The subprime mortgage crisis is a critical factor for the aggregates industry in the US in the coming 12 months, and to some extent for Canada too. Adrian Greeman looks at the quarrying sector in North America

The aggregates industry in the US has been on a long roll. For more than two decades, with the exception of a small hiccup in the early 1990s, output has climbed steadily, along with company profits. Prices have gone up too, though in real terms they have more or less just held steady, or in fact slightly declined.

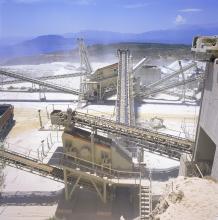

"We have mostly seen a climb of about 3% year on year in output," said Jason Willett, the specialist for crushed stone on the US Geological Survey minerals information team. Crushed stone makes up just over half the country's supply, some 1.6billion tonnes in 2006, with natural won sand and gravel another 1.28billion tonnes.

Crushed stone is defined in the US as blasted rock; slightly anomalously the natural aggregate may also be passed through a crusher without becoming "crushed rock".

Both are produced more or less across the whole US which is after all a huge country with a wide ranging geology, though there is slightly more crushed rock in the eastern side states and natural aggregate on the mountainous west. With so much inland geology it is perhaps not surprising that offshore sea won aggregates are almost non-existent; there is no need for it and environmentalist concerns are strong.

Both types of aggregate have sold at good prices; currently around $6.45 (€4.3) per tonne with a possibility of it rising to $7 (€4.7) this year. That is the yard price: transport comes on top, typically by truck.

Falling demand

The long climb in output may for the first time see serious trouble. That is not "on the horizon" but right now; output dipped fractionally in 2006 and in the last year has dropped back substantially and could continue to drop, or at least stagnate, for more or less a long period yet. Certainly 2008 could be a slow year.

According to the

"There may be some levelling out on that figure as we bring in the data from smaller companies which we only get annually," said Willett. "But I think we will still see a large drop, perhaps 10% for the year." The main culprit for the fall is the now infamous subprime mortgage crisis, the collapse in the less than solid sector of house-purchase lending where finance companies and banks lend money to the lowest sections of the market. At some risk they pushed loans onto borrowers who have limited collateral if any at all, and equally limited earnings capacity to pay back either the debt or the interest upon it. Interest rates which start low rapidly ratchet up as years go by, compounding the problems.

The packaging up of this hollow debt in complex finance structures and its widespread onward sale to banks, has left a credit vacuum the size of which even now remains uncertain. It certainly numbers tens of billions of dollars.

The wider effects have hit the whole economy in the US and abroad, as a notorious "credit crunch" has bitten companies' ability to borrow. It has impacted the aggregates sector directly too because of repossessions on housing, a fall in prices and therefore a turndown in new construction of housing. Since in recent years this has been, if anything, an overheated market with upward spiralling prices, the impact is particularly felt. A continuing office construction market which has partly compensated housing, may also see a downturn this year.

"It is estimated that around 400tonnes of aggregate is used - one way or another - for concrete, roads and for landscaping - in a new dwelling," said Gus Edwards, spokesman for the National Stone, Sand & Gravel Association which represents the majority of the industry at federal level. So the subprime effect is important for materials use.

Just how important is a moot point according to Edwards, who said he and his members are as unsure as anyone else in knowing the extent of the problems.

Industry analysts vary.

At the NSSGA most of the members have not yet felt the full downturn reported by the Geological Survey figures and profits have continued until now. But for all that producers are edgy.

Part of the reason may be that the larger companies which have a public voice, usually have activities spread right across the US or at least over major regions. But the housing downturn has tended to be regional to date with some areas strongly affected and others, like the hugely popular Las Vegas urban area still powering along. Smaller companies in just those areas may tell another story.

There are plenty of those. The aggregate industry in the US still has a strong mixture of companies from small family businesses to a full spectrum of the big corporations, some operating mostly in the US such as the largest of all, the

"There is a wide range," said sand and gravel analyst Wallace Bolen at the USGS, "and a smaller percentage of production by the larger firms than you might think." Just 46% of the total output of aggregates is produced by the bigger companies.

As in many countries this is slowly changing and a rash of takeovers has been underway in the last few years, and is expected to continue this year. "In July the

Florida Rock is a producer of cement, concrete and other products as well as aggregates and is typical of many of the larger companies which increasingly have vertically integrated their operations to control everything from the initial resource through to the end products. This may buffer such companies against the effects of downturn.

Road requirements

So too for the highways sector, which is more significant in the US than in most countries. With its extensive Interstate highway network and a strongly orientated car culture, there is continuous road repair to be done on a large scale, as well as some new construction.

"The Interstate may have been completed in the 1990s but it has to be constantly maintained," said Bolen. States too have road networks to maintain on their own account along with major cities; Los Angeles alone covers two-thirds the area of Belgium. Direct use of materials is important for sub-base, as well as for making asphalt and concrete. The demand can be for as much as 40% of overall output.

For this reason the federal highways budget allocations are always carefully watched by the NSSGA. These are renewed every six years in the Surface Transportation Act which was last due for renewal in 2003. As it happens there was a hiccup in proceedings.

"Congress did not sort things out in time, perhaps because of other preoccupations like Iraq and Afghanistan," said Edwards. For two years therefore allocations were made on an interim basis based on the old act with the new legislation only starting at the end of 2005.

"It meant that states could not plan their major schemes ahead," said Edwards, "and the balance shifted to about 33% in highways." Just at that time however the housing and office construction boom was taking off and the 30% or so of demand in this sector compensated.

Another 30% of demand continues for public works, water schemes, environmental works and other work such as beach replenishment.

From the end of 2005 the highway work has picked up again, taking up demand from the housing downturn to some extent "though it does not fully compensate," said Willett. Highway work is still coming through but the Act has to be renewed again in 2009, shortly after the elections and this may change the climate overall.

While all this is the central preoccupation, the industry has been facing many of the typical issues affecting aggregate producers in Europe: environmental concerns; diminishing resources; and the tightening of health and safety regulation.

Resource access

Urban sprawl has been a big factor said Willett, as housing and other development has encroached on outlying areas which had been used for extraction and quarrying. Once there, residents are unhappy with the levels of noise and dust and have forced shutdowns in some places even though the quarrying operation was there first.

The NSSGA has supported its members on the issue and has won a number of cases to prove dust levels were not as those perceived by residents. But the difficulties remain.

There is an increasing trend, as in Europe, to find ways to landscape pits, and find after-use functions for them in order to win planning permissions. Pits are approved at the city and county level mainly, though environmental and safety standards may be set at state or federal level, and quite frequently there is a need to negotiate future uses with communities.

It could be thought that America was big enough to simply find another place to win material but not so; "We are a very large country compared to Europe perhaps," said Bolen, "but the aggregates are required in just those places where urban development is happening."

Perhaps in the mid-west states' open plains there is less pressure, he suggested, but on the highly populated east and west coasts the issues are increasingly important.

Another important factor is simply that resources are covered over by development. In some states this is becoming such a problem that systematic mapping and recording of deposits has been undertaken with earmarking of resources for planning purposes to try and avoid future conflicts. "It is the smart thing to do but not yet a consistent trend," said Bolen.

Another trend is a move towards reclaiming construction material and recycling it. Statistics on this are less reliable said Bolen, largely because it is done by demolition and construction companies on site and does not show up in production figures. He thinks around 5% of material is supplied this way.

Recycling is increasing however, and economic pressure is likely to sustain this. "There are tipping fees locally in various areas," said Bolen, and petrol prices have climbed in the States as world oil prices increase which means trucking is more expensive. Material is moved a little further than in Europe, perhaps up to 50km, with 80% delivered by lorry. The rest goes predominantly by train over longer distances, with only 2% moved on barges.

There is also some import from Mexico and Canada of both stone and crushed rock. Ships bring material to the southern states around the Gulf of Mexico and there is trade on both the east and west coasts and also through the Great Lakes. Recent years have seen an increase in coastal quarries in British Columbia, in particular exporting to California (see the quarry profile in this issue for a report on the Orca Quarry in Canada).

At present this comprises only 2% of overall use but it is a steadily increasing quantity which may rise further.

"It is becoming more important to the Canadian market," said Doug Panagatko at the National Resources of Canada aggregates division. Canada is a much smaller market than the US, about 10% of its neighbours size, he claimed.

Similarities with the US market include vertical consolidation with the big players increasingly dominant. Canada's road network is not as significant as the Interstate system in the US both in terms of demand and movement. Canada uses its waterways for movement much more, transporting over 20% of aggregates this way.

It too may be affected by the subprime crisis, although less directly because of the impact it will have on its larger neighbour