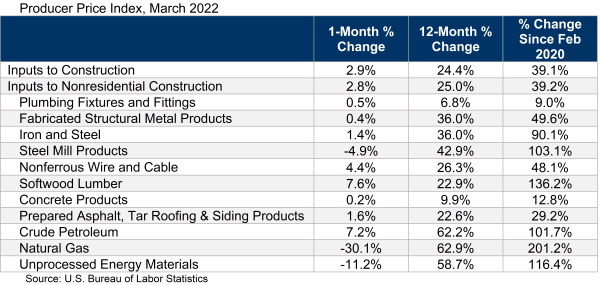

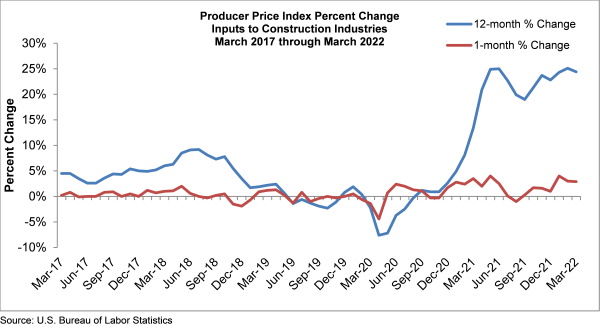

Construction input prices are up 24.4% from a year ago and 39.1% from February 2020, the month before the COVID-19 pandemic began to affect the economy, while nonresidential construction input prices are 25% and 39.2% higher, respectively. Natural gas prices are up more than 200% since the start of the pandemic, while crude petroleum prices are up more than 100% over that span.

“Consumers are right to complain about inflation, which has been north of 8% during the past year,” said ABC Chief Economist Anirban Basu. “But America’s contractors have experienced materials price inflation nearly three times that during the same period. For now, there are few signs of relief. Many prices rose on a monthly basis in March, reflecting ongoing upward price momentum, including iron and steel (1.4%), key roofing materials (1.6%) and nonferrous wire and cable (4.4%).

“For contractors, this is not where the inflation narrative ends,” said Basu. “Despite recent growth in the nation’s labour force participation rate, contractors continue to contend with shortages of skilled construction workers. Supply chain setbacks related to the spread of another omicron variant along with the Russia-Ukraine war will also affect equipment availability. The latest ABC Construction Confidence Index survey indicates that approximately 3 in 4 contractors have suffered an interruption in delivering construction services in recent months. These challenges will persist.

“There is one more significant consideration for contractors,” said Basu. “With inflation running hot, the Federal Reserve will have to work even harder to slow the economy to trim price pressures and expectations. Recession risks are accordingly rising, and while that is unlikely to affect the level of contractor activity in the near term, that could eventually set the stage for a period when demand for construction services declines.”

“There is one more significant consideration for contractors,” said Basu. “With inflation running hot, the Federal Reserve will have to work even harder to slow the economy to trim price pressures and expectations. Recession risks are accordingly rising, and while that is unlikely to affect the level of contractor activity in the near term, that could eventually set the stage for a period when demand for construction services declines.”