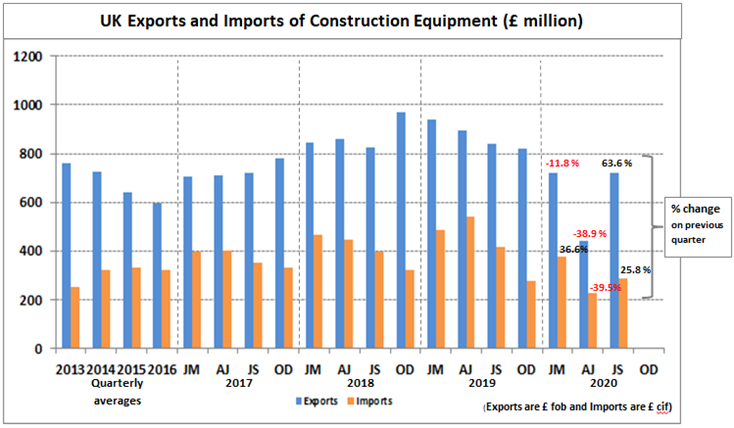

Exports of equipment showed a significant bounce back in Q3, increasing by 64% on a £ value basis, and 57% on a tonnage shipped basis compared with the previous quarter. This returned exports to similar levels to Q1 this year, but still below 2018 and 2019 levels. In contrast, imports showed a more modest recovery in Q3, and remained below the levels seen in the first quarter of the year. Imports increased by 26% in Q3 compared with Q2 in £ value terms, and 25% on a tonnage shipped basis. However, this left both measures at around 24% below the levels seen in Q1 this year, and below the quarterly levels of imports seen in the last three years.

The regional pattern of export shipments continued to show a distinctive pattern in Q3, compared with last year. As in the first half of the year, shipments to the leading destination, the USA, have remained weaker than other areas. In 2019, the USA accounted for 27% of UK export shipments on a £ value basis but has only reached 21% in the first three quarters of this year. Similarly, the EU continues to account for a larger share of exports this year compared with 2019. Last year, exports to EU countries accounted for 46% of total exports on a £ value basis, but this increased to 52% in the first nine months of the year.

In the first three quarters of the year, imports are 41% lower this year compared with 2019 on a £ value basis, and 39% lower on a tonnage shipped basis. Imports were expected to be lower in 2020, in line with reduced equipment sales in the UK, after experiencing peak levels in 2018 and 2019. However, imports have fallen to their lowest quarterly levels since data has been recorded from 2013.

The regional pattern of imports in Q3 recovered to a more typical pattern compared with Q2. The EU share of total imports fell to below 50% in Q2, with big falls in all the leading markets, particularly Germany. However, the EU share recovered in Q3, reaching 68% on a £ value basis and 65% for tonnage shipped. This returned the share of EU imports on a year to date basis in the first nine months of the year to similar levels to 2019. EU share stands at 66% on a £ value basis, and 62% on a tonnage shipped basis, compared with 64% for both measures in 2019.

The UK remained a significant net exporter of construction and earthmoving equipment in the first three quarters of 2020, with exports (£1,186mn) more than double the level of imports (£887mn).

The table below provides an update on the significant EU share of UK imports and exports of equipment in the first nine months of 2020. This illustrates the significance to the industry of any changes in customs and trade agreements due to Brexit: