Portugal's aggregates Producers are hoping that high-speed rail will inject a much-needed boost to their businesses. Lisa Russell reports

Demand and prices for Portuguese aggregates have dropped in recent years and there is little optimism that there will be an imminent upturn.

Current opportunities are few and far between but the industry is pinning its hopes on plans for a new airport and for Portugal's roll-out of the European highspeed rail network.

The market is down this year, with a drop in construction causing a decrease of about 20% compared with 2008, estimated Victor Albuquerque, project manager in Agrepor Agregados, which is part of

Cimpor is Portugal's biggest aggregates producer; other major suppliers include another leading cement group,

Some major contractors such as

"The market started really slowly at the beginning of the year. It went a little better in the summer but is now slow again," said Secil Britas manager Pedro Pereira. "In most cases, aggregates are probably 30% below budgets or expectations and the government has put big construction or renewal schemes on hold, dashing even pessimistic expectations." Work associated with the planned new airport and high-speed railways offers hope. "Everyone talks about it," said Pereira. There is an expectation that there must be progress on the rail network by 2010 or 2011, particularly to support the football World Cup 2018 bid. The government that was re-elected favours rail construction, but has lost its majority.

Some limited public works have injected a little "breath of fresh air" into the market, said Albuquerque, with some road construction in the Lisbon area and around Porto. Pereira points to some construction in the north, mainly dams for water supply. The south in particular has been hit hard, with a dearth of construction in the tourist areas of the Algarve.

The ornamental stone and industrial sectors are both suffering from the downturn in the construction sector including public works, said Maria Sobreiro of the

The latest official production figures are for 2007, when there were 1001 quarries in operation, of which 516 were for ornamental rock and 485 for industrial uses. Together they employed 8,391 people across five regions.

ANIET - the

The number of industrial operations remained virtually unchanged between 2006 and 2007, but there was a drop of 90 in the ornamental rock quarries. In certain areas, especially the marble of the Alentejo region, there has been the closure of several quarries which have been unable to withstand the competition of Chinese and Indian stones, said Sobreiro.

"Some quarries have been put on standby to avoid adding to stockpiles," said Silva. "Other smaller quarries have been bought by larger groups." Competing is particularly hard for the family-run businesses that depend on their local area for business. "Some aggregates quarries - mostly family businesses - are in trouble and closing, which reflects the difficulties in the market," said Pereira. "The big groups with their more diverse portfolios are better placed to cope with the crisis." Albuquerque feels that smaller, familyrun quarries must find it particularly hard to compete in terms of issues such as cost control, quality and environmental measures.

"Strict legislation covers quarries," explained Silva. "Previous laws were reviewed and collated in 2007, covering every aspect of the requirements placed on a company including operation, remediation and worker safety." Prices have been quite stable for the last couple of years, according to

says Lizuarte Gomes, a director of CIMPOR group company Agrepor Agregados added, "There is hope that the quantities will grow with the planned projects. Prices remain quite stable and indeed the prices of standard rail aggregates are growing a little to a typical value of around €10 a tonne. Limestone is at around €3.5, and granite around €5.5 per tonne." Portugal's economy took a downturn long before the present international crisis. "Usually what happens is we go down faster than some and we tend to take more time to go up again," said Pereira. There had been a boom around the turn of the century, when infrastructure investment included developments for Expo 1998 and road construction in the 1990s that created key cross-country links.

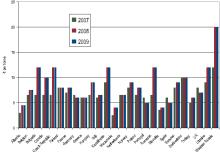

"The Portuguese aggregates market does have something quite special," said Santos. "It can cope well with living in a crisis. Aggregates production was about 120million tonnes in about 1999/2000, although annual production has now fallen considerably, volumes are fairly stable." DGEG is responsible for the sector and it also compiles official statistics. The figures show that 79.6million tonnes of sand, gravel and crushed stones were produced in 2003, with a value of €375million. The amount rose in 2004 to 83.7million tonnes, but the value fell to €345million. Volume and value dropped in 2005, 2006 and 2007, when 74.8million tonnes were produced with a value of €305million. More recent figures are not yet available.

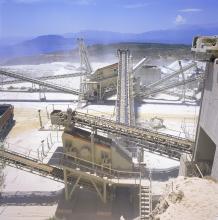

"Portugal has three large groups of stone industries," said Silva. "Ornamental stone dominates in the south. In the centre of Portugal from Lisbon to Coimbra are more calcareous stones and largescale production of aggregates from limestone. The north is where hard rock is found, with granite deposits.

"Local materials availability influences construction techniques. The Algarve tends to have concrete roads to cope with the heat, granite aggregates are used in the north's asphalt roads and limestone in the centre.

Information from the Laboratório Nacional de Energia e Geologia (LNEG) shows the western central region as the primary area for Cenozoic deposits of sands and clays and Mesozoic limestones, clays and sandy clays. There is also a smaller zone in the southern coastal area.

To the north and east are large areas of intrusive magmatic rocks and Paleozoic deposits of Schists and greywackes, marbles and quartzites.

There is a widespread distribution of key production sites for stone including ornamental marble and granite. Almost all the abundant granite outcrops can produce granite crushed stone too, pointed out LNEG's Jorge Carvalho. In the same way, the extensive Mesozoic rich carbonate areas are able to produce limestone aggregates as well as ornamental stone, and the Cenozoic rocks can supply sand and gravel.

"The difficult times for Portugal will continue," said Santos. "We will not get out of the deep crisis before France and Germany.

"But we are optimistic people and are hoping for a better 2010 at least," said Pereira. "If some of the construction happens, there is belief that quantities will start to improve."