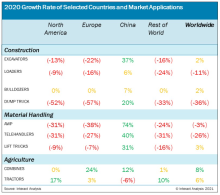

Research from Interact Analysis shows that the global machinery market was worth US$1.98 trillion in 2020, a year-on-year fall of around 6% on 2019.

Interact Analysis CEO Adrian Lloyd predicts a rebound in 2021 with the market increasing up to a value of US$2.11 trillion. Materials handling equipment (including aggregates and quarrying which is included under the mining machinery category) is the largest segment, with a 2020 value of US$275bn.

"Our forecasts for the total machinery sector out to 2025 put the three highest CAGRs [compound annual growth rates] as mining machinery (5.3%), farming machinery (5.1%) and textile machinery (4.5%)," Lloyd comments. "Multi-industry machinery will have a CAGR of 3.8% over the forecast period, with materials handling equipment performing particularly well within that category (CAGR 4.7%), owing to the booming warehousing and logistics sectors."

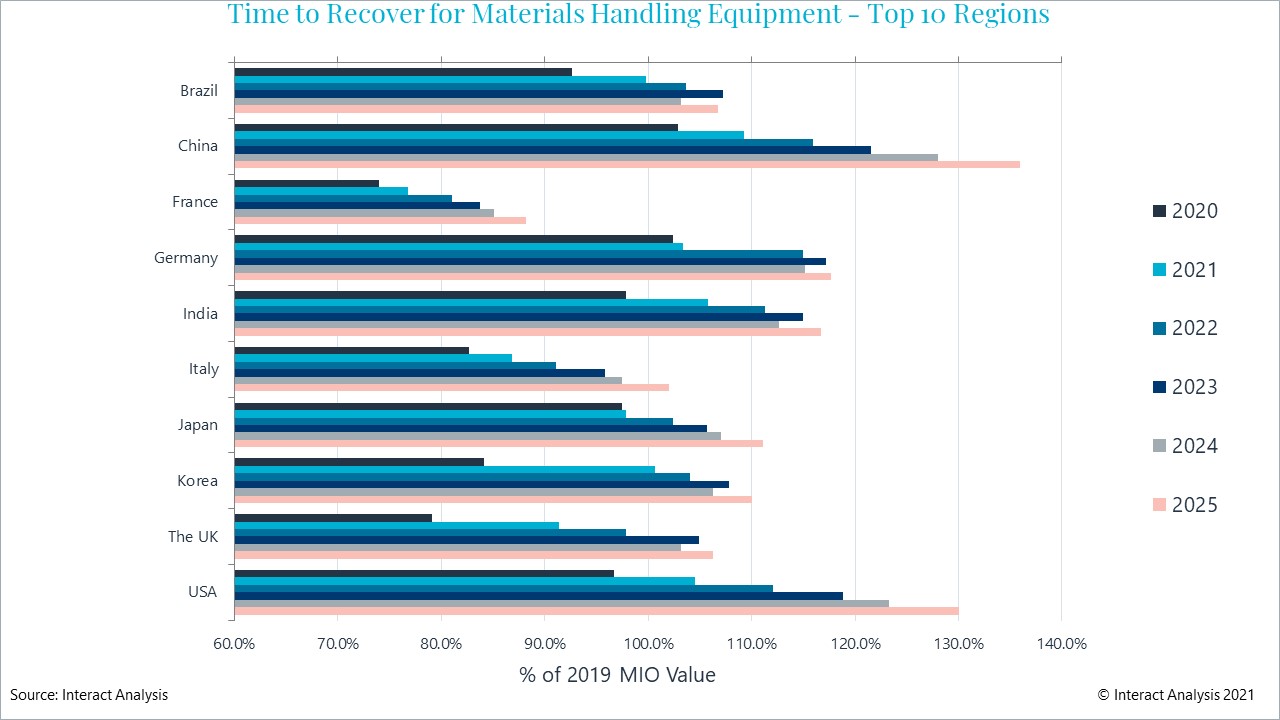

From a regional perspective, the global machinery sector is highly consolidated, with the top five regions accounting for over 70% of global market value. China alone accounts for over 40% of the world’s machinery production. In terms of CAGR out to 2025, Intereact Analysis predicts the USA will lead the way with a CAGR of 4.9%, followed by Italy and India with CAGRs of 4.0% and 3.7% respectively.

Materials handling equipment can be split into four separate sub-groups: conveyors, which take up 30% of the market, escalators and lifts (30%), cranes and hoists (25%) and forklifts and other industrial trucks (15%).

Lloyd says the fortunes of the materials handling equipment (MHE) sector are closely linked to those of general industrial production. This means that, as the global recovery accelerates, MHE will see concurrent growth.

And this growth will be from a relatively strong base, given that it saw modest contraction in 2020 of only -3.8%. The sector will see 6% growth in 2021. One of the motors behind this will be the drive for greater industrial automation. Another is the sector’s universality: MHE is used across a wide range of industrial sectors.

Regionally, the biggest producers of MHE are China (43.6% in 2019), the USA (10.8%) and Japan (8.5%). "We expect most of the top ten regions to recover by 2025," says Lloyd. "For example, the market in China grew by a modest 3% in 2020, and will see 6.2% growth in 2021. In contrast, the data shows that the worst performer on most MHE counts will be France."