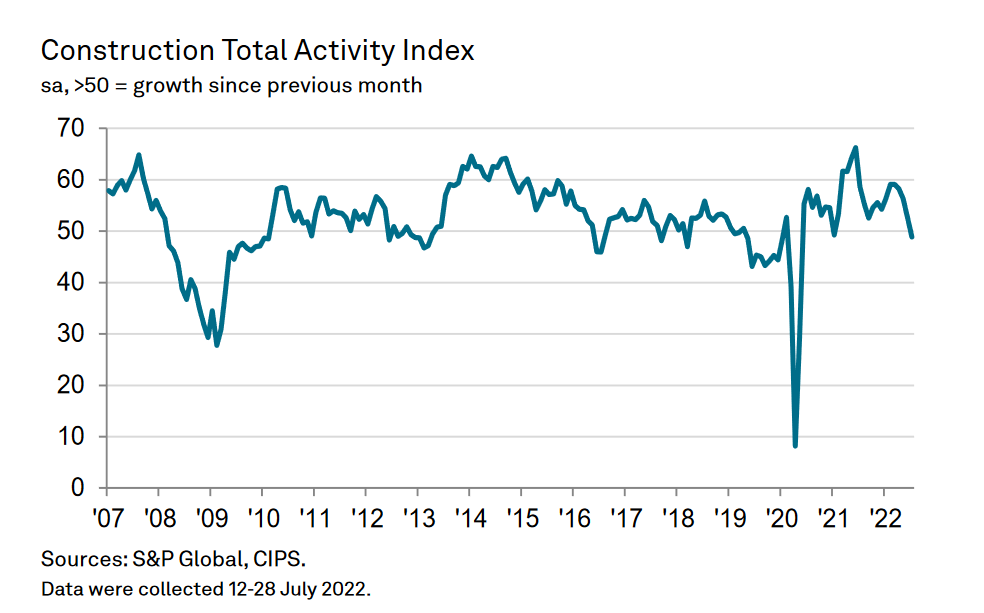

The latest S&P Global/CIPS UK Construction Purchasing Managers’ Index (PMI) fell to 48.9 in July, down on 52.6 in June and below the 50 neutral reading for the first time since January 2021.

Drops in housing and civil engineering activity were blamed on rising inflation, fragile consumer confidence and higher interest rates.

However, purchase price inflation eased, with the rise in cost burdens the least marked since March 2021. Higher costs for energy, fuel and transport were partly offset by some easing in commodity prices, particularly metals and timber.

Purchasing activity expanded at the weakest pace since January 2021 against the backdrop of a gradual turnaround in supply conditions and hopes of softer price pressures ahead.

Business optimism remained subdued amid recession concerns, the cost of living crisis and lower consumer confidence.

Duncan Brock, group director at CIPS (the Chartered Institute for Procurement & Supply), said: “After several months of difficult conditions for builders, these challenges have now resulted in a contraction in construction with the biggest fall in activity since May 2020.

“This disappointing result was felt across all the sectors, including housing which had demonstrated more resilience over the last couple of years, but fell for the second month in a row in July. However, it was civil engineering that fell the hardest and furthest. With fewer new orders in the offing, it may be some time before we see a rebound in this sector bearing in mind the time lag of infrastructure projects.”

Tim Moore, economics director at S&P Global Market Intelligence, said: “More positively, input cost inflation has retreated from the peak seen this spring as lower commodity prices and supply improvements gradually filter through to buyers of construction products and materials.

“The latest round of purchase price inflation was the least marked for 16 months, despite sustained pressure from escalating energy costs and staff wages, while supplier delays were the least widespread since the pandemic began.”

Meanwhile, UK services saw growth hit a 17-month low in July as economic uncertainty hit the sector.

The S&P Global/CIPS UK Services Purchasing Managers’ Index dropped to 52.6 from 54.3 in June.

Operating costs continued to rise with higher fuel and utility bills, so despite reports of pressure to remain price competitive, many firms saw little choice but to raise charges.