Red Diesel Reform: Will it drive a shift to electric in the UK construction sector, or will it just cause inflation? Alastair Hayfield, senior research director at Interact Analysis, tackles a key question.

From the 1st of April, the UK government has banned the use of rebated diesel – Red diesel – for machinery used for construction work. The construction industry has lobbied hard against this change – particularly given the recovery from Covid and the impact of the Ukraine conflict on oil prices – but the UK Treasury has stuck to its position: it is necessary to implement this change to help the UK meet its 2050 net zero ambitions.

Will this policy drive a shift to electric machinery to save costs, or will it have little impact on emissions and lead to project cost inflation? And with raw material prices still high and an increase in National Insurance, will this lead to a ‘perfect storm’ in 2022?

What is Red Diesel?

Red diesel is a rebated form of diesel that can be used in a variety of off-road applications. Red dye is added to standard white diesel to help inspectors identify if it is being used illegally. The rebate is used to offset fuel duty and is worth 46.81 pence per litre, making a significant contribution to cost savings for construction and agricultural users.

Impact on Fuel Prices

Even before the end of the fuel rebate, fuel prices have risen to a level not seen since 2012. Prices have been slowly creeping up during the recovery from Covid, but the invasion of Ukraine by Russia has seen prices sky-rocket. Whilst oil-producing nations have agreed plans to increase production to offset the shock. It seems clear that higher prices are likely to be the norm for some time to come.

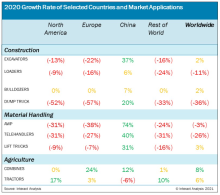

To give an indication of the impact of the removal of the red diesel rebate for the construction sector, Interact Analysis has looked at the cost implications for a variety of machines based on their typical operational performance.

For smaller equipment – compact excavators or medium-sized backhoe loaders, the additional cost per month or year may not seem very high but multiplied across tens or hundreds of machines, it becomes substantial. Large contractors may be able to absorb this cost – for a while – but smaller or independent contractors may struggle to absorb them without passing them on to customers. Combined with an increase in National Insurance payments and raw material costs, it seems inevitable that project cost inflation is on the cards for 2022.

Are Electric Machines the Solution to High Fuel Costs?

The great advantage of electric vehicles – cars, trucks or excavators – is that the running costs are much lower than conventionally fueled equivalents. Electric powertrains are much more efficient – making better use of the ‘fuel’ – and maintenance and service costs are lower.

As of April 2022, if you look at the main JCB website, the monthly hire purchase price for its electric mini-excavator – the 19C-1E – is listed as £1,320. A diesel model – the 18Z-1 – is only £660 per month. Even allowing for the lower cost of fueling an electric excavator, the red diesel rebate reform doesn’t add enough cost to justify a move to battery-electric machinery in the short term. The high price of batteries means that it is still better – if painful – to stick with diesel. In this regard, the UK Treasury’s decision to remove the rebate for construction vehicles is unlikely to reduce emissions.

Are there other efficiency options for operators? For larger, heavy-duty applications, there are hybrid machines – that can recover energy – that are more efficient. The Volvo EC300E uses a hydraulic accumulator to recover energy from the boom arm. Or there is a range of Komatsu excavators that use an electric motor to swing the upper structure, where energy is harvested when the rotational motion is braked.

Beyond new machinery, operators would be well advised to concentrate on maintenance to ensure machines are operating as efficiently as possible – replacing filters and oil, reducing idling, and selecting the right sized machine for a job.

What can the UK do?

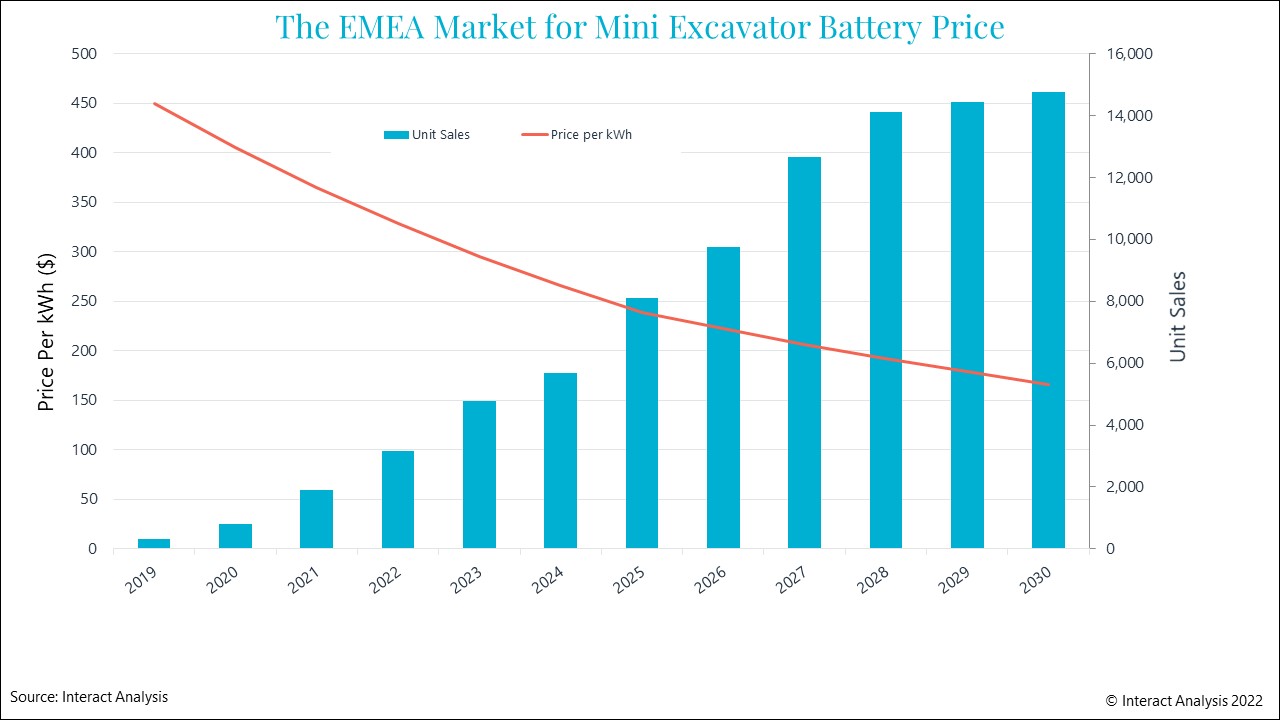

Interact Analysis forecasts that battery prices for electric construction machinery will decline quickly over the next 5 to 10 years; however, this won’t happen quickly enough to make a difference with the current situation.

The UK government could look across the North Sea to The Netherlands, where a set of smart government policies are helping to fund the adoption of electrified construction machinery.

In the meantime, UK operators are left in a very difficult position – take a hit on the costs or pass them on to their customers.

Alastair Hayfield has over 15 years of experience leading research activities in scaled, high-growth industrial and technology markets. As senior research director of Northamptonshire, England-based Interact Analysis’s commercial vehicles division, he’s responsible for cutting-edge research on electric trucks and buses, autonomous trucks and off-highway electrification.