Hardly a day goes by without the words recession or credit crunch hitting the headlines. Many question how many of these headlines are really media hype but how much will the instability of the banking world affect aggregates production in Europe?

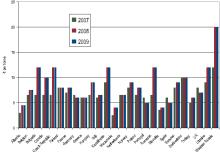

In preparing the news for this issue of ABE, it is clear the financial crisis is impacting the quarrying sector with slower sales recorded in the fourth quarter of last year, compared to 2007. But where will the market go from here? Governments around the world have committed many billions of Euros of funding for infrastructure investment over the next few years. While these projects may take a while to get started on site, they will mean a guaranteed market for building materials for their duration.

But the current lower levels of demand are impacting on the cash flows of companies right now.

UK-based Ennstone is also suffering a lack of liquidity as its good business in Poland has failed to offset difficult conditions in the US and slow business in the UK. The company has been selling off assets since late last year but without prospects of a quick return to growth in the US or the UK, it looks like the business may go into administration.

While these debts and lower levels of revenue growth point to a difficult year, this recession is very different from others experienced in the past. This economic crisis differs due to the speed at which it hit - the whole situation seemed to spiral after the collapse of the US-based

All with commitments to infrastructure, governments around the world have also been pouring millions into the banking system but until those institutions start to lend to each other at reasonable rates again, we cannot expect the global economy to recover.

While the crisis seems to be global - with the UK, Spain and Ireland worst hit in Europe - the severity of the impact on the aggregates market does vary. Quarry operators who have already reported their accounts for last year are indicating that markets such as Switzerland and some parts of Eastern Europe are still performing well and good growth is being seen in other emerging markets.

Few want to put a date on, or can agree when, widespread recovery will start - some are optimistic for spring this year while others, and depending on the region they are looking at, suggest it could be mid-2010 before the market rebounds.

Nonetheless, some industry analysts have warned that the recovery, triggered by re-availability of credit, could be as rapid as the arrival of the decline, leaving many quarry operators struggling to meet demand. The companies that are likely to do well following the recovery are the ones that are currently using this lean period to sharpen and optimise their businesses.