The Committee for European Construction Equipment (

The release of the latest figures, which coincides with the CECE Congress 2014 in Antwerp, follows other figures showing how sales were strong in Q1 2014 compared to the first three months of 2013.

For the first time after the long dry spell, the CECE notes that construction equipment sales in the Southern European countries like Italy, Spain and Portugal have improved notably, signalling that the European construction sector is now stabilising after having hit the bottom – with positive effects on the construction equipment market.

However, the CECE believes market demand might cool down further in the second half of 2014, particularly in countries like Germany, France and the UK.

“Looking at 2014 as a whole, robust growth figures across product groups and countries still seem realistic”, said Eric Lepine, President of CECE and managing director of

Within the CECE’s overall H1 2014 figures, star performer among European markets continues to be the UK. Earthmoving equipment sales grew by 44% in the first half of this year compared to the same period a year before. Other Northern and Western European countries all recorded a robust growth as well, while the Central and Eastern European countries have been developing unevenly.

Meanwhile, the CECE says that the Russian market has continued its heavy downturn due, it believes, to the political situation, but also because of a cyclical downturn in the construction equipment industry. In addition, players from Asia increasingly expand their business. Turkey, once a promising market for the industry, is not recovering, according to the CECE figures. It saw double-digit declines for the fourth consecutive quarter. However, the majority of European construction equipment manufacturers report growing incoming orders, particularly from non-European countries. The best region for incoming orders is the Middle East with Saudi-Arabia being the growth engine in the region. The North American markets are developing rather well, says the CECE, while no signs of improvement can be reported from Latin America.

The Asian market shows mixed signs, as the CECE notes in a press release containing the latest European construction equipment sales figures: “The increasingly positive mood in the Indian industry after the elections this spring does not accelerate construction equipment demand. A change is not expected before next year. China is currently facing another troubled year. After the first quarter had given rise to cautious optimism, this has changed back to a negative evaluation. China will probably see the third consecutive year of double-digit declines. Southeast Asian countries including Indonesia are performing much better. The second quarter has also brought about the turnaround for Australia which is now on a growth path despite the weakness of the mining industry.”

In terms of product groups, road equipment was the best performing construction equipment sub-sector, according to CECE H1 2014 figures. CECE is expecting a double-digit growth for 2014.

Earthmoving equipment is also said by them to be doing “rather good”. In the first half of 2014, sales recorded a growth of 9,6% on a year-over-year basis. “This is positive, however, we have to bear in mind that this is a good 43% below the peak we had in 2007,” said Lepine.

Concrete equipment is still weaker than the other sub-sectors and shows a flat development up to now, whereas tower cranes recorded 8% more in sales in the first six months of 2014 compared to the same period of last year. In this segment there is no boom in sight, says the CECE, but a stable development can be expected, all the more so since export out of Europe picked up by 10% this year.

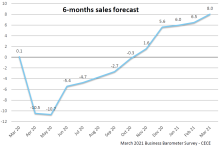

The post-summer CECE surveys show the overall business climate going markedly down, but also confirm a positive trend in the construction industry in general for the second half of 2014. The balance of incoming orders is still stable. “In all, CECE maintains its growth estimate of up to 10% for the European construction equipment industry over the year”, concluded Lepine.

CECE represents and promotes the European construction equipment and related industries towards the European Institutions, coordinating the views of national sector associations and their members, and working with other organizations worldwide to achieve a fair, competitive environment via harmonized standards and regulations.