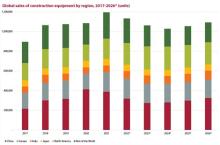

Global construction equipment sales hit an all-time high of 1.1 million units in 2018, according to new analysis by Off-Highway Research (OHR), a leading industry market research consultancy. OHR says the 2018 sales – with a retail value of around US$110 billion - eclipsed the most recent highs of 2011, the peak of the Chinese stimulus spending boom, and 2007.

Continuing the trend seen in 2017, OHR notes a widespread improvement in equipment sales around the world last year, with increases in North America, Europe and emerging Asia, including both China and India.

In China sales of construction equipment including mobile cranes grew 37% in 2018. This, OHR states, followed on from the 81% surge seen in 2017, and took the market to 343,817 units. This was the highest Chinese equipment demand has been since 2012, and established the country once again as the largest market in the world.

India also had a big year. Sales of construction equipment including mobile cranes grew 35%, the third successive year of robust growth. This took the market to a record high of 98,204 units – some 44% above the previous high seen in 2011, and more than double the demand seen just three years previously during the cyclical low point of 2014 and 2015.

Meanwhile, OHR highlights how sales in Western Europe hit their highest for a decade in 2018, with a 10% to 177,694 units. Demand increased in 14 out of the region’s 15 largest markets, with sales in Germany and the UK in particular reaching impressive levels. OHR states that the only time the German market has been as strong was at the height of the post-reunification building boom in the early 1990s.

North American equipment sales also improved last year, with growth of 13% taking demand to some 195,500 units.

The only disappointment among the world’s largest markets last year was Japan, where sales fell 5% to 63,700 machines.

While 2018 is likely to represent the peak in the current cycle, OHR forecasts only a moderate decline in global demand this year. Sales are expected to remain above 1 million units, which would be only the fourth year in history this has been achieved.

The outlook for the following years is for demand to stay at good levels. However, OHR cautions that this bright outlook could be threatened by negative and unexpected political and economic events.