It might be a cliché, but if you want your aggregates business to survive, you are going to have to find out how to get the right goods to the right place at the right time ... and all at the right cost. If you don’t, and your transport and distribution strategy is incorrectly costed, you are going to be put out of business. It is all about logistics, an area in which the aggregates industry is often found wanting. We seem to forget to account for things like road tolls, bridge weight limits, traffic congestion or wait times at the quarry. It is time to stop subsidising your customer and/or your logistics provider and boost your own bottom line and company value. Join our experts from Commercial Performance to find out why logistics is so important.

The Oxford English Dictionary defines logistics as “the commercial activity of transporting goods to customers.” Professor Alan Waller, former president of the Chartered Institute of Logistics and Transport and a visiting fellow at Cranfield School of Management, once defined logistics as “the time-sensitive placing of resource.”

However you define it, logistics is a vital part of your company’s activity …a real driver of success or failure. In a recent study, it was shown that only 2% of pricing quotes generated by aggregates companies were correct. Astonishingly, 92% of the quotes studied were undercharging the customer.

This is bad news of course. but it gets much worse ... much worse. Logistics is a key part of the equation that our industry is getting wrong, over and over again. How do we perform and evaluate logistics in the aggregates industry, and where does it fit into our Six Deadly Sins theme of “not destroying the value of your aggregates business”?

This article is not an in-depth look at logistics per se. It is, instead, a think piece focused on looking at the ways in which we quote for logistics, and the impact this approach will have on company profitability and long-term value creation. It is a tactical look at how we leave money on the table, effectively subsidising (often to a surprisingly large extent) either the customer or the logistics provider … sometimes we are inadvertently putting money into the pockets of both!

Logistics is an important factor in driving up value creation, customer experience and customer profitability. The different operating models for logistics, such as whether you own your delivery vehicles or you lease, rent or subcontract them has a major impact on your balance sheet or your P&L (profit and loss statement) or any other financial metric that you use. And don’t just think about the financial implications of a well-run logistics organisation … think about your logistics provider as the person who has the most frequent contact with your customers. The delivery person is the face of your company out in the real word. So, the old cliché of on time, at the right price and with the correct quality sits firmly in the logistics camp.

Logistics is not just about cost, it is also all about revenue. In our experience at Commercial Performance, aggregates companies are quite poor at reconciling both, which is very worrying when you consider that the logistics accounts for 20% to 50% of the delivered cost of the average aggregates product. So … here is how you should track and reconcile your logistics cost, and how you should avoid the deadly sin of “not destroying the value of your aggregates business”.

Don’t quote me on that!

If our industry is getting its supply chain costs wrong again and again, the first thing to ask is: “What magnitude of impact does this inaccurate quoting have on our company value?”

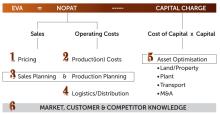

To start to answer this question, the experts at Commercial Performance begin with the client. “First of all,” they say, “we consider looking at this topic through the lens of a company that excels in customer excellence or ‘customercentricity.’ Firms like this see a customer-focused approach as fundamental to creating strong long-term value. They work hard to yield the best EVA (Economic Value Add) ... and all of this is especially relevant when we discuss logistics and the quoting of the logistics cost.”

Commercial Performance explains it like this: Just to recap on EVA (Economic Value Add) for a moment, it is well worth remembering that EVA is a perfect measurement tool. It is crystal clear, like the outcome of a sports contest. You either win or lose. Your company either creates value or it doesn’t. Indeed, this may well be the reason why it’s not often reported or used in the aggregates business!

Think about this for a second. Ask yourself: Do our metrics for success really give us long-term value, or do we get swept away by quarterly performance targets and look for a ‘good’ result in the short term? Does this sort of approach undermine the long-term profitability and value of the company?

We agree that EVA is not a perfect metric … but what is? The main advantage it offers is that it forces you to allocate all costs as accurately as possible, such as accounting for the capital used in the business (fairly large for many aggregate companies particularly). This is a fiscal discipline that outweighs some of the disadvantages such as the difficulty assessing the impact on EVA (Economic Value Added) of efficiency changes from large or small plants … or of business areas that have large intangibles - although not many aggregates and concrete businesses have lots of intangibles. Quite the opposite in fact!

What we particularly like at Commercial Performance is the fact that you can use EVA as a framework to identify the key drivers of value in an aggregates and concrete business. This allows you to focus on what is important … and it is here where we would argue that there are six sweet spots across the three key parts of the EVA equation - Sales, Operating Costs and Capital.

Logistics, therefore, is an important driver not only of EVA, but also of a better customer experience. This, in turn, will allow you to grow your profitability per customer.

There are different operating models for logistics. Some aggregates businesses prefer to own and operate their delivery vehicles themselves, in-house. Some prefer to outsource their supply chain and lease, rent or subcontract their vehicles. Some use “drive-ups” or other business structures for logistics. Whichever way you do it, the cost of an aggregates supply chain will have a huge and business-critical impact on your balance sheet or P&L. It will have a major impact on every financial metric that you use.

And there are far more implications than just the financial impact of a well-run logistics operation. In most cases, your logistics provider is your most frequent customer contact. Your delivery driver is the face of your company on a day-to-day basis. They, quite literally, deliver the goods.

So, we come full circle, and end up back at the old cliché of needing to be on time, at the right price, with the correct quality. These performance criteria all sit firmly in the logistics camp. Get it right and this will be a significant driver of profit. Please refer to our second “Deadly Sins” article on pricing.

Of course, logistics doesn’t just mean cost, it also means revenue. In our experience, aggregates businesses are quite poor at reconciling both the cost and the revenue. This is especially surprising when you consider that the delivered cost of a typical aggregates product is usually comprised of 20% to 50% logistics costs.

Customers don’t usually mind how the final invoice is constructed. The delivered cost is the delivered cost.

Keeping track

How well do you track or reconcile your logistics operation? As a general observation, our industry not only is extremely poor at tracking or reconciling logistic costs, it is also very bad at defining what these costs should be in the first instance. That is evident from the graphic above.

In the aggregates industry, there are so many different ways in which logistics are managed. Aggregates get delivered through the supply chain in so many different ways … by trucks large and small, by train, by barge and by ship.

It is how we deal with logistics that has such a large influence on our company profitability. You may be reading this and wondering what we are talking about – if you get a margin on a subcontractor for example, isn’t it money for free?

Absolutely not. One experience with the logistics function of a large company went like this:

Logistics was its own function across all product lines. Heading up the logistics function were qualified logistics professionals. The fleets were extremely well maintained: a mix of company-owned trucks and subcontracted trucks. Metrics for success, both budgeted and measured as KPIs (key performance indicators) were solely based around the function of logistics itself … safety, asset utilisation, cents per kilometre etc.

Does this make sense?

Initially you would think: “Yeah … how else would you do logistics?” The problem here is not uncommon to the logistics part of our business. The customer, who supplies the revenue, doesn’t care how we slice and dice our costs. It doesn’t matter if we are looking at drill and blast, crushing and screening or anything else. Logistics is the same. Either we quote a delivered price, or, the customer handles the logistics function and cost.

So, what difference does that make?

Well, quite a lot. In the case above where the logistics function was solely focused on having an optimal fleet with high utilisation rates and low unit running costs, it was the logistics function that dictated the charge and pay rates for the trucks.

The great claim of the logistics function involved was that: “We make more than $30 million profit per year.” And they were quite right. In the P&L, they were $30 million positive. However, the logistics function’s main success metrics were based upon safety, asset utilisation and many other worthy metrics for a well-run operation. They were not based upon the real metric … overall profitability.

When you set the charge and pay rates for the subcontractors (as was the case in this example) and then set out to make a margin, you can shuffle the costs and the revenue across to the business unit and it is really quite simple to make any profit you desire. Is this really an issue? After all, it is all internal, or in-house money.

Yes … it is an issue. It is one of many behaviours that can shrink the aggregates producer’s margin. In this case, the sales people in aggregates would simply take the logistics component cost and add it to the sales price of the aggregate at the quarry gate. That would appear to be common sense but, straight away, assuming you win the project, you have made two very simple errors.

First, because there is a margin involved, and the margin is included in the transportation value, this is what the customer will pay. No problem with that. But, as in this example, the “margin” kept by the logistics department was only $1.00 if the value of the delivered product to the customer was $20.00 and the cost of that delivery was $19.00

Second, you have not assessed any advantage you may have in distance. If you are 10km away from the project site, and your competitor is 30km away from the project site, why wouldn’t you add some extra margin on the product?

You need to ask yourself the simple question: If I can contract someone to haul aggregates and make a $1.00 profit margin, shouldn’t I assign that margin in logistics to the product that was hauled and push the price up a bit … especially if the delivery was subcontracted?

Typically, when the logistics component of a delivered quote is calculated, it can be full of errors. Any inefficiency or miscalculations that are made in calculating the logistics charge will not be two-way. The reasons for this are simple.

1 If you are using company-owned trucks, you probably do not reconcile the quoted distance to the distance actually travelled. When you prepare a quote, how sure are you that the quoted distance is correct? Do you ever check distance travelled equals distance charged?

2 If you are using owner drivers, or subcontractor vehicles, we are sure you will be charged extra if your quote distance was lower than the actual distance travelled by the subcontractor. Your dispatch will receive a call as soon as the subcontractor is short on the payment. However, ask yourself the question - if the payment is too high, will the subcontractor alert you or refund the balance? We suggest not.

You lose both ways, unless you get that quote exactly right.

So … what is this all worth? A lot, especially if you bear in mind that the logistics charge is often up to 50% of the full delivered price of your aggregates. In some cases, it is even greater.

Let’s break the business down into some simple blocks to illustrate the impact on profitability not quoting accurately. Obviously, if you make an extra dollar, you make an extra dollar. But how much effort does your company put into that extra dollar, compared with other activities?

You are company X. You have a total annual sales revenue of $10 million with fixed costs at $3 million and variable costs at $2 million. Your logistics costs are $4 million, leaving you with an annual profit of $1 million. Your sales are 1 million tonnes annually.

Take a look at the table below. You can see the massive impact of accurately quoting the logistics function:

As the industry starts to embrace technology, especially GPS in its delivery vehicles, there needs to be a concerted effort in reconciling what we charge and what we pay for in terms of logistics (in-house or contracted out).

In the example we discussed above, the $1.00 margin should be included in the FOB ( Free on Board) price of the other aggregates quoted. When you add that dollar or part of that dollar to everything you deliver across your full products range, the revenue numbers start to grow very quickly.

Look at the effort you put into reducing your costs, both fixed and variable, or the effort you spend on increasing your sales volumes (usually at the same price) and you will see the area that has the largest return is getting fair value for your delivered product.

Trimble has a good technology tool called ASP (www.killerbee.biz). It will help you get your pricing quote right. Remember, people don’t call you when you overpay them. They only call when you do not pay enough.

This is a complex and fiddly part of the business. There are many little things involved … things that can add up fast and turn a simple error into a large missed opportunity. The client pays the delivered cost … so it is up to us as an industry to take away the inefficiencies and redundancies we have in our processes, systems and methodologies.

Here are some examples of common errors when calculating your logistics:

• Using Google maps, not having the origin location correctly placed;

• Not accounting for tolls;

• Not allowing for road limits, or changes in the route;

• Bridge weight limits;

• Adding “an extra km” to make up for any errors.

There are many more of course, far too many to mention. Let’s copy our friends in the concrete sector and start charging for waiting times, the cost of delivering in peak hours, and so on. We have got to stop aggregates delivery schedules and costings that pay no attention to traffic congestion, waiting times first thing in the morning at the quarry, idle times on site, etc., etc.

We need to take a leaf from Cemex, who are rolling out their Cemex GO technology into their aggregates division internationally, (track and trace in the delivery vehicle) and start to become more like Uber or Lyft.

And you can quote me on that!