Companies involved in Germany’s aggregates industry, Europe’s largest, are looking to 2016 with optimism. Patrick Smith reports.

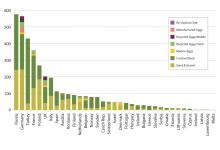

Germany is Europe’s largest producer of aggregates with an annual demand of 500 million tonnes of gravel, sand, silica sand and natural stone products.

The industry has in the region of 1,600 companies with approximately 3,200 plants and 27,000 employees, and its main customers are contractors and construction materials producers. However, other sectors of the German economy from IT hardware production to pharmaceutical industries also rely on mineral resources producers.

According to

The expanded MIRO, a single voice for the German aggregates industry, was created in July, 2011, when the organisation merged with BKS, the German Sand and Gravel Association.

In its 2013-14 annual report, MIRO says the fact that demand from domestic sources for aggregates often involves travelling short distances is a major economic advantage. It is also an ecological advantage as the demand for raw materials in a particular region can be met by production in that region, with rock companies producing only what is necessary.

According to calculations by the Federal Institute for Geosciences and Natural Resources (BGR) and the German Mineral Resources Agency (DERA) the extraction of minerals annually takes up “barely 0.004% of the used total area of Germany. And, unlike many other types of land use is the extraction of raw materials is only a temporary requirement.”

MIRO points out that after completion of the extraction, there are a number of uses to which quarries can be put. In many cases the decision will be in favour of conservation.

“Thus, in the past 15 years, backed by professional support, more than 3,000hectares of former mining areas, mainly inspired by nature, have been re-integrated into the landscape. Also numerous charming recreation areas owe their creation to the former extraction of raw materials.”

The organisation says that today the extraction of raw materials from stone quarries and gravel pits no longer has anything to do with the shovel and hammer-breaking job of former times.

Now companies are using high-tech extraction and treatment methods with geophysics, GPS, intelligent machines and plant control, and largely automated processes to deal with shipment and invoicing.

Major manufacturers of quarrying equipment such as crushing and screening equipment; wheeled loaders and excavators and dump trucks, are already well established in the market, and a good example of this can be seen at the Schwinger Granit quarry at Nittenau, Regensberg, south-east Germany (see report next issue).

The family-owned quarry produces 1 million tonnes of material each year, and employs a big fleet of

Atlas Copco equipment is used during the blasting process while

“We do a lot of monitoring using Caterpillar’s VisionLink and we look at the results every day. If weekly targets are achieved, our team gets a special dinner as an incentive,” says Jörg Schwinger, director.

Another company, Feess Urdbau, is one of the major C&D waste recycling companies in the Stuttgart region of Germany. Its Kirchheim plant is involved in the CANDY (CompAct, highly mobile, Next generation, CD&E waste recoverY system) project, a partnership between

Recycling a variety of products, including aggregates, sand and railway ballast, the site uses developments from CDE which include the feed arrangement to the plant; enhanced mobility; reduced plant footprint; improved maintenance access, and developments at the sludge management stage of the process. These were seen at the company’s recent Open Days Event at the site, where the CDE plant has been operating for the last 18 months.

However, notes of both optimism and caution are sounded in the latest report from the

German construction equipment manufacturers are more optimistic at the mid-point of the year than they were at the beginning, “even though uncertainty is the largest obstacle for us at present,” says Johann Sailer, chairman of the VDMA.

In its latest report, the organisation says there has been double-digit growth in turnover by member companies throughout the sector in the first five months. Despite a brief downturn in May, construction equipment manufacturers are therefore correcting their forecast upwards for 2015. An increase in turnover of 4% to €8.7 billion seems achievable, although building material facility manufacturers are more sceptical.

Many companies are on schedule, but large-scale orders are rare and fiercely competitive.

“We therefore expect only to break even in 2015,” explains Sailer.

This is equivalent to turnover of €4.3 billion, meaning a turnover of around €13 billion for the whole construction equipment and building material machines sector in 2015.

Construction equipment sales in Europe and North America have grown significantly in the first five months of the year despite the fact that the Russian market is in free fall, recording a decline of around 70%. Even France, once the second largest construction equipment market in Europe, is suffering a pronounced downturn with an above-average decline of 19% compared with the previous year.

The drivers of business are the UK, Scandinavia and Germany, says the VDMA.

After a brief interim high, the order situation for building material facilities is currently becoming gloomy again. The reasons are many and various. Above all, companies are feeling the effects of lost orders from the once important Russian market that have fallen through, sometimes to the tune of up to €80 million.

The merger of the two industry leaders in cement production,

Large-scale projects and identifiable growth markets are lacking worldwide, and fewer of them are actually implemented.

“And everyone is vying for the few that do materialise,” explains Sailer.

The playing field is becoming smaller and for building material facility engineers to compete with confidence in the future, too, they need more orders, adds Sailer.

In addition to Russia, the markets in Southern Europe and South America are currently causing difficulties. In contrast, Scandinavia, the Middle East and South-East Asia are providing impetus The fact that many companies have diversified and are supplying facilities in various industries is also having a positive impact on the order situation.

VDMA says that companies today are looking forward to 2016 with optimism not least because

Indeed, many companies will be unveiling more new models at bauma 2016, the event for construction machinery, building material machines, mining machines, construction vehicles and construction equipment.

“According to market researchers at

And as the newly-created LafargeHolcim looks to the future, another upbeat note has come from the German-based

With a group revenue of €12.6 billion in 2014, it is one of the world’s largest building materials companies, operating in more than 40 countries, with 44,900 employees at around 2,300 locations.

Its core activities include the production and distribution of cement and aggregates, complemented by downstream ready-mixed concrete and asphalt activities.

While Lafarge and Holcim received European Commission approval for CRH, the Irish-based group, to buy the assets to be divested by both companies in the European Union, including Lafarge’s assets in Germany, Heidelberg Cement says its ambition is to achieve more than €17 billion in group revenue and more than €4 billion in operating EBITDA (earnings before interest, taxes, depreciation, and amortisation) by 2019.

“We have delivered on our strategy of growth and deleveraging which we announced in 2010. As we enter the next phase of our corporate development, HeidelbergCement is in an excellent position to capitalise on its considerable strengths and drive future growth and value creation,” says Dr Bernd Scheifele, chairman of the management board.

“We have a compelling strategy in place which clearly differentiates us from our competitors and we remain the industry leader in business excellence and cost efficiency. Over the next five years, we intend to achieve continuous growth and significantly increase our free cash flow with the clear commitment to building shareholder value.”

Dr Lorenz Näger, chief financial officer, added: “We are focused on being the first major building materials company to earn our cost of capital in 2015. On this solid financial base, we will allocate our strong free cash flow to carefully selected growth initiatives and increasing shareholder returns.”

HeidelbergCement says that it is also optimally positioned to capture the growth potential in important mature and emerging markets. The group will carefully deploy capital for selected growth opportunities in existing geographies and expand its footprint to new markets through a targeted and disciplined M&A (mergers and acquisitions) approach.