Several countries in the Middle East and North Africa have initiated steps to relax the lockdown norms and planned their exit strategies in May.

According to a report entitled ‘COVID-19 crisis response in MENA (Middle East – North Africa) countries’, which was released by the OECD (Organisation for Economic & Cultural Development) in June, deconfinement plans disclosed were either progressive, such as Lebanon’s five-step reopening plan which started on 27 April, or rely on a geographical breakdown between low-risk and high-risk regions, as is the case in Iran, which has been divided into white, yellow and red areas based on numbers of confirmed cases and deaths.

Algeria, Bahrain, Iraq, Jordan, Lebanon, Saudi Arabia and the UAE have all authorised businesses and commercial outlets to resume activity, at least partially, the report said.

Kuwait lifted the nationwide curfew in the country on 30 August while Morocco, which stopped works for two months, started work on projects after Eid-ul-Fitr (Ramadan) festival in the last week of May.

However, Morocco’s Minister of National Land Use Planning, Town Planning, Housing and City Policy, Nouzha Bouchareb, stressed that construction sites should comply with health and safety measures in accordance with the Moroccan authorities’ guidelines to avoid major COVID-19 outbreaks.

“Both, public and private operators in the construction sector, were required to follow the safety instructions and if not, the projects would be suspended for non-compliance of the government’s directives,” the minister warned.

In Saudi Arabia, work on the development of the first phase of the Diriyah project, was launched by Diriyah Gate Development Authority (DGDA) in June. The US$20 billion project marked the beginning of a bold new era of construction and transformation for Diriyah, a city within Riyadh province in Saudi Arabia.

With workers returning following the relaxation of lockdown in Egypt, the government has permitted the reopening of offices and construction sites but directed those engaged in the field work to put up posters to create awareness among workers besides distributing masks and hand sanitisers to them.

Qatar too has announced lifting lockdown in four phases in June and the latest relaxations came into force on 1 September. Qatar needs to accelerate the pace of ongoing works on various infrastructure projects as the country will be hosting the prestigious FIFA World Cup in 2022.

Material availability

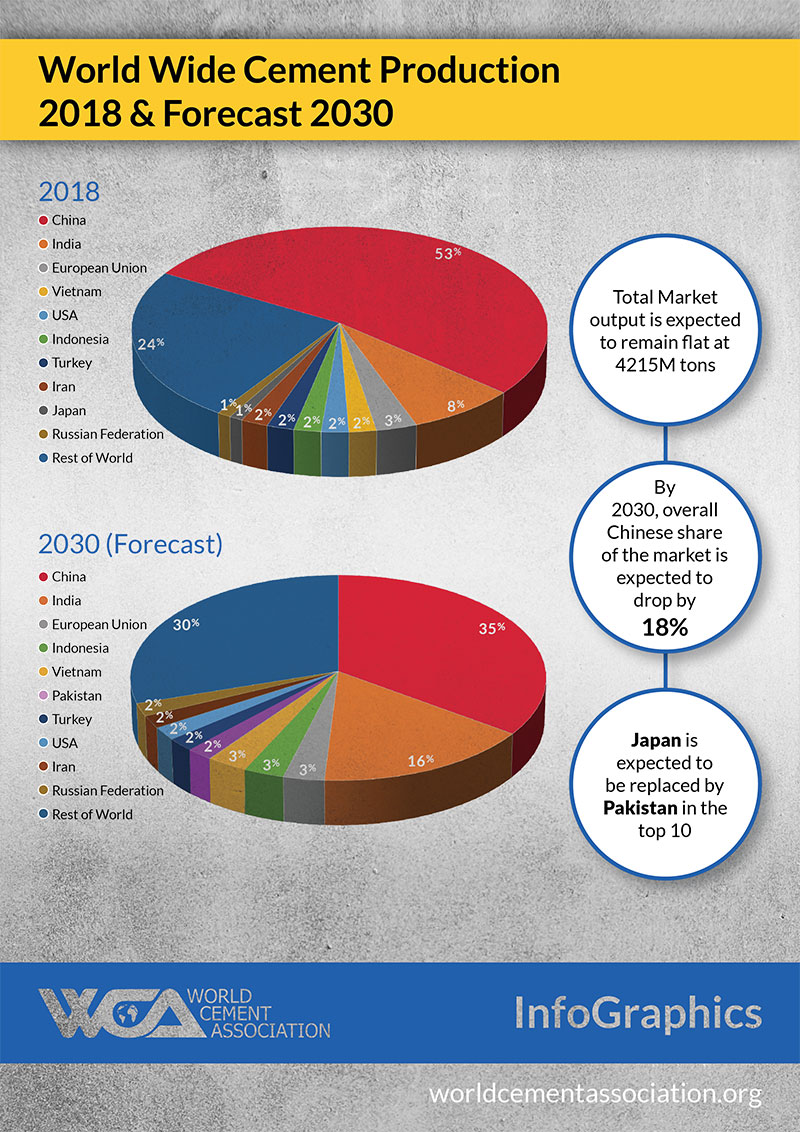

The London, England-headquartered World Cement Association (WCA) expects that 2020 will be a very difficult year as the sales of aggregates, cement, concrete, clinker and construction equipment in the Middle East reduced by almost 50% from 2019 levels in some markets. But 2021 should see a rebound to a level close to 2019 but countries which lack the financial capacity to boost investment in infrastructure may recover more slowly.

According to WCA CEO Ian Riley, the Chinese companies engaged in production of building material have become active as the local governments have effectively controlled the spread of coronavirus. “Demand levels are already back to normal and in many cases are exceeding 2019 levels. Most of our members expect to beat their pre-COVID budgets in terms of both volume and profits,” he said.

According to WCA CEO Ian Riley, the Chinese companies engaged in production of building material have become active as the local governments have effectively controlled the spread of coronavirus. “Demand levels are already back to normal and in many cases are exceeding 2019 levels. Most of our members expect to beat their pre-COVID budgets in terms of both volume and profits,” he said.

While several countries in the region are suffering from serious overcapacity as demand declined due to the pandemic in the last few months, WCA expects cement plant utilisation to fall below 50% this year, bringing pressure on pricing and cash flow. Currently the excess capacity is alleviated somewhat by exports, for example from Gulf States to East Africa.

“We expect producers will try to secure their market position by investing in local production in their export markets, either through acquisitions or new build. There is an opportunity for clinker exporters selling to regions with shortages of limestone to invest in local grinding stations and metakaolin production which could give sustainable cost advantages. The pandemic is also likely to lead to some consolidation as weaker companies’ assets are acquired by investors with deeper pockets,” Ian Riley added.

Egypt marching forward

Mindful of the shortage of building material such as cement, clinker etc., Egypt has announced in July this year plans to construct 765,000 social housing units at a cost of US$10.3 billion during the next three years.

Egypt’s Finance Minister Mohamed Ahmed Maait told a local English news website Amwal Al Ghad that the government will build 60,000 middle-income housing units within a total of 310,000 new housing units. “Within the next three years, 765,000 housing units will be completed as part of the One Million Housing Initiative,” he said.

Egypt will finish implementing 100,000 housing units during the fiscal year of 2020/2021, in addition to planning to finish implementing 105,000 units in 2021/2022, while carrying out an additional 105,000 housing units during the fiscal year 2022/2023.

Saudis going strong

In an online webinar sponsored by Bobcat, industry captains of Saudi Arabia detailed the government’s role in leading the fightback.

Kabbani Construction Group chief executive officer Hatem Salahhendin was confident in the market and opined that the government’s Vision 2030 Strategy was still on despite the pandemic.

He said that nothing has stopped on all of their projects. “Yes, it has slowed down, but this is normal,” he said, adding that at the same time there were new challenges to face, including nurturing reassurance among workers, investors, contractors and consumers at a time of crisis.

Hibernation ends

A report by BNC Projects Journal, being published by the Dubai-based Industry Networks, the GCC’s construction market has been showing early signs of recovery with projects worth US$30.7 billion achieving construction completion in July and $11.6 billion worth of new projects being announced.

The GCC construction market is estimated at $2.4 trillion, with over 22,000 active projects at the end of July, thus indicating early signs of the sector’s recovery even as the Gulf nations started easing COVID-19 restrictions.

A number of megaprojects were announced in Saudi Arabia and Oman including the $5 billion green hydrogen-based ammonia production facility in the Neom Economic Zone, a $2 billion mixed-use development announced for Durrat Al Nakheel in Al Khobar and the $1 billion Low Sulphur Fuel Oil (LSFO) Refinery in Oman.

Saudi Arabia drove new announcements in July with $8.4 billion worth of new scheme announcements, followed by Oman with $2.2 billion worth of new announcements. The industrial sector contributed 44% of the total value of new project announcements followed by the urban construction sector with a 35% contribution.

“July thankfully ended the Q2 hibernation as project awards during the month were driven by the UAE with a 52% share,” remarked Avin Gidwani, CEO of Industry Networks. According to him, transport, utility and the urban construction sectors were frontrunners in terms of contract awards with 38%, 31% and 26% share, respectively.

The UAE achieved completed construction of the Barakah Nuclear Power Plant Phase One project which is currently operational and the Dubai Metro Red Line Extension Route 2020 while the Offsites & Utilities (Package 3) for Al Zour New Refinery was completed in Kuwait.

“The total value of project completions in July was significantly higher and recorded an 84% hike when compared to the total value of project completions in the entire Q2 2020 owing to the completion of a number of megaprojects,” Gidwani added.

New workplace norms

After relaxing restrictions, the Arab nations have put in a series of measures such as limiting the onsite staff to 30% of the full capacity, providing one set of tools to each of them, asking them to follow social distancing and directing non-essential staff to work from home, among others, to prevent spread of the cases. The region had recorded 1.69 million cases up until 9 September with Iran and Saudi Arabia being the worst-hit countries.

Emirates Building Systems (EBS) general manager, Joseph Chidiac, said that the post-COVID-19 era will be different from the previous outbreak of COVID-19, which accelerated the slowdown process, adversely impacting all economic activities.

Citing industry reports, he said that the global steel market was estimated to reach 1.6 billion tonnes by 2027. Amid the COVID-19 crisis, the global market for steel, which was estimated at 1.5 billion tonnes during 2020, is projected to grow at a CAGR (compound annual growth rate) of 0.7% till 2027. “However, in the short term, the outlook of the steel industry post-COVID-19 will be adjusted to meet the new market requirements which will regain more resilience and move fast. The market will be changing into a more sensible one where medium-sized, and competitive players, quickly adopting to clients and market needs would seek an upper hand,” Chidiac said. He also said that the COVID-19 crisis will accelerate transformation: A large share of solutions, like building information modelling (BIM) and integrated project management platforms to name a few, were already identified as digital building blocks for the construction industry.

Chidiac continued: “There’s been a paradigm shift in many areas that has been leading engineering and construction companies to do many things differently than they did in the past. Companies who fast-track their digital adoption by augmenting workers and engineers with digital collaboration capabilities, automating low-value-added activities and sharing data for rational and insight-driven decision-making, and who reinvent their relationship with third parties - clients, suppliers, subcontractors - will be strengthened and ready to succeed in a post-COVID-19 world.”

Chidiac said that with the efficient planning, support and far-sightedness of the UAE government, key industries like manufacturing continued production to meet the local demands as most of the projects in the construction industry resumed developments. Identified as a crucial sector to achieve sustainable growth and in line with our EBS’s promise to contribute to the UAE economy through this vital sector, Chidiac said his company continued production at its manufacturing plants and also operations.

He added: “Like Emirates Building Systems, which is well stocked to take care of its immediate materials and consumable needs for a minimum of six months to secure continuity in our production schedules and maintain timely delivery commitments, other construction companies in the region have been maintaining stocks to ensure no disruption in the timely deliverance of the projects.”

Chidiac said local and regional sourcing of materials helps to improve competitiveness, meet project timelines and ensure on-time delivery of projects. “Bulk purchases well in advance of project schedules was another major advantage that helped us mitigate the risks and navigate smoothly during these unprecedented times with zero cancelled orders or held projects. The support from the local government towards supporting these initiatives have benefitted the economy and helped maintain stimulus around UAE's most significant sector, giving a boost to the local construction industry.”