Are we still in recession or already in recovery? That seems to be the question most people in Europe want to know right now, particularly a year on from the collapse of US-based Lehman Brothers which triggered much of the financial crisis. But the answer is not an easy one for the aggregates industry - some indicators suggest the situation is easing, others that further declines are coming, while some point to the situation not being as widespread as was first believed.

According to national statistics, the French and German economies are now out of recession and other European economies expect to be able to report the same soon. However, the worst-hit economies in Spain, Ireland and the UK may take longer to rebound, although no one seems to agree on just when this will be.

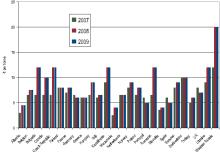

Preparing the figures for this issue's Sharewatch does give cause for optimism with widespread share price gains across the major quarry operators, equipment producers and contractors in Europe. Some share prices have recorded double-digit gains since the last report in ABE - indicating the kind of investor confidence that the industry has not seen in the last 12 months.

Nonetheless, this summer has seen report after report from the major quarry operators recording falling sales and profits compared to 2008, although many acknowledged a lessening in declines in the second quarter. Unlike in previous years, many of these reports have steered away from giving detailed forecasts of financial performance for the following year and only provide vague indications for the rest of the year.

These financial reports have also been followed by a number of market assessments from the industry associations around Europe, which have also noted declining demand in the first half of the year. Many of these sector organisations have suggested that further declines in materials demand will be seen in Western Europe during 2010 and a return to growth will not be seen until 2011.

But it does seem that Western Europe was far worse hit by the financial crisis than Central and Eastern Europe, where confidence seems to have remained strong.

Travelling through Poland in September to research the quarry profile feature also gave me the opportunity to talk about the impact of the financial crisis outside of Western Europe. General consensus seems to be that Poland has seen a slight fall in demand for aggregates but no one seemed justified in calling it a recession. In fact most companies seemed to be preparing themselves to increase investment to meet the future demand that is expected.

This view is generally supported by the detail in the first half financial reports which, behind the headline sales and profit falls, there is a clear message that emerging markets are still doing well.

So in response to the question on recession or recovery, the answer is yes, no and maybe - some countries and markets will continue to suffer for a while but others have levelled out or are recovering. The upcoming third quarter reports will make interesting reading as the summer months are generally good ones for the building materials market