It’s hard to believe that a decade has passed since the global financial crisis (GFC). But, in the 10 years since 2008, many markets around the world have improved markedly. We are now seeing economic growth, technological innovation, low interest rates, higher infrastructure spend, more effective use of information technology and single-figure inflation policies all contributing to a situation in which aggregates businesses can thrive. We have the perfect conditions for creating value and one of the best ways to unlock that potential is asset optimisation (AO). Join our experts from Commercial Performance to find out what AO is all about and how it could transform your business.

For most of the last century, aggregates companies measured their competitive advantage by looking at tangible assets such as inventory, property, plant and equipment. They were living in an economy dominated by tangible assets … assets that were recorded on the company’s balance sheet. Income statements would also capture the expenses associated with the use of these tangible assets, and they would be used to produce revenues and profits. Operationally-excellent companies won the day.

But, by the end of the 20th century, the physical was giving way to the intangible and a new breed of assets was taking over on the balance sheet. Intangible assets had become the major source of competitive advantage. Assets such as data, data analysis and data management have become the primary drivers of superior performance.

Today, companies need to assess themselves in terms of measures that are directly linked to their strategic vision such as “economic value added” or their approach to customer care, as well as their overall market share. Internal measures such as the percentage of satisfied employees are important too. Many analysts now want to look at things like your external branding policies and your company’s innovation record. How good are you at generating new customer revenue?

According to the experts at Commercial Performance: “An exclusive reliance on financial measures in a management system is insufficient.” There is a new world order. “Financial measures are lagging indicators that report on the outcomes from past actions. A cursory glance at some of the world’s (admittedly integrated) leading aggregates players shows that they continue to focus on cost reduction and commercial excellence actions to improve their net operating profit after tax (NOPAT) and (that they are) also trying to reduce debt, by selling off parts of their businesses they may have bought just before the GFC (combined with actions to drive NOPAT synergy benefits). This is to avoid potential bankruptcy and/or downgrades in their ratings - a necessary evil due to unfortunate timing.”

There is of course nothing wrong with these actions, especially given the context. However, says Commercial Performance: “It does indicate that little has changed in the last two or three decades … just look back at annual reports/investor presentations and you’ll get the idea. The aggregates industry goes through cycles and the actions remain the same. There is a limit to how much cost you can cut before impacting the ability to grow. A little bit of debt, let’s call it capital, is good so long as you can get a return greater than its cost. After all, this is what drives higher growth in a mature business … especially in a business like aggregates.”

Modern organisations should use a mixture of financial and non-financial measures and they should seek to put in place “measurement systems that are more ‘balanced’ than those that use only financial measures alone.” The experts at Commercial Performance say: “In an asset-intensive operation like aggregates, asset optimisation is critical and eliminating asset performance losses is a major part of overall performance management system. AO is designed to ensure that operational performance is maximised relative to cost.”

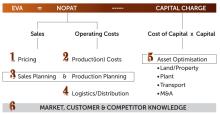

In earlier articles in the “Six Deadly Sins” series Commercial Performance discussed “some of the key areas that improve the NOPAT side of the value creation equation in aggregates, [such as] pricing, production costs and logistics.” In this article, we are going to look at the second part of the value creation equation and how the assets provided by your capital are optimised. Here is the expert view:

Aggregates is a capital-intensive business and we all know how poor asset management can negatively impact results … from plant downtime to excess stock levels which increase working capital. There are the less obvious downsides too such as shipping a customer order from one site when another would have been more cost effective and better for your stock/pit balance. The potential list of examples is almost limitless, which is probably why aggregates businesses continue to focus on the same areas.

We are not saying don’t stay focused on your traditional parameters - far from it - but what links these actions is a common area where the tried and tested approach is failing to extract new and untapped value. We believe that asset optimisation is one of these key areas where the current common approach is letting things down. In short, we need a more holistic and integrated approach to asset management.

Three main issues are creating a sub-optimal approach to asset optimisation:

1 The traditional view and definition of assets to be optimised is too narrow.

Ask most people in the building materials sector what they understand by the term “asset optimisation” and you usually get the following answers: firstly, it’s about the planned and preventative maintenance of plant and equipment to ensure these assets remain up and running at maximum efficiency for as long as possible; and secondly, it’s about getting the right return on capital employed (ROCE) … a big picture view of plant, land, property and logistics.

In fairness, both are correct. AO is big picture and detail at the same time. Assets are both individual bits of kit and the collective whole. But when it comes to AO what we often forget is that assets can be tangible or intangible, and the latter can be just as important.

Indeed, for many of the world’s most valuable companies, their greatest asset is their brand name ... a truly intangible thing often driven by perception and image. OK, optimising the brand is a challenge, especially in the aggregates business, and it would take us far too long to cover that here (besides … that’s the marketing department’s job!) but there are two other intangible assets in aggregates that receive far too little focus when it comes to AO and value creation: people and knowledge. To be even more specific, think about your sales force size and structure and your market knowledge.

Also, please bear in mind that the value from intangible assets is indirect. Assets such as knowledge and technology seldom have a direct impact on revenue and profit. Improvements in intangible assets affect financial outcomes through chains of cause and effect. Indeed, intangible assets seldom have value by themselves. Generally, they must be bundled with other intangible and tangible assets to create value. For example, a new growth-oriented sales strategy could mean that you need to acquire new knowledge about your customers, that you need to set up new training courses for your sales employees, or that you have to develop a new database, a new information system, a new organisation structure and a new incentive compensation programme.

They stand and fall as a group. Investing in just one of these capabilities, or in all of them except one, could cause the new sales strategy to fail. The value does not reside in any one single individual intangible asset. It arises from creating the entire set of assets along with a strategy that links them together. The value-creation process is all about multiple and linked assets working together as a whole.

It is usually the sales force that is responsible for gathering and harnessing this sort of market knowledge, along with any member of your staff who is in regular contact with customers through the buying process. Numbers of people and how they spend that most valuable asset - time - and their levels of productivity (time travelling, size of patch, number of customers, quality of meetings, etc) are all critical to overall AO. After all, that nice shiny or rusty bit of plant will sit idle if no one orders anything!

So, when thinking about AO, by all means continue the great work of optimising the traditional “fixed” assets, but widen your viewpoint to include at least two others … sales people and knowledge. And make sure that you don’t fall into the trap of only thinking about your people when trying to find new ways to reduce costs. Why? Because taking sales people out of a market is often to the long-term detriment of the business. You end up “flying blind.” Your sales team may not be capital-intensive assets as such, but it is the best lever to drive the value of your assets as a whole.

2 A ‘silo and piecemeal’ approach to asset optimisation dilutes value creation.

The desire to get more from less is embedded in aggregates culture. The focus has always been on volume and cost. In theory there is nothing wrong with finding the sweet spot on the curve … the lowest cost of production. However, what we often find is that to do this business ends up drilling down to ever-increasing levels of detail, identifying hundreds of key performance indicators (KPIs) for distinct parts of a plant (or for those of you with a wider view of assets … the length of time a sales person spends selling versus doing administrative work). To shift the needle a little bit further towards the sweet spot, you employ a small-gains approach.

To some extent, this works. It is easier to manage and motivate if you can measure a distinct outcome, and things are easier if the overall goal is crystal clear. For example, a typical KPI could be to increase throughput by fine-tuning the company’s crushing parameters.

Different businesses use different KPIs. The manufacturing sector looks at downtime and uptime, the logistics providers will look at truck turnaround times and the sales sector will look at revenue by product and customer.

The challenge is that these distinct KPIs and their functions are all linked … they are part of the whole business process. For instance, consider how much value an optimised sales team aligned with a finely tuned production team brings to the sales production balance. The challenge is only increased when you try and bring this all together - which is why a more holistic approach to AO is needed. The main barriers to this are a combination of organisational structures (either centralised or decentralised), processes, plans, routines and habits. This is further exacerbated by complexity added by merger and acquisition (M&A). Any aggregates business that has more than one plant serving a single market knows only too well the challenges of optimising its assets in this situation.

The starting point for creating a more holistic approach has to be through changing people’s mindsets and creating a culture where functions work seamlessly together. They can then help each other optimise through knowledge sharing and process improvement, integration and the sharing of functional plans as set out in the original philosophy of just-in-time (JIT) in the 1970s and ‘80s. Making asset optimisation a habit will, of course, take time but the payoff is worth it.

3 Intelligent use of big data and technology.

Big data and technology give us the ability to model and track inputs and outputs at a component level (conveyor speed/throughput, for example) and to link these higher up the process/hierarchy of assets to the plant level and stock feed/levels and then onto product/customer mix balance. They also enable us to model alternatives so we can adjust machine parameters etc. How many aggregates businesses do this?

Just as there are many creative ways to reduce costs, so there are numerous ways to track metrics over the life cycle of a tangible asset to enable an accurate picture of its use. An asset may be 10 years old but its actual age based on use may only be an equivalent of 3 years but good maintenance programmes could extend the life of many components and pieces of highly expensive capital equipment. The age of the internet, and cheaper and faster processing power that allows plant to be controlled and monitored via apps, are opening up multiple pathways to extract value. Does your organization have the skills to harness big data and new technologies?

Some aggregates businesses buy into the value of data and analytics but struggle to build sustained capability in-house. Others build technical data and analytics capability but then struggle to get the wider organization to adopt and achieve long-term value through analytics. Even though they are accumulating data at an exponential rate, they are not fully harnessing the value of this new rich asset. The question you need to ask is: Are the knowledge workers in your organization positioned in the right place and ready (i.e. trained) to make the right decisions using institutional data?

For decades management consultant Peter F. Drucker was widely regarded as “the dean of (the USA’s) business and management philosophers” (Wall Street Journal). Writing in the Harvard Business Review in 1992, he observed that: “Every few hundred years throughout Western history, a sharp transformation has occurred. In a matter of decades, society altogether rearranges itself – its worldview, its basic values, its social and political structures, its arts, its key institutions. Fifty years later a new world exists. And the people born into that world cannot even imagine the world in which their grandparents lived and into which their own parents were born.” To paraphrase Drucker, our current age is just such a period of transformation.

In the information age, Drucker reminds us that “doing things right” is as important as “doing the right things”. This usually involves doing what other people have overlooked as well as avoiding what is unproductive. Intelligence, imagination and knowledge may all be wasted without proper training being undertaken and the correct skills being in place.

Drucker identifies five practices essential to business effectiveness that can - and must - be mastered:

• Managing time

• Choosing what to contribute to the organization

• Knowing where and how to mobilize strength for best effect

• Setting the right priorities

• Knitting all of them together with effective decision-making

Final words on how to improve

We’d like to finish by using a great example from another industry that highlights what can happen to business performance and asset optimisation when a common unifying theme is used to change mindsets and ways of working positively. The added bonus for most aggregates businesses is that it builds on an ongoing body of work that has been going on for decades now but just requires an additional emphasis……safety.

Paul O’Neill, a former US government bureaucrat became the CEO of Alcoa (the American aluminium company) in 1987 at a time when the business was struggling. An audience of analysts and Wall Street investors was waiting to hear the company’s plans for the future. O’Neill opened with “I want to talk to you about safety!” This initially unnerved investors and worried employees to some degree but it then became clear that he had chosen a subject that would unite everyone in the company, open up the flow of communication and lead to an examination of the manufacturing process which ultimately resulted in a transformation of the business in terms of safety, efficiency and financial success.

Well, as we know, safety has been the number one priority in aggregates companies for a long time. A positive unintended consequence of looking at safety through process optimisation is that it presents a potential area in which to improve aggregates AO.

Conclusion

A new era, post-GFC, is presenting aggregates companies with an ideal set of conditions that should allow them to further optimise their assets and create yet more value than before. However, this new era requires that we take the blinkers off and widen our view, adding something new without throwing away all of the old. Here are three ideas for you to take away:

Firstly, traditional views of what assets should be optimised need to be recast: intangibles, people and knowledge are top of the list.

Secondly, we need to think differently about how we organise the business, how assets (both tangible and intangible) come together as a system and as a complete value chain process (think Porter’s Five Forces Model meets JIT – see footnote) using methods from different industries that have been applied so successfully in the past (e.g. JIT in the 70s). For example, how can Volkswagen allow you to pick and choose the features of your car allowing individual customisation, and then simply slot this into mass production in a JIT-optimised way? Well, they can and do, so why not make it happen in aggregates!

Thirdly, we need to capture and use big data intelligently. After all, the tools are available and are cheaper and more powerful than ever. Knowledge sharing, capture-efficient and effective use of sales force teams and others can be used, creating a culture of openness. Knowledge sharing will only come about by breaking down traditional barriers through closer working relationships, but then the industry has been here before. Perhaps with a little more thought and using what it already has under its nose, it can begin to optimise its assets. The right conditions are there so why not go for it!

Changing the way we look at things brings new perspectives and new ways of working that can yield considerable benefits. In the case of asset optimisation in the aggregates industry these benefits can be substantial, so it is time to take advantage of the improved economic, market and technological conditions.

Perhaps this will give you something to build on?