In the below first of a new series of Agg-intel Management Masterclass features, we are taking a looking at product costings. Over the coming months, we are going to present you with a carefully selected group of in-depth features looking at the Six Deadly Sins that many aggregates businesses commit every day. Don’t be a guilty sinner; be a business angel and consider our advice on helping you run things better, faster and more profitably.

Manufacturing likes to run lean and mean. To keep its product costings as low as possible, a successful manufacturing business will constantly seek low raw material prices and fight hard to keep its overheads under strict control. In the aggregates industry, we have a world full of skilled engineers who appear to know the exact cost of every individual product at each of their sites but, once you get under the skin of the business, you quickly realise that things are not that simple. There are at least six different rules to get right if you want to properly calculate the costs of producing aggregates. What are they, and how does it all work?

It might sound obvious but, first of all, every single production cost needs to be captured if you really want to manage your aggregates business properly. And you need to be honest with yourself.

You might read that and think what kind of business manager would not want to capture costs properly? Well … certainly no reasonable aggregates manager would try to hide costs but, if we are being honest with ourselves, we might only want to declare them during a more “favourable” period.

For example, to avoid overspending an annual maintenance budget, the related costs accrued this year could be declared next year. Or seasonal subcontracting costs could be spread equally across the year to avoid monthly fluctuations. We have all done it.

None of it is illegal, but eventually it will get in the way of understanding actual production costs during the period in question. Capture every cost in real time … all of the time. This is rule number one.

And then, secondly, all production costs need to be classified properly. Again, this sounds easy. Hopefully, your company will already have cost classification rules and policies in place, and you will have communicated them throughout the whole business. You will be clear on the distinction between fixed and variable costs and all of your main cost types will have been defined and explained … such as depreciation, maintenance, salaries, benefits, and third-party services.

However, how often does anyone in your business actually sit down and check if these rules are being applied correctly? Was last year’s electricity bill for an onsite office building captured under production “utilities”, for instance? Do all site employees deal with production only or do some of them work on sales as well?

In a full year, the cost difference might only be a few percentage points, but the devil is in the detail. Thin margins can end up ever thinner if you have cost fluctuations as a result of putting the wrong cost under the wrong classification code.

Thirdly, all production costs need to be allocated to the activity or the process stage that generated the cost. And this is where the “ABC madness” begins. Even if you have best analysts on the planet … they will never think alike.

Unless your cost-related activity and production stage definitions and codes are standardised, and then applied very strictly, your cost centres will not be comparable. It then becomes impossible to compare and contrast the costs of similar products from different sites. You must always make sure that you are comparing apples with apples.

Fourthly, all production line outputs need to be measured … carefully measured. How many aggregates sites equipped with one scaling technology have you visited lately? 1 out of 25 in your area? Are you sure that this modern quarry has a belt scale on each conveyor? How do you measure your inventories? How often do you measure your inventories? What do you do to reconcile any variances from production reports to the actual volume of material on the ground?

The list goes on and, if you cannot measure it, you cannot manage it.

The fifth issue to understand is that all site business activities need to be understood.

Aggregates is a local business, and each site will have a different organisation, structure or purpose. Some sites, for example, will deal solely with production. Others will focus more on sales, marketing and logistics. The costs related to those activities could appear on a site’s P&L (profit and loss sheet) but, if they don’t and they have not been allocated correctly, the true production costs of the company concerned become even more difficult to calculate.

And last, but not least, it is essential that all overheads, such as sales, administration, finance charges, cost of capital and so on, are acknowledged. Allocating central overheads is usually a harsh business decision and no sober production person likes to see these “extra” costs being imposed on their P&L but, in the long run, it is essential to be honest about such activities.

In such a production-driven industry as aggregates, where distribution, R&D (research and development) and marketing costs are not always the biggest hits, looking at product costs without taking your central overheads into account is misleading - and potentially damaging - to the business.

This is especially true in large vertically integrated companies with a “product line business unit” structure. You need to avoid getting into a situation where, instead of understanding the true cost of all product types and the profitability of each individual site, your team of general managers fight against allocating the real overhead of the business because they want to protect their local teams.

All this explains why defining the costs of an aggregates business is a challenging and time-consuming activity.

No wonder production departments prefer to use stock capping value as a product cost reference. It is much easier for accountants, who have never been or worked in a quarry, to know exactly how to value the rock produced rather than trying to calculate it by yourself. It is also very empowering to sell aggregates just above their stock capping value, thinking that you have actually generated profits for the company.

In short, true product costings are essential. If you do not know your true product cost, how can you calculate any meaningful and actionable margin? It becomes impossible to create credible operations plans going forwards. If you do not know your margins with precision and, if you have products with negative contribution margins (revenue does not cover the total fixed cost), it is impossible to determine optimal product schedules or that sweet spot in production volume for a given period.

Accurate production costs are essential to running an effective and efficient aggregates business. Ask yourself some honest questions. How accurate are your production costs? How often do you refresh your production costs? Does finance work with operations to allocate and capture the correct costs with the correct production stage? Do you include all overheads?

For more information on tools and processes for the methodologies mentioned in this article, please contact the authors at [email protected]

How to achieve the best “economic added value” outcome for your business

So much has been written in recent years about the way in which companies have tried to tie real economic growth to their investments in assets and capital appreciation that it is hard to see the best way forward. Hundreds of books and articles are out there offering you advice on techniques “guaranteed” to solve the problem.

In the end, it’s best to keep it simple and, as Peter Drucker, one of the best-known and most widely influential thinkers on management and business, says “economic value added (EVA) is based on something we have known for a long time: what we generally call profits, the money left to service equity, is usually not profit at all. Until a business returns a profit that is greater than its cost of capital, it operates at a loss.”

So, we would suggest that it is best to put in place a cost and performance measurement system that integrates activity-based costing (ABC) with economic value added (EVA) if you really want to get a grip on the problem. “This proposed ABC-EVA system is a decision support tool for managing costs and capital,” say our experts at Agg-Intel and Commercial Performance. “A properly integrated ABC-EVA system adds the cost of resources consumed (like traditional ABC) with capital demands to position these resources and provide them with assets.”

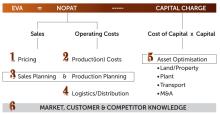

Economic Value Added (EVA)

The theory of EVA is, in essence, pleasingly simple. To be economically justified, an investment must earn at least its cost of capital. The ABC-based EVA formula for a given product or product category therefore is EVA-ABC = revenue – (ABC cost + (capital employed x cost of capital)).

And, according to the experts at Commercial Performance and Agg-Intel, “the EVA extension to ABC requires that the capital employed for each product be determined and that a risk-adjusted rate for that capital be identified. The power of EVA can be demonstrated by considering two products.”

For example, “the first sells for $1,000 at an ABC cost of $300 but requires capital employed of $1,000. The second product also sells for $1,000 at the same ABC cost of $300 but requires capital employed of $10,000. If the cost of capital is 10%, then the first product has a positive EVA of $600 (($1,000 - $300) – (10% x $1,000)), whereas the second has a negative EVA of $300 (($1,000 - $300) – (10% x $10,000)). The first product creates wealth, while the second destroys it.”

And yet, ironically, “both have the same $700 ABC profit!”

A more formal definition of EVA is net operating profit (revenue – cost) after taxes (NOPAT), minus an internal charge for the capital employed in the business (such as the opportunity cost of capital), while ABC assigns product costs based on resources consumed not purchased.

So, if you keep it simple and get it right, “EVA and ABC together give managers the ability to purchase strategic assets (capital employed) and understand their profitability” says Commercial Performance and Agg-Intel, especially “when combined with the operational cost of those assets.”

Furthermore, “the simple example above highlights the two major advantages of the integration of EVA and ABC. Firstly, the decision maker becomes sensitive to the economic return of products, customers, and channels, and, secondly, the process allows businesses to reward the more efficient use of capital.”

Empower your managers with a powerful tool ... Economic Value Added (EVA)

EVA is a powerful tool for several reasons say our management masterclass experts at Commercial Performance and Agg-Intel. “It aligns employee behaviour with shareholder value generation, separates employee incentive compensation from the traditional performance measurement that compares actual to budgeted results, and it is relatively easy to communicate and understand. EVA rewards employees for maximising shareholder wealth.”

EVA “also supports corporate governance, which has become a widely discussed topic in recent years. There are numerous situations where management’s obligation to act on behalf of shareholders is in conflict with their own best interests. Growth, either internally generated or through acquisition, is typically in the best interests of management because compensation is often based upon such factors as sales volume, size of department and size of budget. Yet, this growth doesn’t necessarily provide increasingly positive EVA contributions to shareholder value.”

To conclude our section on EVA, it is also worth noting that some people out there believe in the concept of not maintaining company assets for short-term gains. In his book, ‘The Hard Things About Hard Things’, author Ben Horowitz refers to this practice as “flattening the hockey stick”. EVA will identify to shareholders if management is not reinvesting in corporate assets. In fact, the Security and Exchange Commission (SEC) has considered requiring companies to include an EVA calculation as a part of their annual reports.

Activity Based Costing (ABC)

Unlike traditional costing, which builds from the “bottom up” (looking at the basic building blocks of a business such as things like labour, material, and overhead costs) and concentrates primarily on manufacturing-related costs, ABC starts from the other end of the process. ABC “determines which activities and related costs are used in carrying out the complete value chain of activities associated with the product or service,” say Commercial Performance and Agg-Intel. And “some of the activities and related costs are related to production volume, but others are not.”

To “validate the expected financial impact of a decision,” say our experts, “managers should use cost analysis to classify the behaviour of all their expenses. This should include regarding changes in mix and volumes as being variable, semi-variable, step-fixed, or fixed.”

“Such analysis should also distinguish the difference between capacity provided and capacity used and consider the presence of unused and available capacity. Full absorption costing in an ABC context does not mean that 100% of a period’s expenses are traced to customer-related products, services, and channels. Costs not related to customers, including unused capacity expenses, are ideally traced to a final cost.”

This approach involves four steps:

1 Identifying work activities: The work activity identification exercise should be guided by materiality and the objectives of the ABC system. For example, if the objective is strategic (e.g., product line profitability, pricing policies), the primary need is to accurately assign costs to final cost objects. In such cases, activities can be broadly defined.

2 Identifying elements of cost: Elements of cost are the expenses of the company, including staff salaries and expenses of capital, machinery, buildings, materials, supplies, equipment, and utilities. A company’s general ledger is typically the source of information about these cost elements, but it does not break those cost elements down by activity performed. That is why ABC reassigns those resource expenses into activity costs using cost drivers.

3 Determining the relationship between activities and elements of cost: During the implementation of ABC, expenses contained in the general ledger are assigned to activities. This assignment is determined by the relationships between the various work activities and the elements of cost. Some ABC models first group similar expenses into categories or jobs, referred to as cost pools. The elements of cost pools can be assigned to activities in a directly measurable manner (e.g. metering electric consumption, charging maintenance via a work order, charging requisitioning activities for supplies, etc.) or through estimation, often determined through questionnaires and interviews. Arbitrary cost allocations, particularly those using broad averages, should be minimised whenever possible. This is because they do not improve the understanding of the economics of performing activities. In addition, over-averaging the allocations distorts the costs of things by over-costing some while under-costing others.

4 Identifying and measuring activity drivers: Activity drivers are the usage-based variables that explain the behaviour and magnitude of activity costs. They reflect the consumption of resources and how they relate to products and/or services.

The quest for precision often “tempts companies to select too many excessively detailed activities and/or tasks, each of which will require a cost driver.” Make sure you don’t get lost in the minutiae. “Decisions must be made on the trade-off between accuracy and administrative effort,” say Commercial Performance and Agg-Intel, “as well as the difficulties of operating a more complex costing system.”

The “difficult part of this system is identifying the cost drivers associated with each activity. Some cost drivers are directly related to volume, like machine hours or assembly labour hours, but other cost drivers are not directly related to volume, like the number of inspections. Each company must decide how many separate activities (and related cost pools and cost drivers) to identify. If too many activities are identified, the system will be unnecessarily costly and confusing. Conversely, if too few activities are identified, the system will not produce accurate or meaningful data. Most companies that design ABC systems use 25 to 100 distinct activities.”

The “benefits of implementing an ABC system can result in real advantages in the highly competitive market in which you operate. This system is less likely to under-value complex, low-volume products or services and over-value simple, high-volume products or services. The second benefit that ABC provides is improvement in cost-control … your managers will be able to see costs broken out by a number of activities rather than buried in one or two overhead cost pools. The activities themselves can then be analysed and made more efficient.”

Once again, you can’t manage what you don’t measure. “Having an accurate production cost is essential to planning and running your business efficiently,” say Commercial Performance and Agg-Intel. “Used correctly, it will help maintain the value of your company in the long-term and enable good decision-making. Product cost is much more than a number to be used by the finance department.”

So … the next time someone tells you that their product cost is zero, or close to zero, just give them a strange look and walk away.