Whilst growth sunk to a mere 2.6% in 2020, Interact Analysis’s research predicts 6.5% growth in 2021, and an overall CAGR (compound annual growth rate) of 3.6% up to 2029. In addition, electrification of certain classes of off-highway vehicles is expected to continue at a rapid pace.

Alastair Hayfield, senior research director - UK Interact, says the talk now is of economies bouncing back after a poor 2019 and a catastrophic 2020.

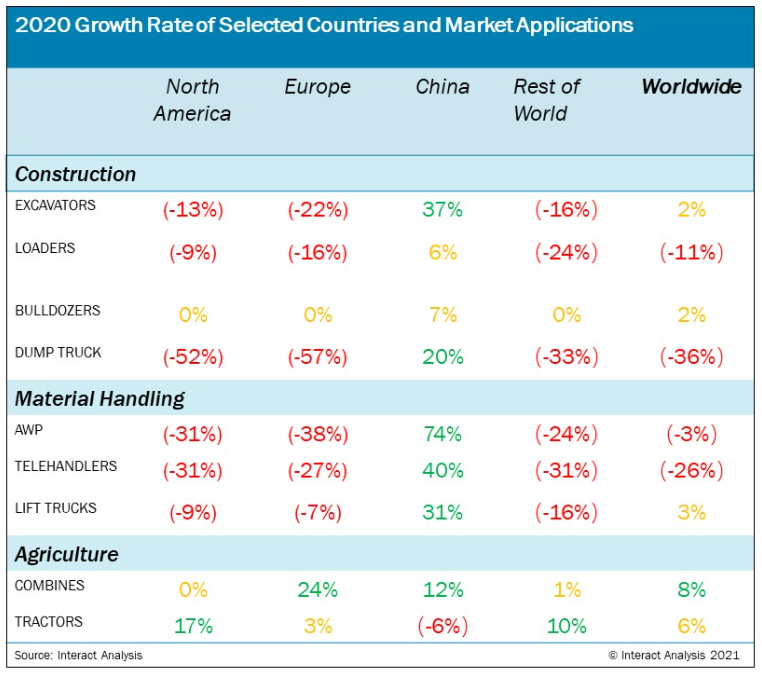

As the table above shows China is the only major region to emerge unscathed from the COVID-19 effect, with not even the virus stopping the unprecedented modernisation and extension of China’s infrastructure network.

Whilst the figures in red describe tumbling growth in 2020 for many different machinery types across most of the globe as countries battled with the virus and production slowed or shut down, in China things stabilised quite quickly, as rigorous measures to combat the virus were enforced. Production got back to normal by May 2020, and demand for off-highway equipment resumed. Aerial work platforms saw a massive 74% hike in sales, telehandlers +40% and excavators +37%.

"While China has mitigated the overall impact of the pandemic on the global off-highway vehicle market, 2020 was undeniably a shocker for the industry, but it’s an industry poised to make a comeback, with material handling equipment leading the field by 2025, when sales are forecast to surpass those of agricultural machinery," Hayfield commented.

2019/20 saw a slowdown in sales of material handling equipment, but the surge in online shopping and eCommerce caused by the virus is likely to be a significant long-term driver for investment in machinery such as lift trucks, particularly as new warehouse automation projects come on stream. Interact Analysis has detected the likelihood of future healthy demand from SMEs and forecasts a return to double-digit growth rates by 2022, with sales of around 2.4 million units by 2023. All this, of course, rides on the battle with the virus.

Overall unit shipments for the construction segment decreased by 2.5% in 2020, due to the impact of COVID-19, giving a growth rate of -2%. But sales of construction vehicles in China sustained solid growth of 26.6%, otherwise the global figures would have been far worse. The size of the Chinese market in 2020 was close to 400,000 units and it was the largest regional market, accounting for 43% of the global sales in terms of unit shipments. The global construction vehicle market will reach its cyclical peak in 2021, having achieved a growth rate of 8%. Thereafter, up to 2029, the growth rate is forecast to be of the order of between 2 and 4 percentage points year on year.

Excavators are the largest product group in the construction segment, accounting for over 50% of units shipped in major regional markets such as North America, Europe and China.

The research shows that over 36% of shipments of off-highway vehicles will be electrified machinery by 2029. However, the overwhelming majority of these will be smaller machines.

"Our research shows that there are good reasons for using BEV technology in larger construction vehicles, such as lower TCO and environmental concerns; but there are also significant barriers, such as upfront costs, lack of charging infrastructure, and charging downtime," Hayfield stated.

"Electrification of compact construction vehicles offers many obvious benefits, minimising emissions and noise levels, allowing the equipment to be used in enclosed environments such as in mines, buildings and in other noise-sensitive areas. For many of the environments where material handling typically works, such as airports and logistics centres, there is already a high demand for 'greener' equipment. These places will continue to adopt electrification aggressively."