The GCC region, which is considered the financial hub of the Arab world, announced US$35.6 billion-worth of new projects in the first quarter of 2021, equal to around 55% of the total committed to in 2020, according to BNC Projects Journal.

While Saudi Arabia is leading with 54% of the cost of total projects, it is followed by Qatar (21%), Oman and the UAE (11% each), Kuwait (2%) and Bahrain (1%) respectively (see box below). Saudi Arabia’s construction sector is expected to record growth of 3.3% in 2021 and the value of contracts awarded is expected to reach US$29.45 billion for the year.

In 2020, the pandemic dealt a major blow to the financial and economic charts of the GCC. As a result, new scheme announcements and project awards during the year saw a disproportionate drop. Project announcements, which were rising at the end of 2019 with a 4% year-on-year hike, reduced by one-third at the end of 2020 and ended with US$63.6 billion.

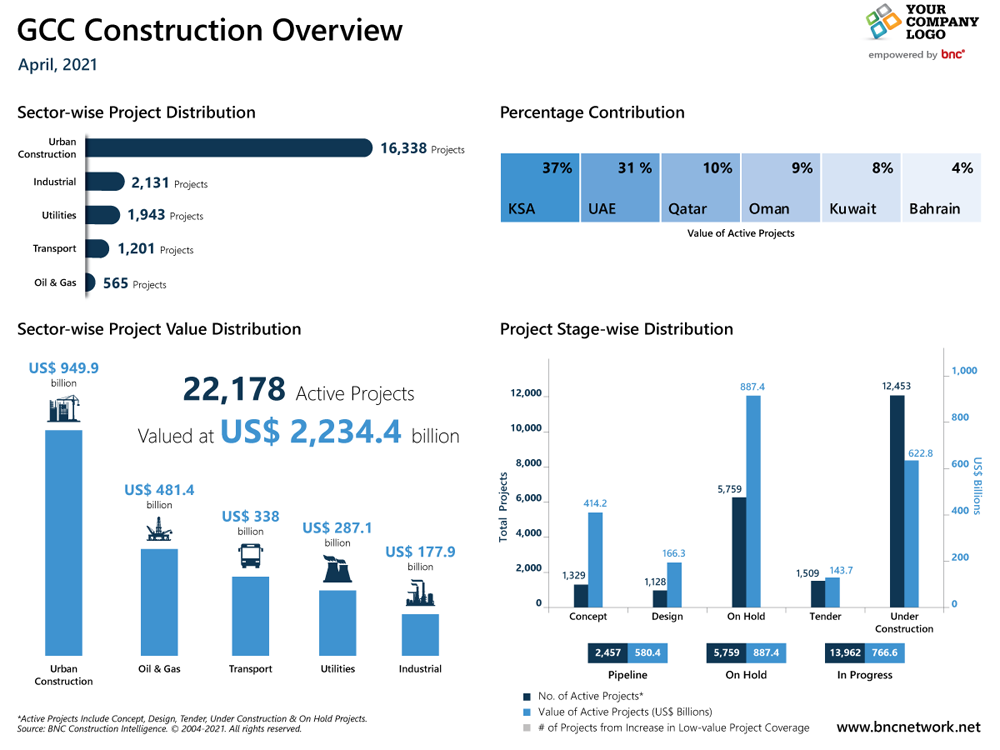

The value of the GCC construction market is estimated at US$2.2 trillion, with over 22,000 active projects as of Q1 2021. While Saudi Arabia currently holds US$823.5 billion of active projects, of which 28% are in the early stages, Qatar shared two-thirds of total project awards in the GCC, with the oil and gas sector sharing 70% of them, the Journal said. “Saudi Arabia would like to draw a fine line in the sand that leads the country into the future. This isn’t just another line that the Red Sea can gently wash away. This is a bold, daring and ambitious line,” said Avin Gidwani, CEO of Industry Networks, which publishes the Journal.

However, uncertainty looms large as the GCC nations, which mostly depend on oil sales to fund most of their construction projects, are concerned that their oil revenues might take a hit due to the ongoing tensions between Israel and Hamas, and an increase in COVID-19 cases in energy-hungry nations such as India.

If these developments continue for a long time, the GCC construction sector could be affected to some extent. Global oil prices may also be dented by the re-entry of Iran into the global oil markets, altering the demand supply picture.

Spurt in building material prices

According to a report on the latest data from the General Authority for Statistics (GASTAT) in Saudi Arabia, the price of steel surged to SR 3,514.73 per ton in Q1 of 2021, a 33% increase year-on-year and the highest price since 2008.

The cost of ready-mixed concrete too rose 14% year-on-year to SR 204.63 per m³ during the same timeframe, while cables rose 21% year-on-year to SR 40.27 per metre. In addition, wood prices rose 15% year-on-year to SR 3,067.49 and cement was up 5% to SR 14.03 per 50kg bag in Q1. While steel made the biggest surge, the growth slowed as the year progressed, going from 40% growth in January to 28% growth in March.

The spiralling prices of building materials, especially steel this year, is a clear indication that construction activity in Saudi Arabia has begun to recover from the slowdown caused by the pandemic last year.

In its recent report, real estate consultancy firm JLL said: “From a supply perspective, the first quarter of 2021 recorded an increase in construction activity in Saudi Arabia. In the residential sector in Riyadh 7,700 units were handed over in Q1, bringing the total to 1.3 million units in the capital. In Jeddah, around 2,000 units were added, bringing the total to 838,000 units.”

In the UAE, the construction industry is expected to rebound in 2021, with growth of 3% forecast and construction’s output in Bahrain is also expected to rebound, with growth of 2.1% this year.

Kuwait cautious

In Kuwait, the first lockdown has impacted the construction sector vastly but construction giants like Al Hamra Group ensured that they recouped the lost time by putting in additional efforts.

In an interview with Oxford Business Group (OBG), Al Hamra’s CEO Mohammed Hamad Al-Ghanim said that Kuwait’s construction sector was “shut down” for four months last year but the industry started to grasp how this would continue to impact supply chains as they are an intrinsic part of project delivery.

Looking at the global market outlook, most reports indicated a regression in terms of public spending. In the GCC region, the regression was due to the drop and ensuing fluctuation in oil prices, coupled with governments’ stressed cash flows.

“In Kuwait the public sector drives construction demand, but it is expected that only 15% of the projected state budget will be allocated to capital investment. Hence the construction sector is expected to be in a difficult situation for the next two years,” Al-Ghanim told the OBG.

Maghreb countries

For countries such as China, Russia and Turkey, the Arab Maghreb is the gateway to Africa and Europe. However, travel restrictions, minor lockdowns, and night curfews, along with internal strife, have become the order of the day in a region comprising five countries – Morocco, Tunisia, Mauritania, Algeria, and Libya. This has affected ongoing Arab Maghreb construction projects.

Through its Belt & Road Initiative (BRI) project, China has entered into agreements with Morocco and Tunisia with an eye to exploring the phosphates and rare earth elements in those countries that are of vital interest to the dragon nation. Morocco possesses over 70% of the global phosphate rock reserves, while Algeria has the world’s fourth-largest stock of the mineral. In 2018, China also clinched a deal with Libya, paving the way for the latter to join the BRI initiative.

While Chinese companies have been executing infrastructure projects worth over US$40 billion in Iraq, Algeria and Egypt, the state-owned China State Construction Engineering Corporation (CSCEC) is developing many projects in Tunisia and notable among them are the University Hospital at Sfax and a Diplomatic Academy in Tunis.

Tunisian president Kais Saied, who inaugurated the 246-bed University Hospital at Sfax in December 2020, announced that more megaprojects will be developed in the country with Chinese support.

“We will work together with our Chinese friends to carry out many megaprojects that will meet the aspirations of Tunisians,” said Saied. The Academy is expected to be completed by this year end and both projects were funded by China.

Even Algerian prime minister Abdelaziz Djerad lauded the efforts of Chinese firms in Algeria for making new contributions to Chinese-Algerian friendship.

Djerad made the remarks while inaugurating the Public Engineering Technology School which was assisted by CSCEC Algeria in the province of Djelfa, some 300km south of Algiers.

In another development, a consortium of three Chinese companies signed a memorandum of understanding with Algerian National Iron and Steel Company, regarding the exploitation of iron in Algiers.

The Chinese consortium, composed of Metallurgical Corporation of China, China International Water and Electric Corporation and Hunan Heyday Solar Corporation, will carry out a feasibility study on the exploitation of Gara Djebilet iron ore in western Algeria.

Importer to exporter

In 2014, Algeria was importing cement and other construction material mainly from Tunisia and other countries for its infrastructure projects worth around US$13 billion. Within three years it has not only increased the production capacity of cement to meet domestic consumption, but also emerged as a major exporter of cement as several companies, including LafargeHolcim opened their units in the country during this period.

As construction activity slowed down last year due to the pandemic, Algeria’s Trade Ministry drew up plans to export 20 million tonnes per annum (MTPA) surplus cement. Over one million tonnes have already been exported to Niger and other West African neighbours.

The plans also involve opening Algeria’s land and sea borders for cement exports which constitute 50% of the country’s 40 million tonnes per annum cement production.

Algeria’s Trade Minister Kamel Rexig said that the surplus production will be exported and will generate revenues up to US$900 million per annum. The ministry has identified 10 national zones of production, including the export of cement, as a strategy for 2021.

“The efforts made by companies to increase cement production and export the same deserve to be encouraged,” he added. Turkey in Maghreb

The construction sector is one of the main economic growth engines for Turkey and the country has been the biggest concrete producer in Europe since 2009. However, local construction firms are facing problems due to contraction in the construction sector in the last couple of years, and they are looking to trade with Libya and other countries. They have already undertaken construction projects worth up to US$29 billion so far but could not complete them due to turmoil in Libya. Recently, Turkey and Libya have entered into an agreement to allow these companies to complete the remaining works, as well as being involved in the construction of a commercial seaport in Tripoli.

Karanfil Group, a major Turkish company, has already established the largest concrete production facility at Misrata in Libya and has spent over US$10 million on the facility so far and plans to invest up to US$50 million.

Karanfil Group’s CEO Fatih Sari said in a statement in February this year that the facility is likely to employ 1,000 people and will be able to produce up to 90m³ of concrete per hour. “We will continue our investments in Libya in 2021. We are also looking for investment opportunities for Algeria and other countries,” Sari said.

Sari added that the concrete production facility was crucial for war-torn Libya’s reconstruction and can also meet the demands of the Turkish construction companies which are executing projects in Libya. The facility has, said Sari, attracted interest not only in Libya, but also from other countries in the Maghreb region. “There is already serious demand from Morocco, Tunisia, and Algeria. Thus, we will ramp up both our investment, production and employment as soon as possible,” he added.

True to his expectations, the Libyan government announced on 10 May 2021 that it was setting aside LYD 3 billion (US$669.34mn) for the reconstruction of cities such as Benghazi, Derna, Sirte and Murzug, which have been damaged during the ongoing internal conflict. While Benghazi and Derna will share LYD 1.5 billion each, LYD 1 billion has been earmarked for Sirte and the remaining LYD 500 million will be spent on the reconstruction of Murzug.