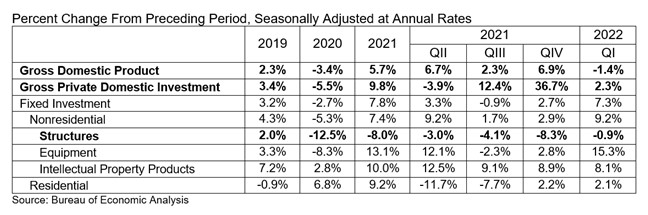

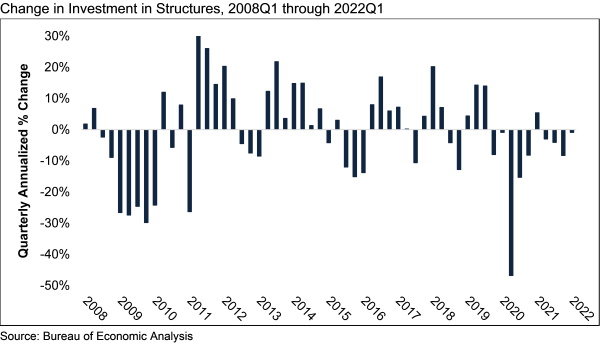

The U.S. economy contracted at a 1.4% annualised rate during the first quarter of 2022. Investment in nonresidential structures declined at an annual rate of 0.9% during the quarter and has contracted nine of the past ten quarters, according to an Associated Builders and Contractors (ABC) analysis of data released today by the U.S. Bureau of Economic Analysis.

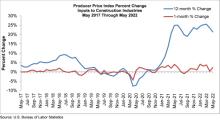

“The economy’s woeful performance during 2022’s first quarter complicates matters,” said ABC chief economist Anirban Basu. “Conventional wisdom says the economy has enough momentum to contend with the tighter monetary policy the Federal Reserve is pursuing to countervail inflation. Today’s data indicate that the economy is weaker than thought, which means the Federal Reserve will have a very difficult time curbing inflation without driving the economy into recession in late 2022 or 2023.

“That said, the economy should manage to generate some positive momentum during the next two to three quarters,” said Basu. “Consumer demand for goods and services remains strong. The omicron variant affected the economy during the first quarter, and that does not appear to be the case during the second. Global supply chains have been adjusting to the dislocations caused by the Russian-Ukraine war. Many state and local governments are flush with cash and continue to plan for a period of elevated infrastructure outlays.

“There is one other bit of good news,” said Basu. “The weakness exhibited by the economy during the first quarter may persuade monetary policymakers to raise interest rates less aggressively. This is a matter of significance for nonresidential contractors, who have become less confident in recent months, according to ABC’s Construction Confidence Indicator.

Investment in structures continues to decline in America, in part due to weakness in office, lodging and shopping mall segments. Presumably, additional rapid increases in borrowing costs would further dampen new construction in these categories. It may be that the Federal Reserve will raise interest rates more gradually than they would have knowing that the U.S. economy is already rather fragile.”