An industry with strong company consolidation and high use of recycled materials is the result of a maturing aggregates market in the UK. Adrian Greeman reports

In the last ten years the UK aggregates sector has come to be dominated by five major companies, all multi-national and all operating in allied sectors such as asphalt, cement and ready mixed concrete sales and contracting. They all offer an increasingly sophisticated product, in both quality of material and in customer service, in order to compete.

These major companies control around 80% of the market in sales terms, producing from quarries and extraction pits across the country. Consolidation in the market has seen Mexico-based

While ownership may be moving out of the UK, these major players have the size and backup to make new investments as economic, planning and fiscal pressures put new demands on the industry to meet tougher environmental and social standards.

"The industry has consolidated significantly in the last decade," said Jerry McLaughlin, spokesman for the Quarry Products Association, which is the older of two bodies representing the UK quarrying industry. "Tax changes, the need for big capital investment, and a drop in demand from the peak, has pushed that."

"But there is also a 'long tail' of smaller and mid-sized companies," pointed out Richard Gill, a Department of Industry analyst responsible for construction products. There are around 300 SMEs in the UK aggregates sector with workforces ranging from little more than a family to over a 100 employees.

Steady Demand

Output for construction comes from both natural aggregates, some 120 million tonnes annually, and crushed rock, which accounts for around 80 million tonnes each year. On top there is a high volume of recycled aggregate use, which is currently 70 million tonnes and still rising. Aggregate demand in the UK peaked in the late 1980s at 330 million tonnes, during a period of major road building, but levels have steadied in recent years.

Geographical spread of aggregates is not quite evenly distributed around the country and the demand even less so. The UK's population is concentrated in a few areas, and particularly in the prosperous south-east around the giant conurbation of London. Manchester and Liverpool, Leeds in Yorkshire, Glasgow in Scotland and Birmingham in the Midlands are other major urban areas of high aggregate demand.

The south-east absorbs a disproportionate amount of material and tends to import from both outside the region and from overseas with a substantial marine dredged component. Few of the hard rock sources are found in the flatter lowland south and eastern side of the country.

According to the British Geological Survey, tough resistant rocks like hard limestone and granite are brought in from areas like the Mendip Hills in Somerset to the west and Charnwood in Leicestershire in the Midlands. Granites are also found more commonly in Scotland and western areas like Cornwall, Devon and Wales.

Alternative logistics

Larger companies like Hanson have made significant investments in the last two decades, especially in rail, and to some extent in water transport. The firm has a barge handling wharf on the River Thames at Wandsworth for its marine aggregates, and it has also invested in rail depots.

"We made a massive investment in locomotives and rolling stock in the late 1980s of around £80million (€117.7million)," said Hanson UK spokesman David Weeks. "It has meant huge paybacks - our trains can deliver 2000tonne loads from the West Country directly into depots in east and west London, bringing rock from the west and also from Leicestershire." Cemex has also invested in alternatives to road transport and has established a barge route on the River Severn. The company uses 180tonne barges to carry material the 3km from Ripple Quarry in Worcestershire to the processing plant at Ryall, and once processed the aggregates are transferred a further 15km in 380tonne vessels to the ready-mixed concrete plant. According to Cemex, use of water freight at this site will cut 340,000 lorry movements over the next decade.

The construction for the coming 2012

"In general there are few suitable waterways available in the UK to make it a real alternative to road transport," said McLaughlin. Weeks added, "The need for investment in what are essentially inflexible handling facilities also makes them a difficult proposition." Even for the more flexible rail alternative, the total moved is still less than 10% of Hanson's annual aggregate output in the UK.

Instead, as in most European countries, the production and use of aggregates is still largely local, with truck transport the overriding factor in cost of the product and the limits to its distribution. "If you load a lorry to go 15 or 20km, then the cost of the aggregate has doubled," said Weeks. "If you are competing with a quarry 10km closer, then it will always win on price." The impact of transport costs is the reason why smaller firms still survive even though they have fewer funds for capital investments. However, they are finding it harder to keep up. Increasingly, the market is aiming at providing higher value and specialist aggregates said Weeks, with multi-passed crushing to achieve precision shaping for the stone, for example.

Premium products

"The industry has changed and the focus in production is much more towards premium aggregates with greater added value," said Weeks. "The market for bulk fill and low grade scalpings, for example, has dropped." Hanson currently produces less volume than it did five years ago he said, with around 35 million tonnes currently produced each year compared to 40 million tonnes a few years ago.

The same is true for most of the big companies. At

The same is true at Hanson said Weeks. "It is about route-to-market. You can cut out a lot of the need to negotiate sales deals." A key factor driving the evolution has been the UK Government's tax changes, with the Landfill Tax and Aggregates Tax, aimed at encouraging recycling.

Both are intended to and, according to the DTI, do push the market towards reuse of material by making disposal of building waste uneconomic.

There is currently a £2 (€2.94) penalty for every tonne of inert waste disposed of to landfill, due to rise soon to £2.50 (€3.68) and a direct tax on virgin aggregate of £1.60 (€2.35) per tonne, which is also being increased to £1.95 (€2.87). These taxes add significantly to a material that typically commands a price of £3 to 10 (€4.41 to 14.70) in the market. Interestingly, the Aggregates Tax is applied at a lower rate in Northern Ireland to avoid damaging the export/import market with the Republic of Ireland.

The tax does mean that crushed concrete and other building waste is now a much more attractive proposition, especially in the urban areas. The impact has been substantial. Of the European countries, the UK has the highest proportion of recycled material going into construction.

According to McLaughlin at the QPA, recycled material use is up from 30 million tonnes - 10% of all aggregate use - in the early 1990s, to around 70 million tonnes currently, representing 25% of total aggregate use.

But the QPA and the

Despite protests, the larger companies have ridden the tax changes, seeing it as part of the pressure to adapt in the market. However the Aggregate Tax in particular has drawn strong opposition from the smaller companies, voiced mainly by the BAA.

For BAA chief executive Richard Bird, the tax is both unfair and counter-productive. He argued that it is damaging the industry because of the impact on the sale of scalpings and secondary products from quarries, which he claims can be up to 50% of production.

"We used to sell the less clean material cheap at pence per tonne to farmers and other industries. But since addition of the tax it is uneconomic and so it is piling up in quarries and will clog some of them completely, sterilising the supply," said Bird.

The BAA has mounted a court action against the tax alleging that it was unfair because China Clay waste produced in Cornwall and slate waste in Wales, which are both deemed by government to be environmental threats, was exempt. Following a defeat in the UK legal system, BAA has now taken the case onto the European Court.

"We would like to see tax exempt quarry by-products or for there to be grants towards the kind of equipment that can treat it," said Bird. "That would level the playing field."

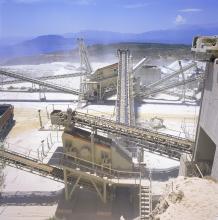

The larger companies, such as Hanson and Tarmac, have invested in newer plant in quarries and pits for just these purposes.

The smaller companies are also harder pressed with increasing environmental demands for winning new planning permissions to open gravel pits and quarries. New ecological sensitivities have combined with increasing population demands for housing and living space in just the lowland and valley areas where aggregates might be won, reducing the availability of new resources.

"In the post-war period planning applications were fairly easy," said Gill. "There was deemed to be a 'national need' and they went through."

Winning planning permission now means having to fulfil stringent noise, dust and ecological impact criteria, and requires completing major environmental impact assessments. It can mean hiring an expensive consultant for an application, according to Gill.

"Bigger firms have in-house resources though it is still an expensive business," said Weeks. "There are many new inputs like traffic, archaeology, visual impact. You can't leave any stone unturned and a report will often run to more than 1000 pages. These are very complex documents." A key issue is having a restoration plan available from the beginning he said, "Twenty years ago quarry operators used to leave disused quarries to fill with water. It was a lake but a sterile one. Now the extraction is engineered from day one to leave islands and terraces for wildlife afterwards."

Improving image

As a former quarry manager himself, Weeks said it makes him feel able to hold his head up, whereas in the past he was not keen to shout about his profession. He feels better too about the safety of the industry in the UK. Until 2000 it had a bad record, standing as one of the worst sectors in the uk construction industry.

"Through pressure from the

It has been one of the great success stories in the UK quarrying sector. A first five year plan instigated in 1999 to cut reportable accidents by 50% exceeded its target and the industry has now committed to a second five year plan to do the same. The QPA has taken the issue very seriously and McLoughlin said that the initiative has found a response among both large and small members.

Despite these advances, the industry still needs to convince the public that they need quarries to meet the demand for new houses and better roads. On the need to do that, the entire industry is united