The European construction equipment sector saw encouraging growth of 10% in 2016, according to new figures in the

The CECE’s (Committee for European Construction Equipment) influential Report states that building construction equipment experienced better demand in 2016 than the civil engineering equipment sub-sectors. Overall, the European market is said to be at its highest level in five years, but still considerably below the pre-crisis record levels.

As in the previous year, the European market outperformed most regions of the world, and ranked third in growth numbers, behind only China and India. “The double-digit sales growth in 2016 sure was positive news for our industry in Europe, but we still see big disparities across the continent”, explained Sebastian Popp, economic expert at CECE. Volume-wise, the strongest sales increases were recorded in France, Germany, and Italy. “The German market in particular, and Northern and Western Europe in general, are close to their historical record levels.”, said Popp. “On the other hand, recovery of Southern Europe and Central and Eastern European countries still falls short of expectations.” A positive notion was the revival of the Russian market after years of extreme deterioration.

Sales of earthmoving equipment in Europe grew by 12% in 2016, states the CECE Report. Building construction equipment (tower cranes and concrete machinery) recorded an even higher growth of 21%. “It is encouraging to see that all construction machinery sub-sectors benefited from the upturn”, commented Popp. “This corresponds to the situation of our customer industry which sees growth both in residential and non-residential construction as well as civil engineering.”

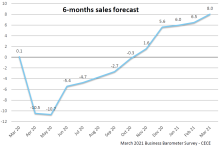

The CECE Business Barometer index had hit a temporary low following the Brexit vote in the summer of 2016, but has been on a growth path since then which resulted in the highest index value in almost six years in February 2017. Interestingly, almost all world regions are seen positive by the manufacturers surveyed in 2017: Fuelled by infrastructure investments pushed forward by the new government, the US market is expected to see an upturn. China and India are anticipated to continue their upward trend seen last year. A majority of European manufacturers expect the Middle East markets to recover in 2017. Latin America, on the other hand, is not yet anticipated to bounce back from the low 2016 level. For the European market, the manufacturers surveyed in the CECE Barometer expect a generally positive scenario, except for the Turkish market. Hopes particularly concentrate on Scandinavia, France, and Germany.

The CECE report notes that optimism is equally strong across sub-sectors: The share of manufacturers expecting an improvement of the business situation is approximately two third, which is true for earthmoving, road, and concrete equipment producers. Only component suppliers do not trust the upswing in a similar way – amid a positive average assessment, 63% of them expect unchanged business in the near future.

Against the backdrop of a modestly growing European construction sector, generally positive industry sentiments, and different stages of market recovery across countries, stable sales of construction equipment with a slight upward tendency appear to be the most realistic scenario for Europe in 2017. Also, European manufacturers should be able to benefit from a world market which is expected to return to growth after three consecutive years of decline.