Don’t destroy your business. Find out how to avoid the six deadly sins that will stunt your company's growth opportunities and destroy its profit margins. In this, the first of a series of articles that will run throughout the whole of next year, Barry Hudson and his colleagues Julia Georgi, Jon Hill and Andy Smith have joined forces with Agg-Intel to outline a series of practical tips on how to be better. They have identified six key areas of change that will drive up the value of your company. Focus, they say, on pricing, product cost, sales and operational planning, logistics and distribution, asset management and knowledge of your customers, your market and your competitors.

In the sports and fitness world, coaches like to use the term “sweet spot.” At first glance, this may seem strange when talking about the aggregates industry but it isn’t. It’s spot on. Why?

Because hitting the sweet spot is one of the most efficient and effective ways of getting great results now, as well as in the future. And, as any good sports coach or captain of industry knows, results matter … both in the short- and the long-term. Hitting the sweet spot is the best way to turn a deadly sin into a positive virtue. It is all about building solid foundations for commercial success.

In aggregates, say our expert writers, there are six areas where companies keep repeating the same mistakes. The industry needs to work harder at things that have the potential to create the most value: pricing, product cost, sales and operational planning, logistics and distribution, asset management and, last but by no means least, knowledge of your customers, your market and your competitors.

This article is an introduction to a series of six that will look at these sweet spots and the value they can create. Each feature will be highlighted in your six copies of Aggregates Business next year, with the first appearing in our January/February 2018 edition. Look out for our articles on the “Six Deadly Sins.”

We begin with a look at the metric of value creation and why this can be an ideal framework to drive action and results. This introductory article highlights the six areas into which each of the subsequent articles will probe. We want to help you be a better business by avoiding the deadly sins that can drag you down.

The idea is to help and guide your business to a brighter future. We know that many of your companies are already aware of - and indeed working on – some, or all of these ideas. However, we believe that our industry could benefit from a more focused effort on the practical issues involved. Better results will follow.

The reasons are often twofold. Firstly, most discussions, concerning value creation float about in the theory clouds on sexy strategic topics like market structure, rebalancing the portfolio, and improving M&A. Whilst these are important, they are like a vision … they are nice to have but they don’t get the work done.

The second reason is the metric(s) being used in many companies to drive action and results. If you were to take a quick look at some of the industry leaders’ annual reports and investor presentations, you would see the four most notable metrics used today: EBITDA (earnings before interest, taxes, depreciation, and amortisation), volumes, free cash flow and earnings per share.

These are a good basket of metrics of course, but they tend to focus effort in the wrong areas. After all, what gets measured is what gets done. Take the industry favourite: volume.

Volume drives a certain degree of thinking based on economies of scale, which to some extent makes sense, particularly in a capital-intensive business. However, it can and often does destroy value and cause future problems. How many of us can recount a story of a quarry plan gone wrong due to someone taking a large volume order for a project which proved tricky to deliver, one which put the quarry completely out of balance?

What about EBITDA? Have you ever worked for a company that is EBITDA paranoid? This is paranoia born out of the fact that EBITDA is often used to value a company and everyone likes to see how much they are worth. But what happens is an endless cycle of forecast, re-forecast, and forecast again … hoping the EBITDA improves, usually seriously sacrificing key assets in the process. Some companies use their Capex (captital expenditure) to prop up their EBITDA ... a sure cause of value destruction in the short- and long-term. The obvious issue with this metric is that managers end up not considering the capital (particularly the working capital) needed to deliver these earnings.

And yes, even though cash is king, it still doesn’t answer the most fundamental question and a company’s “raision d’etre” … does the company create value? Cash’s metric, EVA (economic value added), is a great measure because it is clear. Going back to another sporting analogy. EVA is like the outcome of a sports contest … you either win or you lose. The company either creates value or it doesn’t. It may be the reason why it’s not often reported or used!

We agree EVA is not perfect (what metric is?), but it has advantages. It forces you to allocate all costs as accurately as possible for example, and account carefully for the capital used in the business (which can be a large amount of money for many aggregates companies). This approach outweighs some of the disadvantages such as the difficulty of assessing the impact on EVA of efficiencies from large or small plants or businesses that have large intangibles - although not many aggregates and concrete businesses have the latter.

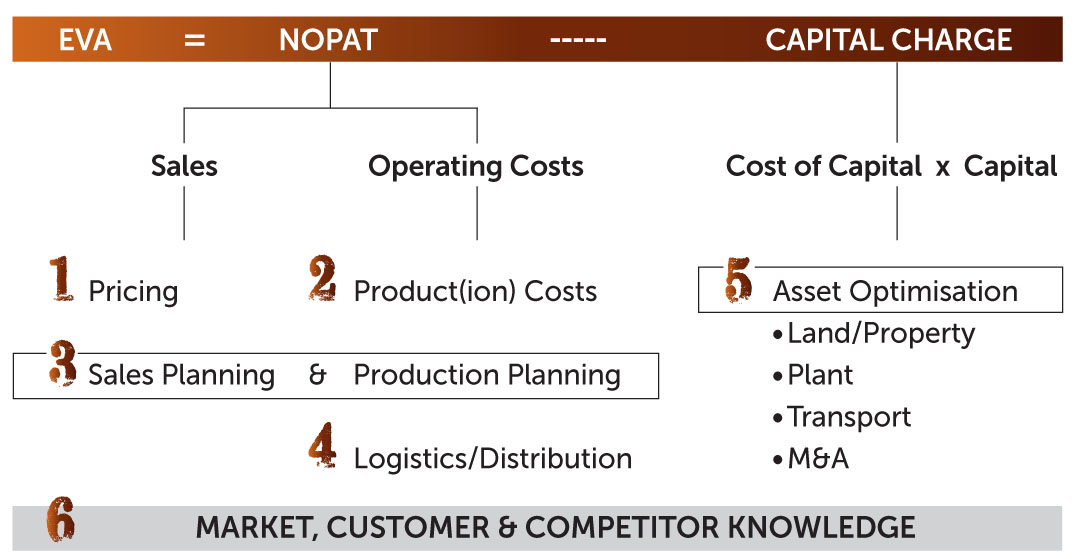

Take a look at Figure 1 (right). Using the EVA metric as a framework helps an aggregates company take practical actions that drive results in the areas key to value and it is here that we consider there are six sweet spots across three key parts of the EVA equation - sales, operating costs and capital.

The management articles that will follow in the coming editions of Aggregates Business will cover these key areas in much greater detail. We want to help you find the right way to make a real difference. There will also be a look at the upside of digitalisation, an area which we believe will be the way forward for aggregates … not least because our sector is not industrialised.

WHAT TO EXPECT IN OUR "SIX DEADLY SINS" SERIES OF MANAGEMENT MASTERCLASS FEATURES NEXT YEAR:

1. PRODUCT COSTING

Manufactured sands anyone? How do you cost a by-product If you do not know the profitability of a given product. How can you efficiently generate a production plan? Many people within an organisation confuse production costs with stock values. This article will look at product costing, the importance of defining fixed and variable costs correctly, and how to use product costing as a value creation process in itself. What does the accuracy of product costing do to the total value of your company?

2. PRICING

Most people think of pricing in terms of market share dominance or other generalisations. Remember the old days of price leaders and followers, waiting for the published annual increase letter? Perhaps that still happens, but what a waste of time and - let’s face it - a common reaction to the annual price increase letter is a customer saying “you have asked for 4%, but I can only accept 2%”. Can you think of any other industry that actually prices the way our industry does? The article looks at customer buying patterns, loyalty, payment history, product sensitivities, geography and many other factors often used in segmentation by marketing. And of equal importance are all those back office supporting processes used in price setting, quoting and monitoring.

3. SALES & PRODUCTION PLANNING

Unique to aggregates is the fact that what you extract from the ground is the major factor in determining what you can sell profitably. So … balancing the sales mix with the product mix is critical. We all know the clichés: sell the curve, make what you sell, don’t sell what you make. But, the most important and often the most overlooked problem is the impact on quarry production balance. If a customer wants an extra 200,000tonnes of a sand and it puts your pit balance out of whack, then why not charge a specific premium for this?

4. LOGISTICS/DISTRIBUTION

External and internal? Delivered versus collect customers? What is the most efficient model? What is the impact of logistics on price? The supply chain remains the major cost for a customer (delivered or collect) because they have to pay a price that covers this function. As a result, it is vitally important to understand things such as part loads and delivery routes during peak hours. How do you account for logistics? Is logistics a competitive advantage for you? How do you leverage that advantage? Important stuff, especially when you consider the customer is probably paying between 30 and 60% of the aggregate-delivered price in logistics charges.

5. ASSET OPTIMISATION

Be careful where you cut in the drive to optimise assets. Some markets will require a sales presence and you may decide to remove your sales force which can be expensive but be careful, don’t do it just for a short-term goal. You may create a one-off EVA improvement but stall momentum for years to come. Think back to the global financial crisis and how many players left certain markets this way.

6. MARKET CUSTOMER & COMPETITOR KNOWLEDGE

Market and customer knowledge: let's face it, most aggregates businesses don't have an unmanageable list of clients and it shouldn't take too much effort to understand their needs … yet this knowledge is often missing in many businesses. What is your ability to capture and analyse customer and market information, quotes, seasonality, specific conditions in the market real time like traffic flows, out of stock product, blended products and vertical integration? Segmentation, in and of itself, is vitally important and has been around for decades but the key question to ask is: on what basis do you segment customers to build your pricing policy?