In researching and writing the aggregates pricing feature for this issue of ABE, I am forced to look back over the past year and how the market has fared in that period.

Unfortunately, 2009 has been a very difficult period for the aggregates industry and I seem to have spent my time writing about job losses, divestments and refinancing.

However, many of those stories have centred around the larger, global players in the sector and not just because they are larger, but because they seemed to have found the transition to the new economic climate more difficult.

During my interview with Metso Minerals' Luis Santos for the pricing feature, he hit the nail on the head of why the larger companies seemed to have suffered, while the familyowned operations are still investing. He explained that following the last recession in Europe in the early 1990s, which was a more gradual decline than the current crisis, that there was still money available - albeit at high interest rates.

The larger companies could afford to continue borrowing and snapped up the ailing SME businesses to create the empires they have today. But this resulted in debt-laden operations, which have suffered with the dramatic drop in volume demand in Europe and they are now being forced to hive off non-core businesses.

Santos said that it is the family-owned and medium sized businesses that have their own capital that are investing for the future and will be well positioned when the market picks up. He believes that these businesses were quicker to adapt to the fast downturn and will probably benefit from acquisitive expansion as the larger players downsize.

This belief is something that I have seen borne out during my visits to quarries all over Europe this year - investment is still underway but it is the regional operators who are splashing the cash.

On a recent visit to Poland, both quarry operators I visited had recently invested in new equipment in the same way they always have because they both believe that standing still is not an option. For this issue, I travelled to Switzerland to meet Luc Briquet from Lessus who also firmly believes in continued investment. I have also recently visited family-owned quarries in Portugal and Italy that are also expanding or upgrading their equipment fleets ready for the next challenge in the development of their businesses.

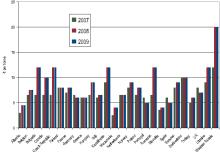

Looking at the third quarter results that many companies have recently published, many are expecting the full year to be significantly down on 2008 but with some hope of a recovery sometime in 2010.

The optimism varies around Europe but still some of the larger players have their capital expenditure plans for the region on hold, which leaves some quarries several years behind in terms of technology, and maybe also quality. How long will it take for them to react and catch up? While we haven't seen the aggregates price tumble of the early 1990s recession, Santos said it took prices in some countries five years to recover - maybe the impact this time will be the opportunity to achieve the new, higher standards?