet republics.

DSS, for example, is now using a

Only the second machine of its type in Europe, the latest Zaxis large excavator has already made a positive impression in Lower Silesia. It has been installed by DSS to help reduce costs and increase productivity.

And at a new aerated concrete factory in the Ukraine, systems manufacturer Masa of Porta Westfalica has increased daily output at the factory in Dnepropetrovsk from 1,000m³ to 1,400m³.

In the last decade, the company has invested €131 million in the Serbian market.

And Correct Beton of Slovakia has received an Environmental Impact Assessment (EIA) approval for its mobile concrete plant project, to be built in Bratislava’s borough of Devinska Nova Ves. The project prompted protests from local residents and activists, as the plant is to be built just 250m from residential buildings. The EIA has said that annual concrete production must be limited to 71,460tonnes and the company must build a noise barrier or a wall of trees on the southern part of the plant’s premises.

As always, individual figures show ups and downs across the region.

Holcim reports that sales of cement and clinker in the first nine months of 2013 in Romania fell by 2.4% compared with the same period in 2012 but sales rose by 15.5% in Bulgaria in the same period.

According to Ivan Andreev, the executive director of Bulgarian mining chamber BMGK, mineral resource production in the country fell by 7% year-on-year in 2012, equivalent to a drop of 6.28 million tonnes. Most mining sub-sectors saw declines in output, with the exception of natural stone materials which was up by 10%, and metallic mineral resources which rose by 1%. Total mineral resource production for 2012 reached 85.654 million tonnes. Total value of production rose by 7.1% to reach €1.52 billion.

Portland cement production in Kazakhstan has increased by an impressive 63% over the past three years, with further growth due.

According to research organisation PMR, the construction industry has been one of the key drivers of the Kazakh economy over the past decade. The growth rates have largely been due to the residential construction sector plus state-funded infrastructure development plans and projects implemented within the State Programme for Accelerated Industrial and Innovative Development for 2010-2014, which predicts the implementation of 872 investment projects at a total cost of about $76 billion (€56 billion).

Total annual output capacity of Lafarge enterprises in Ukraine is more than 7 million tonnes of raw materials, yet in 2012 company sites in Ukraine sold 4,545,718 tonnes of aggregates.

Figures from PMR state that the construction industry in Ukraine generally will decrease significantly in 2013: in January-October 2013, an increase in construction activity was observed in only six of the 27 administrative areas of Ukraine. During the period, construction output plummeted 15.1% year on year in real terms.

The contraction was mainly within the civil engineering construction segment, which tumbled 20.1% year-on-year. The non-residential construction segment also performed very poorly, with output falling 16.9% short of that achieved during the first ten months of 2012. Nevertheless, the residential construction segment managed to post an 8.8% year-on-year growth.”

The pendulum of positivity swings again when we look at Russia, where the National Association for Pricing and Value Engineering reports that average wholesale prices for ready-mix concretes and mortars grew 2.9% in 2013. Prices for sand grew 7.5% and those for crushed rock 7.2%. Cement prices grew 1.5%, and walling materials 10.1%.

Quantifying the productivity of Eastern Europe as a single entity is notoriously hard: it comprises more than 20 countries of very differing sizes, and the UEPG publishes figures for just nine of them.

Individual countries and individual companies are less than uniform in their reporting. But the overall picture remains optimistic, with much more good news than bad.

Cat loader’s 100,000 hours

A

Assarel-Medet is the largest Bulgarian company for open pit mining and processing of copper ore, provides around 50% of the national production of copper and processes around 13 million tonnes of ore/year.

The Cat 992D is now displayed in the Assarel Medet museum, being replaced by the latest Cat model, the 134tonne 993K.

During its 18-year productive life the 992D followed a strict maintenance programme to the manufacturer’s recommendations using genuine parts and components. It loaded an estimated 61.8 million tonnes of ore, and underwent overhauling of the powertrain, engine, and torque converter.

“When the 992 was first introduced in 1968, it was intended to last through multiple engine lives but we did not envision it delivering 100,000 hours of service. It is testament to a very good maintenance programme by both Assarel-Medet, our customer and Eltrak Bulgaria, the Cat dealer, that this 992D has reached this milestone,” says Randy Aneloski, Caterpillar marketing specialist for large wheeled loaders.