In comparison to many of the more established markets around the world, Romania appears to have a general optimism among Eastern Europe’s aggregates markets, writes Julie-Anne Ryan.

Alongside the Africa/Middle East region, it was expected to see significant growth in construction aggregates consumption in the near future. But it’s slow in coming.

Within Eastern Europe, the construction materials market brought in US$34.6 billion (€26 billion) in 2011, representing a compound annual growth rate (CAGR) of 4% between 2007 and 2011, according to a Marketline report.

The sand, gravel and other aggregates segment was the market’s most lucrative in 2011, with total revenues of $24.2 billion (€18.4 billion), equivalent to 69.8% of the market’s overall value. Currently in a predicted period of acceleration, the market is expected to rise to $60.8 billion (€46 billion) by the end of 2016.

The

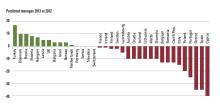

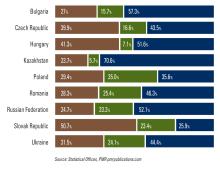

Romania sat just sixth from the bottom of the UEPG table of predicted tonnages for 2011 compared to 2010: while some countries returned to economic growth, most were expected to suffer further declines. And it was above only Serbia in aggregates production in 2010 in Europe.

Latest figures show that Romania had a total production of 49 million tonnes (out of the 3,680 million tonnes for EUPG members).

There are 430 producers working out of 735 extraction sites, turning out 34 million tonnes of sand and gravel, and 15 million tonnes of crushed rock. A relatively small producer, the country does not recycle or manufacture aggregates.

A period of appalling weather seemed to join forces with the generally gloomy economic background to result in a 0.2% decline in the Romanian cement market in 2012, and there appears to be no improvement so far this year.

Infrastructure investments and better use of EU funds might result in some small growth by the end of the year, though the large annual increases of eight to ten years ago will probably never return, according to key players such as Carpatcement.

General director Florian Aldea was quoted as saying that “a moderate yet stable and constant growth rate of about 1-2% per year is achievable”.

In 2011 Carpatcement had a turnover of about €187 million, and in 2012, a cumulated turnover worth €195 million. In 2012 it achieved a net profit of about €36 million.

Daniel Bach, general director at

In addition to infrastructure developments, logistics parks and office space projects also fuelled the construction market last year and should continue to do so in 2013. But Romania’s Business Review also states: “As for manufacturers pinning their hopes on infrastructure developments, there have been few positive signals from the government. The Ministry of Transports has a 40% higher budget this year (about €1.6 billion) but this does not mean more money for investments.

“The funds necessary for the majority of this year’s road, highway, railways and subway investment projects will be, or more likely, should be, mostly EU money. This does not leave room for a lot of optimism considering that in the six years since joining the EU, Romania has managed to absorb a meagre six per cent of the over €4.5 billion available from the EU for transport projects.”

Holcim Romania recorded a loss in 2012, its first annual loss in ten years, despite the fact that it reported that sales of aggregates rose in Romania, and the group companies in Romania, Croatia and the Czech Republic increased sales of ready-mixed concrete.

The €8.67 million (RON 37.70 million) deficit is said to be due to a rise in costs. The company’s turnover amounted to around €218.12 million (RON 948.70 million), similar to 2011.

“Even if we managed to post the same turnover as in 2011, we faced cost increases which eroded our profit margin. We also had to close down some operations,” says Daniel Bach.

Holcim Romania has two cement plants in Campulung and Alesd and one grinding station in Turda; 19 ecological concrete stations; five aggregate plants and a cement terminal in the capital Bucharest.

Indeed, the group recently announced that Romanian Costin Borc will be the new CEO of its Romanian subsidiary, replacing Sonia Artinian, recently appointed deputy general manager, organisation and human resources within the group.

Costin Borc is the first Romanian to lead the French company’s local operations in the last 16 years. Between 2008 and 2013, he was CEO of Lafarge Serbia.

Borc started his career within Lafarge Group in the US and afterwards, he managed the concrete and aggregates division of Lafarge Romania for four years. In April, 2006, he was promoted regional director of development and strategy on the cement business.

Lafarge Group has been active on the Romanian market since 1997 and operates three integrated business lines: cement, aggregates and concrete. The company has 40 industrial sites across Romania and 1,000 employees and collaborators.

Lafarge Romania has invested €2.99 million (RON 13.70 million) to increase the waste co-processing capacity of its cement factory in Hoghiz, Brasov County.

The organisation currently operates two cement factories at Hoghiz and Medgidia and a grinding station at Targu Jiu. In 2011, Lafarge Ciment recorded a turnover of over €39.34 million (RON 180 million) and a net profit of €9.35 million (RON 42.5 million).

The company’s annual report from 2012 reveals positive volumes trends across all activities, with notably an increase in cement sales volumes of 7%. But the first quarter 2013 report states that “in Romania, the construction market was marked by constrained financing of infrastructure projects, high inventories in distribution channels and adverse weather. Cement volumes were down 10% in the quarter.”

Lafarge’s involvement in environmental projects such as the quarry restoration at Matasaru-Fusea is a big part of future business. Thirty years ago this site was the biggest sand and gravel operation in Romania, providing materials for what is now the Romanian Parliament building (People’s House), the second-largest building in the world after the Pentagon.

Rehabilitation work on the quarry started in 2009 on the first section and Lafarge plans to carry on, section-by-section over several decades, hand-in-hand with its partner WWF Romania.

Jim Rushworth, Lafarge vice president environment and public affairs, quarries, aggregates & concrete, explained that any operation near a watercourse must be managed correctly to avoid negative impacts on the ecosystem or surrounding communities. A comprehensive restoration project does more than mitigate harm, it adds value.

“The good thing about restoring a sand and gravel pit or a quarry is that quite often it doesn’t require a significant amount of money,” he says on the project’s website.

“By working with an NGO that understands the local biodiversity, you can create significant improvements just using the equipment on site. It also really boosts the morale of the people at the quarry, because they can see that the area that was extracted has now become a beautiful place, with forests or wetlands. As we get more examples of what can be done and the benefits it creates, I believe Lafarge can encourage greater interest in the environment within our industry.”