Aggregate prices seem to be stable in Europe despite the financial crisis of the last year. Claire Symes talks to Metso Minerals' Luis Santos about the impact

Previous recessions and lower volume demand has triggered close competition on aggregates prices but the most recent economic slowdown does not appear to have followed this pattern.

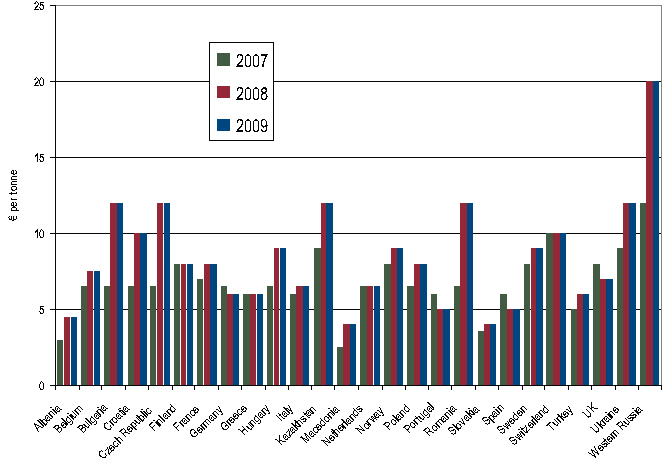

"Aggregates pricing in Europe has remained fairly stable in the last year," said

"There have been some provisional variations in some countries and a few major projects have influenced some local prices, but in general aggregates prices are pretty much the same as they were in 2008." Looking at the Big Five countries in Europe - France, Germany, Italy, Spain and the UK, which represent around 80% of Europe's construction market by value, it is clear that prices are not much changed.

Although the UK and Spain have been worst hit by the economic downturn, aggregate prices have only slightly lowered and are stable. In France, road construction aggregates are stable but the ex-works cost per tonne of rail ballast materials have risen slightly due to demand from specific projects. In Italy there are no major changes to prices, just some provincial movements and the German market remains unchanged.

Impact

"Prices have not suffered in this downturn - there have been some local changes but otherwise prices remain the same across Europe," explained Santos. "This is quite different from the crisis in the early 1990s when there was a big battle on prices.

"The difference may be down to several factors - firstly the industry may have learned from the last crisis but also this economic recession hit far quicker and harder than the last one, so there was less time for companies to act on price.

"Following the early 1990s crisis, prices took a long time to recover - in Spain it took maybe five years. But that crisis was more isolated to Europe and this time the recession is global." According to Santos, the main issue for quarry operators in this downturn has been the low volumes combined with changes to terms of payment. "Many customers are now only paying after 180 to 210 days," he said. "In the 1990s interest rates were high but there was money, but today, although interest rates are low, there is no money in the system.

"Cash is king these days and everyone is trying to hold onto it but the late payment that is now becoming more common is impacting on the quarry operators. The lack of profitability at present is clear from the restructuring that is being undertaken by all the major quarry operators." These large quarry groups were created during the recovery from the last economic downturn but now the size of these groups means that they are unable to react quickly to cope with the lower volumes.

Recovery

"It is hard to predict how deep the crisis will be," said Santos. "The financial system is not currently operating as a proper financial market because of government intervention. France is the only country that is coping, mainly because its president gave the banks clear instruction rather than just taking over. Until the whole financial system recovers, the market will not return to normal." Santos believes that the UK aggregates market will continue to suffer for another one to two years but Spain may be affected for up to another three years. He thinks France will perform much the same as it has this year and, although he said Italy's recovery is hard to predict, it is likely to be the same as 2009 too.

However, he believes the German market may decline further in 2010.

"Overall I think we may have touched the bottom of the valley, but the valley will have a wide floor," he said. "It is not clear how wide though. I have always believed that when the US sniffs, Europe catches a cold but now the US is starting to show signs of picking up, there may be some influence on Europe." According to Santos, recovery of the aggregates markets in Eastern Europe lies very much with the

"Eastern Europe may pick up very quickly if there is money made available," he said. "There is a real need for infrastructure investment and the market in the Czech Republic has been good this year because funding for such schemes was available. The needs in places like Albania, Macedonia, Romania and Serbia are great."

Medium advantage

According to Santos, the consolidation seen following the early 1990s recession may start to reverse during the recovery from the current downturn. "Some of the big animals are obliged to restructure and sell off some units," he said. "The companies with the money and the willingness to invest are the locally and family-owned medium sized quarry operators.

"It is these businesses that have continued to make capital investment ready for the next cycle of growth. Most of the projects we are looking at in the next three to six months are being driven by the medium sized quarry owners, whereas the larger conglomerates have halted all investment plans.

"While the headline news for the bigger operations is bleak in some countries, I know of some family owned quarries in Spain that are still operating two shifts. There is still money to be made in aggregates and it is clear that knowing the market is essential - I believe that it will be the medium sized businesses that will emerge the strongest from this recession."