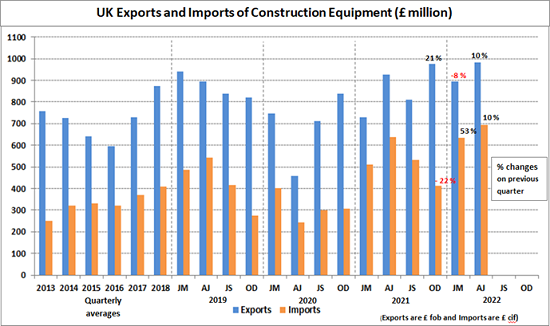

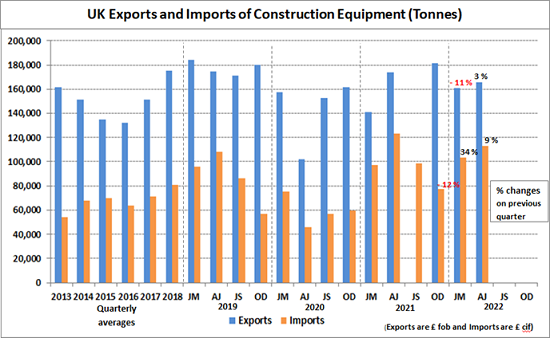

The data says that in the second quarter of 2022, imports and exports of construction and earthmoving equipment recorded increases on Q1 levels in £ value and tonnage shipped terms. In £ value terms, trade was at the highest quarterly levels for both since 2013, when monitoring of trade has been recorded. These record levels can be partly attributed to the higher prices being seen for equipment due to increases in the price of steel and some other products used in machine manufacture. However, the levels of trade measured on a tonnage shipped basis have also been at relatively high levels in recent quarters.

Imports of equipment in Q2 reached £696 million, showing a 10% increase on Q1. This took the level of imports in the first half of the year to £1,330 million, which was 16% higher than the first half of 2021. Imports of tonnage shipped in Q2 were 113,000tonnes, which was a 9% increase on Q1 levels. However, in the first half of the year, imports reached 216,000 tonnes, which was 2% below 2021 levels for the same period. Overall, high levels of imports in the first half of the year are consistent with equipment sales in the UK remaining at very high levels compared with earlier years. The EU share of total imports in the first half of the year was 68%, returning to similar levels seen in 2020. This followed a reduced level of 63% in 2021, which was attributed to a post-Brexit effect.

Exports of equipment in Q2 were £984 million and represented a 10% increase on Q1 levels. This took trade in the first half of the year to £1,879 million, which was 13% higher than 2021 levels during the same period. On a tonnage shipped basis, exports in Q2 were 3% higher than Q1 in the second quarter and reached 165,000tonnes. For the first half of the year, the comparison is similar, with shipments reaching 326,000 tonnes which was 3.5% higher than the same period last year. While the share of exports to EU markets showed an increase to 47% in Q2, it stands at 45% in the first half of the year and remains at lower levels than 2020. As shown in the table below, EU share of exports had shown a growing trend between 2018 and 2020, but lower levels in the last year and a half could be attributed to a post-Brexit effect. An update on total tonnages shipped in 2021 still isn’t available for this report due to problems with some of the tonnage data in Q3, which have not been corrected by customs yet.

The UK remained a net exporter of construction and earthmoving equipment in the first half of 2022, with exports (£1,879 million) 41% higher than imports (£1,330 million). However, this was a much smaller margin than in 2021 overall, when exports were 64% higher than the level of imports.

So far this year, the EU share of trade is showing a different pattern for imports and exports. For imports, the share is increasing and returning to similar levels seen in 2020. In contrast, EU share of exports remains on a downward path and is close to the levels seen in 2018.

In the first half of 2022, UK exports of equipment were shipped to over 160 different countries. The table below shows rankings for the Top 20 countries based on weight of machines shipped (tonnes) in the last year and a half. However, for 2021, the country ranking was switched to a £ value basis due to the problem with tonnage shipped data from customs, as referred to earlier (problem areas highlighted in red). In the first two quarters of 2022, the Top 20 countries accounted for close to 80% of total exports on both a value and tonnage shipped basis.

The USA remained the top destination for UK exports in the first half of 2022 and increased its share of total exports to 27%, compared with levels around 22% to 23% in the previous two years. The destination country with the strongest export growth in 2021 was Russia, when it reached 5th place in the ranking.

However, not surprisingly, its ranking has fallen to 11th place in the first half of this year, following only £3 million worth of exports in Q2. This has followed the imposition of trade sanctions in the first quarter due to the invasion of Ukraine. Exports to the Irish Republic remained strong in Q2 and maintained its position in second place in the destination country rankings, returning it to the position achieved in 2020.

In the first half of 2022, UK imports of construction and earthmoving equipment arrived from over 60 different countries. The table below shows rankings for the Top 20 importing countries based on weight shipped (tonnes) in the last year and a half. In the first half of 2022, the Top 20 countries accounted for over 97% of total imports in both weight and value terms.

Similar to previous years, Japan has remained the leading source for UK imports in the first half of the year on a tonnage shipped basis, while Germany remains the leading source on a £ value basis. Between them, the top two countries accounted for just under 30% of total imports in both tonnage shipped and value terms. Imports from France have continued to grow in the first half of the year compared with 2021 levels. As a result, their share of imports has grown to 9% this year for tonnage shipped, compared with 4% in 2021. This has moved France up to 4th place in the country ranking, compared with 10th place last year.