If you have read the five previous articles in this, our series of Six Deadly Sins, then you will know by now that not understanding key areas of the business you run is unacceptable. It is a sin … a shortcoming that will stunt your business’ growth and destroy its profit base. In this, our final management masterclass feature, we would like to tie everything together and give you some useful tips for being a saint, and not a sinner. It is all about understanding.

It is regrettable that many aggregates businesses neglect the opportunities that arise from properly managing vital processes such as pricing, product costing, sales and operational planning, logistics and assets. But it is simply mystifying to admit that most of them lack a proper understanding of the market they are in.

These deficiencies can often be seen in things like an inability to capture and analyse the information that helps understand supply and demand factors, or in the way in which many aggregates companies fail to understand how the structure and the drivers of each market work.

It seems to be a common sense that any business needs this information to make tactical and strategic decisions. However, the reality is different. Your teams will know a lot of important market elements, but only a few people in your company (and sometimes none) will truly understand how those elements fit and work together.

In this article, the sixth part of our Six Deadly Sins management masterclass series, we will discuss why this happens and how to fix it.

According to our experts at Commercial Performance: “There are five good reasons why so few people understand that aggregates market.

The first involves ignorance. The complexity of the aggregates market is ALWAYS underestimated.

It is often believed that the business of crushing and screening exists in elementary markets with unsophisticated business models. As a consequence, even in the 21st century, many aggregates managers simply ignore the fact that breaking stone doesn’t mean that they have to operate in the Stone Age.

In reality, understanding the contemporary aggregates market requires just as much data as any other business. For instance: market knowledge (e.g. activity levels, who supplies what and from where, vertical integration, price levels, seasonality, product shortages, who is making money “...many aggregates managers simply ignore the fact that breaking stone doesn’t mean that they have to operate in the Stone Age” and who is not); customer knowledge (e.g. needs, growth, sensitivity to price their plans and target segments/projects); and product understanding (e.g. market supply, geology).

These are just some pieces of the puzzle that you will need to put together if you want to understand the battleground.

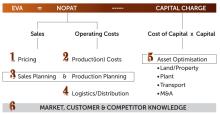

Take a look at ‘Picture 1’ below for a few more examples. You will see a series of jigsaw pieces that all come together in the sales/product mix, a mix that is by far the most important outcome of such basic knowledge.

Lack of knowledge in these basic areas means investing assets in the wrong area, poor capital allocation and poor strategic investments.

The second area where things often go wrong is the background of the business. Historically, the industry is operationally focused. If you were to check the amount of metrics and key performance indicators (KPIs) you look at on a daily basis, the vast majority (if not all of them) will relate to production and logistics. Usually, quite the opposite exists in the commercial side of the business. What operational metrics do you have for sales except total sales?

In addition to that, many aggregates businesses are order takers rather than order makers. As a result, they design their business models to follow the end user’s strategy. The industry is used to supplying what is demanded by the market and is often ready to absorb the negative consequences which result … such as unprofitable sites, mountains of by-product and wasted reserves.

After all, everyone ‘knows’ that sooner or later there will be a new wave of investment in the market and construction activity will kick off. So why even bother to open this aggregates market puzzle box?

The third thing holding the market back is bad habits. Yes, doing the same, familiar thing year after year is very comfortable. Indeed, recycling last year’s general market share presentations updated with this year’s construction market growth number is easier than trying to build a robust end user-based model that considers all of your customers’ and suppliers’ sites within the market.

Fourthly, we should all think about the absence of tools for aggregates businesses. Without appropriate software it is almost impossible to create comprehensive detailed market assessments. Why do we say this? Because, in order to slot together all of those pieces in the jigsaw puzzle above, one needs to define the geographic boundaries of each market as clearly as possible and capture all delivery modes and channels.

What are your customers’ needs and how do these create opportunities for differentiation? If possible, figure out price range for each product type supplied in each sectors who don’t see the links between product geology, reserves scarcity, production outputs and demand in the aggregates market. ” customer segment; and then create simple outputs of such analysis.

Have you ever seen a completed version of such a puzzle? If yes, then consider yourself the lucky one. We would appreciate it if you would share your experience with us. It could be a best seller!

And last but not least there is another, fifth, reason who so few people really understand what is happening in the aggregates sector: A lack of general business understanding among some of the industry’s top managers.

It is not uncommon to hire directors who don’t see the links between product geology, reserves scarcity, production outputs and demand in the aggregates market. Regardless of the reasons behind their lack of knowledge the result will be always the same – they will be validating revenue and profitability plans without understanding what drives them.

This lack of the basics and the consequential poor planning nearly always leads to a ‘boom-bust cycle’ at the company level … unless of course the market is growing so strongly that anyone can make money!

Four ways to fill the knowledge gap

1 Create market overviews that make sense. For example, instead of using a traditional, meaningless top-down approach that looks at the consolidated market shares of leading aggregates producers … use a bottom-up approach instead to review the market. This is a proven way to:

2 Get a habit of sharing market information within the company. When it comes to market information communication is key. At first, challenge your teams to share everything they know (or think they know) about customers and competitors on a daily basis. Any gossip works! Secondly, make sure key information (e.g. pricing trends, material shortages) is captured, standardised and shared during the sales and operation planning (S&OP) process. This will allow you to plan and sell better.

3 Set up a company-wide metric like ROCE (return on capital employed) and encourage your staff to get to the bottom of each issue for everyone and explain where their piece of the jigsaw fits in. We are all in this business to be profitable. Think back to our earlier articles when we discussed the harm that short-term metrics have on our industry. For example, earnings before interest, taxes, depreciation rs & opportunities to make more profits

4 Invest in tools. Let’s face it, the number of tools that allow the average aggregates business to capture and analyse all of its market information is limited. On the other hand, for all the reasons listed above, your company was probably not looking to buy such software. Look hard at what you do, work out exactly how you do it, and then follow the demand.

We hope that we have managed to convince you to invest more time and effort in working out the tricky puzzle that is the aggregates market. If you can’t afford a proper aggregates market assessment software package then start with something as simple as Excel, Google Map, CRM or a quoting tool. You’ll be surprised how much your teams know and how quickly you’ll mature as a business. Get ready now to take that next step, and to consolidate all your knowledge using more sophisticated tools.”

By not having the appropriate market information at the appropriate time, the commercial people in our industry are basically flying blind. We are notorious as a group at seeing what the competitor is charging and then discounting. Actually, discounts are in our DNA. Why? Ask yourself a couple of questions.

1.How many products do I buy in my personal life where there is an annual price list?

2.What other product can I buy that is 2 cents a kilogram?

Add to the points 1 and 2 above the knee-jerk discount mentality, and you have what we have today. As an industry, we unwittingly destroy value in our markets, quite simply because we do not fully understand our markets, our position in those markets, and the value we provide.

Our challenge to the industry is simple, analyse your market, your strengths, your competitors’ capabilities, your customer profiles and needs, and plan, implement and execute a robust commercial strategy. The result will be a minimum five-fold profit increase compared to any cost-cutting exercise you may be contemplating – and usually, there is no capital involved.

Go on, do it, you can achieve your 25% ROCE.