As the top aggregates producer in Europe, Germany is making the most of its strong position to ensure that it continues to lead the way out of the recession. Industry commentators agree that the overall economic prospects still look positive and that the improving employment situation plus favourable financing conditions are helping to incentivise home ownership, which can only be good for Germany’s historically healthy construction market. (Existing buildings, however, still account for more than 75% of that).

The national aggregates federation, MIRO, represents more than 1,300 individual operators (most of them micro businesses with fewer than ten employees) running a total of about 2,100 extraction sites. (In 2011, MIRO, Germany’s Aggregates Federation, amalgamated with BKS, the German Sand and Gravel Association, to offer a single voice for the German aggregates industry).

The main products are primary raw gravel/sand, of which about 253 million tonnes (a growth of 10.5%) were produced in 2011, and stone, at 229 million tonnes (+10.1%). Together these alone represented about €1.5 billion.

Industries other than construction, such as iron and steel production and processing, glass and ceramic industries, chemicals for example, also consumed about 10.5 million tonnes of quartz gravel/sand, as special products, namely glass sand, foundry sand, Klebsand, quartz filter sand, quartz sand and quartzite flour.

Figures from 2008 show that there were 192 million tonnes of mineral construction waste, of which 107.3 million tonnes were soil and stones; 58.2 million tonnes of rubble; 13.6 million tonnes in road construction, 12.4 million tonnes of construction waste and 0.5 million tonnes of gypsum-based construction waste.

From 107.3 million tonnes of excavated soil, dredged material and ballast, about 8.9 million tonnes (8.3%) of recycled building materials were produced. Of the 58.2 million tonnes of rubble 44.4 million tonnes were recycled (76.3%); of the 13.6 million tonnes in road construction 13 million tonnes (95.6%), and the 12.4 million tonnes of construction waste was recycled to 0.3 million tonnes (2.4%).

Miro’s latest report shows that in 2011/2012, there were 66.6 million tonnes of recycled building materials, accounting for 12% of aggregate demand.

In 2011 there were around 2,250 sand and gravel quarry and recovery sites and about 910 for natural stone.

The number of employees decreased slightly in these two areas from 16,000 to 15,800 (-0.6%) and from 11,300 to 11,000 (-2.7%) respectively.

The average operating revenue, however, rose in gravel and sand by 11.7% to 112,300 tonnes per plant and in natural stone by 12.8% to 251,600 tonnes.

The workforce averaged seven (gravel/sand) and 12 (stone) employees per plant.

The current German housing market forecast from the Federal Institute on Building, Urban Affairs and Spatial Development (BBSR), predicts a rise in completed dwellings from 180,000 in 2011 to 271,000 between 2020 and 2025.

Some of the main players differ in their views about the future, though.

But in its latest annual report,

“Mounting price pressure in the larger urban centres of Holcim Germany’s home market in the north of the country impacted on ready-mix concrete deliveries. This prompted the group company to restructure its ready-mix operations and enter into new partnerships.

“Following the buy-out of some remaining minority shareholders, Holcim Germany is now a 99.7% group subsidiary. The sister company in southern Germany reported a downturn in deliveries of aggregates as well as ready-mix concrete.

“A year-on-year decline in results was reported, most notably by the group companies in Switzerland (owing to lower volumes in the face of imports), the UK, Belgium, Germany and Hungary.”

Holcim is transferring the ready-mix concrete business in northern Germany to joint venture partners in which the cement company holds a 50% stake. They are Fertigbeton von Saldern, TBN Transportbeton Nord and Happy Beton.

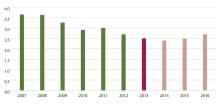

More positively, the VDMA (the German Engineering Federation) issued its economic report, which pointed out that the nation’s construction equipment and building material machinery industry generated €12.5 billion in turnover in 2012. This does reveal a nominal decrease of around 1% compared to 2011, but the report says that after having seen an upturn following the 2009 economic and financial crises, the industry is now “moving sideways on this decent level.”

Johann Sailer, chairman of the Construction Equipment and Building Material Machinery Association within VDMA, said that: “Although, on the whole, times are difficult, last year was a good year for our industry.”

He also predicted that 2013 will not see any peaks either, although companies throughout the industry are currently full of confidence as

The mining section at bauma will be larger than ever, with almost 700 companies showcasing their products and solutions, up from just over 600 companies in 2010, and including products and techniques for deep drilling, tunnel driving and mining in general.

The last bauma, in 2010, attracted 3,256 exhibitors from 53 countries, and over 420,000 visitors from more than 200 nations. With a total of 555,000m² in 2010, it is the largest trade show in this industry in the world.

Its siting in Munich this year reflects the confidence throughout the German market, and the organisers state that the mining sector is actually defying the recent and general downward trend in the construction industry.

VDMA says that since 2007, sales of mining equipment have increased annually by an average of 13%.

VDMA chairman, Dr Paul Rhinelander, said: “We are among the few sectors in Germany that have grown throughout the crisis.”

The reasons are the rising demand for raw materials and the high quality of the products.

The VDMA also welcomed the commodity partnerships agreed with Mongolia and Kazakhstan, intended to protect not only the supply of raw materials in Germany, but also to strengthen equipment sales in these countries. Similar agreements with Australia, Chile and Canada are planned.

The VDMA also expects a sales growth of 5% in building materials, particularly precast concrete, and in construction equipment.

Dr Rhinelander said that this was not least because projects among member companies will close 2011 with sales up 32% to around €5 billion, the best year in its history.

“For us this is an absolute record, which we are looking forward enormously,” he said. “We’re one of the few industries in Germany, which have managed throughout the crisis to continue to grow.”

He sees the world’s growing demand for commodities, especially from the more developing emerging markets, as the reason for this growth.

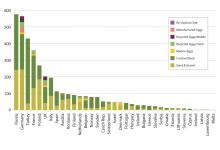

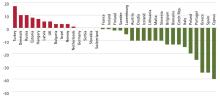

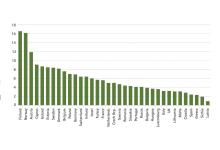

According to the UEPG (

The association’s latest report says gloomily that the “hoped-for return to European growth is proving extremely elusive. The verbally reported trends of early 2012 unfortunately also continue to be negative in many countries.”