The combination of Anglo's

"We can comfortably spend up to £1 billion on acquisitions," said Tom, the former chief executive of

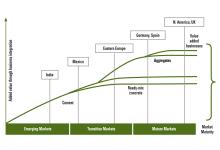

The aggregates industry may see further consolidation as Lafarge and

The Commission on 21 February said the planned Lafarge and Anglo venture will reduce the number of UK cement makers to three from four and limit competition. It may prohibit the transaction in full or demand the sale of assets. The companies may have to divest cement and ready-mix concrete operations on a scale similar to the current operations of either company, the Commission said.

Merger and acquisition activity in the building materials industry jumped 23% in 2011 to $27.9 billion, according to data collected by Bloomberg. That's still just 38% of the $73.7 billion in deals announced in 2007. That year featured the industry's two largest deals ever, HeidelbergCement's $18- billion takeover of

The transactions inflated debt just prior to a slump in US and UK housing markets, and lower economic growth due to the European debt crisis. Like Lafarge and HeidelbergCement,

Lafarge CEO Bruno Lafont said he's aiming to sell at least 1 billion euros of assets this year, and his counterpart Bernd Scheifele at HeidelbergCement in November said he was going to look "more closely at disposals."

"There are not many buyers for these assets," Breedon Chairman Tom said on the plants that Lafarge and Anglo may be required to sell. "We are a natural buyer, and we have the necessary firepower. We are in the fortunate position to be supported by our banks and our shareholders."