IHS Markit/CIPS says its data for June revealed the steepest pace of expansion in UK construction output since July 2018.

At the same time, new orders stabilised after three months of sharp declines and purchasing activity expanded at the fastest rate since December 2015.

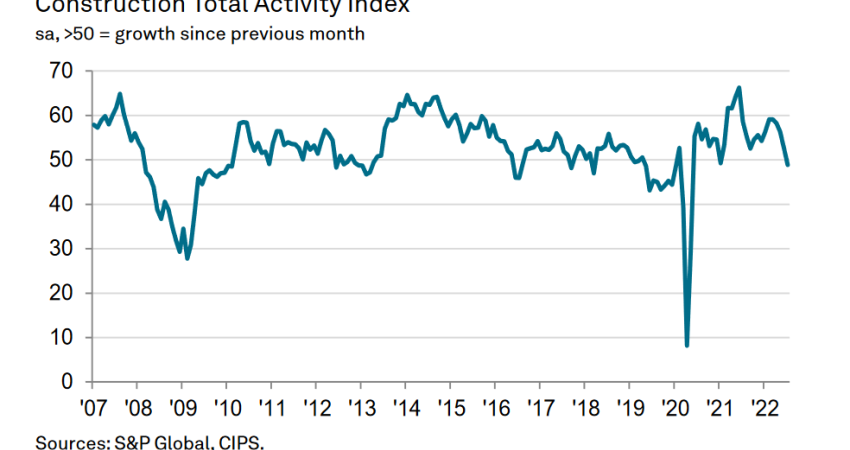

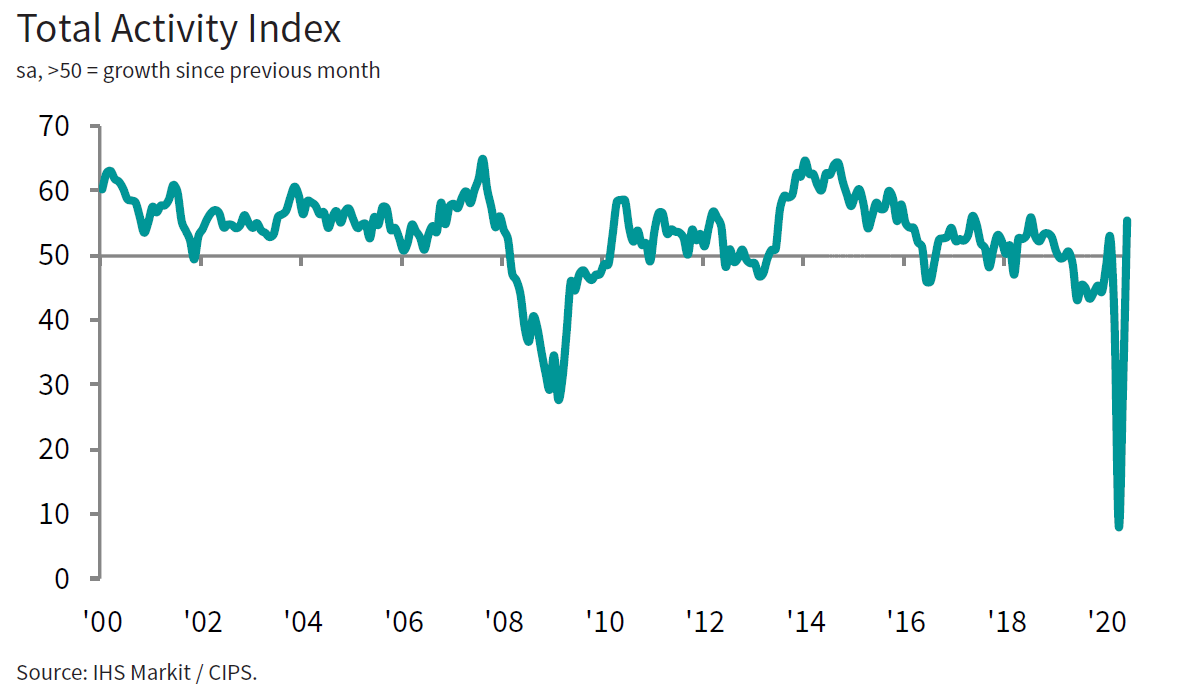

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index jumped to 55.3 in June, from 28.9 in May, to signal a strong increase in total construction output. The new data shows the steepest pace of expansion since July 2018.

Higher levels of business activity were overwhelmingly linked to the reopening of the UK construction supply chain following stoppages and business closures during the early stages of the COVID-19 pandemic.

Residential building was the best-performing area of construction activity in June. Around 46% of survey respondents noted an increase in housing activity, while only 27% experienced a reduction. The latest expansion of residential construction work was the steepest for just under five years. Commercial work and civil engineering activity also returned to growth in June, although the rates of expansion were softer than seen for house building. New business volumes increased marginally in June, which ended a three-month period of decline.

However, the rate of new order growth was far weaker than seen for business activity, reflecting ongoing hesitancy among clients and longer lead-times to secure new contracts. A number of construction firms noted that new work related to infrastructure projects was a key source of growth in June. Employment numbers fell at the end of the second quarter, according to the latest survey data.

Reports from panel members suggested that worries about the longer-term demand outlook had led to cautious hiring policies and, in some cases, redundancies alongside furlough arrangements in June. The index measuring business expectations for the year ahead remained historically subdued but climbed to its highest since February amid a boost from the reopening of work on site.

Forty-six per cent of the survey panel anticipate a rise in business activity, while 31% forecast a reduction. The latter mostly commented on concerns about the wider UK economic outlook. Severe supply chain disruptions continued in June, reflecting stronger demand for construction inputs and ongoing reports of constrained materials availability (especially plaster). This resulted in another rise in purchasing costs, with the rate of inflation accelerating to its highest since the start of 2020.

Tim Moore, economics director at IHS Markit which compiles the survey, commented: "As the first major part of the UK economy to begin a phased return to work, the strong rebound in construction activity provides hope to other sectors that have suffered through the lockdown period. While it has taken time for the construction supply chain to adapt and rebuild capacity after widespread business closures, there is now clear evidence that a return to growth has been achieved.

"While some survey respondents commented on cautious optimism about their near-term prospects, construction companies continued to face challenges securing new work against an unfavourable economic backdrop and a lost period for tender opportunities. At the same time, operating expenses are rising due to constrained capacity across the supply chain and the impact of social distancing measures.

Looking ahead, Moore said that UK construction firms are more confident than at any time since the start of the COVID-19 pandemic.

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, added: "Only two months ago the construction sector produced the worst results in the history of the PMI, and there are still some potholes to navigate around as Government support for jobs is stripped away. "Employment levels remained deflated, with reports of redundancies, furloughed staff and a reluctance to boost staff numbers when new order levels remained so flat. But with a significant rise in the headline output number, it looks as though all the building blocks are there for the sector's increasing health."