In this, the second in our series of "ARI Management Masterclass" features, we are taking a look at pricing strategies. Between now and the end of the year, we are going to present you with a carefully selected group of in-depth features looking at the "Six Deadly Sins" that many aggregates businesses commit every day. Don't be a guilty sinner. Be a business angel. We want to help you run things better, faster and more profitably. Today, it is all about getting the best possible pricing strategy in place.

The best way to value any business is to look at its pricing strategy. And the nice thing about pricing is that it is very easy to understand. It allows you to see how well your company is managing its processes. If you would like to find out how your business is doing, we have included a small quiz at the end of this article. Fill it in and get a set of personalised results along with an overall ranking of where your organisation sits as far as pricing maturity is concerned. Be warned; in our experience aggregates companies often leave at least 5% revenue on the table … and that is a big number.

Running a business in a way that creates shareholder value while staying focused on customers is a management challenge. On the one hand, the shareholders want the value of their investment to increase but, on the other, the customers demand competitively-priced products based on a sound understanding of their needs.

In theory, these are conflicting interests. The challenge is to find a way to see them as complementary and identify to what extent they are complementary.

[caption id="attachment_98380" align="aligncenter" width="300"] © Tund | Dreamstime.com[/caption]

© Tund | Dreamstime.com[/caption]

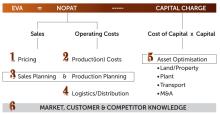

The long-term success of any business is based on its financial performance, especially in terms of wealth creation on behalf of the shareholders. As we outlined in our previous feature, Economic Value Added (EVA) is a modern corporate financial metric being used by many leading companies to assess just this … their financial performance.

EVA gives a true sense of the business’s profitability because it includes the cost of capital. Stern and Stewart, who conceptualised EVA, claim that EVA has got better predictive powers than normal accounting procedures if you really want to measure and analyse the financial performance of a company.

And this is where accurate pricing comes in, because pricing has a huge impact on total revenue and is a key component in a company’s profitability. But how much time, effort and structured thought are you placing on this obvious driver for a healthy P&L statement and, eventually, a healthy balance sheet?

How many times have you heard company executives complain about how short-term profitability pressures are forcing them to sacrifice long-term wealth creation? In order to create wealth, the company has to maximise its total value and enhance its performance through the various operational activities it undertakes. If a company is giving more returns to its shareholders, not only will it be judged as a strong performer, it will also see its shareholder base increase … and vice versa.

Most aggregates companies set prices on the basis of their cost structure, or on their competitors’ prices. By doing so, they neglect the customers’ individual requirements and their perceptions of value. In contrast, aggregates customers usually assess the price they have to pay, and the value of the offer, according to its potential to generate a beneficial outcome.

Customer relationship management systems assist in managing the gap between the value assessments of customers and providers. Setting prices according to customer-perceived value is something we would recommend if you want to optimise profits and focus on customer lifetime value (CLV).

“The integration of CLV with pricing and customer profitability principles ensures efficiency of immediate pricing and inventory allocation decisions without sacrificing long-term revenues, resources, or valuable customer relationships,” say the experts at Commercial Performance. “Customers are increasingly being viewed as assets that bring value to your company.”

To cultivate these assets, successful companies focus on three customer management strategies:

1. Asset acquisition – attracting new customers to the company. Managers need to understand how much it will cost to the company to acquire each type of customer.

2. Asset maximisation – maximising annual profits from each customer. Profits depend on both the amount of revenue (price multiplied by quantity) the customer delivers, and the cost incurred to serve the customer. CLV evaluates the customer’s profitability in the short term by net income (revenue minus expenses) … and in the long run by net present value (NPV) computations (discounting of cash inflows and cash outflows). Unfortunately, many companies don’t have a clear vision of net income per customer because it usually reflects an annual, not a cumulative or lifetime, computation.

3. Asset retention – retaining existing customers for the long term. The key is to retain those customers that align with your strategy and brand and serve them efficiently and effectively.

According to Commercial Performance, “CLV is a metric that allows managers to understand the overall value of their customer portfolio and evaluate how well their management strategies are working. CLV analysis allows managers to estimate the cost of acquiring a customer and to compare that to the expected benefit of that customer’s business during the life of your relationship.”

A customer’s lifetime value is dependent on three different factors:

1. The cost required in order to acquire the customer.

2. The annual profits the customer generates for the company.

3. The number of years the customer is likely to purchase from the company.

In an ideal world CLV analysis is used to allow managers to understand the overall value of their customer portfolio and apply the right strategies to deliver maximum value in the long run. In reality most managers in aggregates businesses will be facing very short-term profitability goals, measured by earnings before interest, taxes, depreciation and amortisation (EBITDA)… and this is an approach that has the potential to destroy long-term value.

“A classic example,” say the experts at Commercial Performance, “and we are sure most of our readers in the aggregates industry will have suffered through this, is when a directive comes from above that tells you to win a large job, to slash prices accordingly and to move the volume … purely to achieve a short-term financial goal. This behaviour is usually very destructive to successful long-term pricing in the market, and therefore has a massive negative impact on EVA. The same mindset that passes these edicts will also usually force you to forecast multiple times in a month, rather than trusting you to run the business and maximising EVA and long-term shareholder value.”

“Our industry is unique in its approach to the whole question of pricing. In a lot of instances, there are few checks and balances to ensure that pricing policies and rules are followed and, in many organisations, there seems to be an unwillingness to challenge sales people on pricing. Very few aggregates businesses have a true pricing strategy in place.”

So, if you are willing to boost profits of your aggregates business, ask yourself one simple question:

How good is your company’s pricing strategy? And, more importantly, how well do your sales people apply it?

If your answer includes words and phrases such as “average sales price,” “price increase across all markets,” “cost plus” or the famous “volume discount” you may sound convincing to some business leaders. However, those who want to survive in the world’s toughening aggregates markets, will need to think again, and think differently.

One of the ways to differentiate your pricing is to apply an approach that uses fact-based analysis processes; work harder at identifying the drivers of profitability in a given market and how that profitability is built up at a particular quarry.

And, to do this, a 360 degree review approach is needed, focused on the following fundamentals:

- Understanding key market drivers that ultimately determine price and profit;

- Segmenting customers to ensure that the business is targeting the best possible customer mix;

- Managing product and customer mixes for optimal profitability;

- Understanding the pricing dynamic on a regular basis to ensure that the right price is given at the right moment;

- Ensuring that sales people play by the rules. For instance, do you have levels of authority in place or pricing policies that are strictly adhered to?

With today’s tools and technologies, there really is no reason why there can’t be more accountability and science applied to the pricing discipline. Tools such as Killer Bee’s SmartQuote (go to www.killerbeeapps.com/SmartQuote) are useful aids when it comes to digitising the sales process and finding out whether or not it is efficient and profitable.

[caption id="attachment_98381" align="aligncenter" width="300"] © Auremar | Dreamstime.com[/caption]

© Auremar | Dreamstime.com[/caption]

So, what are some of the do’s and don’ts of pricing for aggregates?

Customer Segmentation:

DON’T ... treat all customers as if they have the same needs. DO ... split group customers into segments based on common buying behaviours, needs and end-uses.

We hear it more often than not. We will have a 3% price increase this year. Seriously, is that realistic? In most cases we have seen, a 3% across-the-board price increase relates to an actual price increase of 2%. Why would anyone think that all segments can or will accept the same price increase? Is your value proposition the same for each segment? We suggest not.

Customer Segmentation:

DON’T ... waste potential by treating all low-volume and/or cash customers as a second priority.

DO ... consider smaller customers as a value-added segment that is non-legitimate for high-volume discounts.

15 years ago, Lafarge had a KPI (key performance indicator) designed to attract small-volume clients. The company thought that it had identified an area of high potential profitability here. Our experience is that a large volume of discounting is done “at the gate” for cash, and that this is an area that needs analysing because you may be making a lot less profit than you should be.

Product Costing:

DON’T ... use average production cost to define price.

DO ... do a proper activity-based costing (ABC) before defining prices.

Please take a look at our previous article http://digital.aggbusiness.com/2018/agg-intel/jan-feb.pdf which took a look at the industry practices on product costing. You need to get this right. Think about it this way: if you do not know your product cost, or if your product cost is incorrect, then any “cost plus” pricing you have is wrong. Not knowing your product cost is a common problem in the industry, and in turn leads to value-eroding behaviours.

Sales Analytics:

DON’T... use generic or partial sales analysis to understand how well your company does with the pricing (e.g. average selling price (ASP) increase across all segments).

DO... aim for a clear overview of each customer segment and product cluster as well as a good understanding of a mix effect.

Ahhhh, now we come to an old industry favourite … using ASP as a metric. We would argue that this approach only has any relevance when it is used at a very high level over an extended period of time. How many meetings have you been in where you are questioned about a declining ASP? Of course, the quick answer is “my ASP is lower due to product mix”. No one tends to argue with this and then they move to the next question. It is important though to understand each segment and right down to each customer to ensure you have optimal pricing in place.

Set your own company a small challenge. Rank the importance to your customer of the following: a) on-time delivery; b) price; c) customer service and support; d) quality. Now, take the same set of questions and ask your sales team to rank them. If the order of the answers doesn’t match, there is a large scope for pricing improvement.

Market Assessment:

DON’T... count on your internal sales data to give you an accurate pricing reference.

DO... conduct a proper market assessment exercise to understand pricing drivers and to benchmark yourself against the competition.

How often do you complete a proper market assessment? When was the last time that you did a market assessment? It is crucial in establishing price points, competitor strengths and weaknesses. Don’t rely on a market survey from 15 years ago. In truth, no market assessment or analysis should rely on the gut feel and intuition of individuals. Experience shows us that this approach leads to non-optimal pricing.

Win & Lose:

DON’T ... try to win all jobs.

DO ... establish a reasonable Win/Lost ratio to ensure that you are not the cheapest supplier in the market.

Be honest - as an industry, how much pressure do we put on our pricing strategy? We usually fall into the trap of blaming someone else, or assuming that the “other” company is the low-cost provider in the market, and then allowing ourselves to believe that the buzz is usually around how company X has been losing money for over 10 years.

Really? How many aggregates companies do you know that have gone bust? Not many.

Have you ever stopped to think: “I wonder if the low-cost provider is actually us?” … “Are our competitors having the exact same discussion?” … “Are we actually company X?”

If you are lucky, you get some good bosses in your career. One such boss is Gunnar Syvertsen, the former general manager of HeidelbergCement Northern Europe.

During a rollout of a “Commercial Excellence” initiative, Gunnar questioned one of the sales representatives. The conversation went like this:

“So, how is business?” Gunnar asked.

“Yes Gunnar, business is good, very busy.”

“Forward order book is looking good, is it?”

“Yes, I have quoted 20 projects just this week.”

“Good … and how many of those do you expect to win?”

“We will win all twenty” said the sales representative with a broad smile.

“If I hear you say that again, you are fired,” replied Gunnar.

Of course the firing remark was tongue-in-cheek, but it raised a very important point. If you are winning everything that you quote, you are obviously pricing your product far too cheaply. You are, in effect, that “Company X.”

Message – track your orders won and lost because there are all sorts of gems to be uncovered in this simple analysis.

Product Cluster:

DON’T... use production driven product cluster for price setting.

DO... cluster products to reflect product availability/usage and substitution in the market/business. This should allow the same product to be sold under a different cluster in a different market.

Aggregates have a different value proposition for different clients and market segments. However, a majority of companies sell the same product at the same price to different segments. Sound crazy? Check your own practices and pricing before making a comment.

Zones of Natural Advantage (ZNZ):

DON’T... ignore the importance of the location of your production site.

DO... make sure you understand your transport and production cost advantage.

Again, it all sounds simple. But, in practice, is this happening in your organisation? Again, sadly, our experience is that this basic part of pricing is not performed correctly. What tools do people use to make sure you get this right? Google maps? Are you sure that this system provides you with road and bridge constraints so that your true distance from the client is understood? With the technology of today, tools like SmartQuote, mentioned above, deliver the right answer. ZNA paired with orders won and lost starts to give you a very powerful analytical suite that will allow you to make informed pricing decisions.

Analysis of Previous Sales History:

DON’T... rely on the gut feel and instincts solely of the sales team.

DO... fully analyse the market, competitors, clients and logistics to establish what pricing the market can handle.

Unfortunately, some organisations seem to be a little worried about questioning their sales teams. The sales teams almost seem to be a taboo subject. Here is an example of a real conversation that was had regarding low pricing in an area where a company had high pricing power:

“If we raise the price for our products we will lose the business to our competitors.”

“But you told me that we didn’t have competitors in this market?”

“Well, we don’t.”

“Ok, so explain to me why we cannot get the same price for our products here that we get in other markets?”

“We can, but you don’t understand.”

“I don’t understand what?”

“You don’t understand that the salesperson has more than 20 years working in this market. He knows the clients well, he goes hunting and fishing with them.”

Stunned silence … and then … “We can of course get another 2 euros a tonne for the aggregates, but we don’t want to stress-out the relationship.”

Contact our expert authors at [email protected] if you would like more information.