Those are among the predictions in a new report on the sector's prospects over the next two years from Glenigan. However, the industry analyst adds that the recovery in construction activity will be greatly influenced by currently uncertain factors such as the future course of COVID-19, the UK's response to the pandemic, and the operation of UK trade with the EU. These elements could all lead to a potential divergence of project starts from the report's central forecast.

The report states that the COVID-19 pandemic and the lockdown of much of the UK economy from March last year inflicted a massive external shock to UK construction.

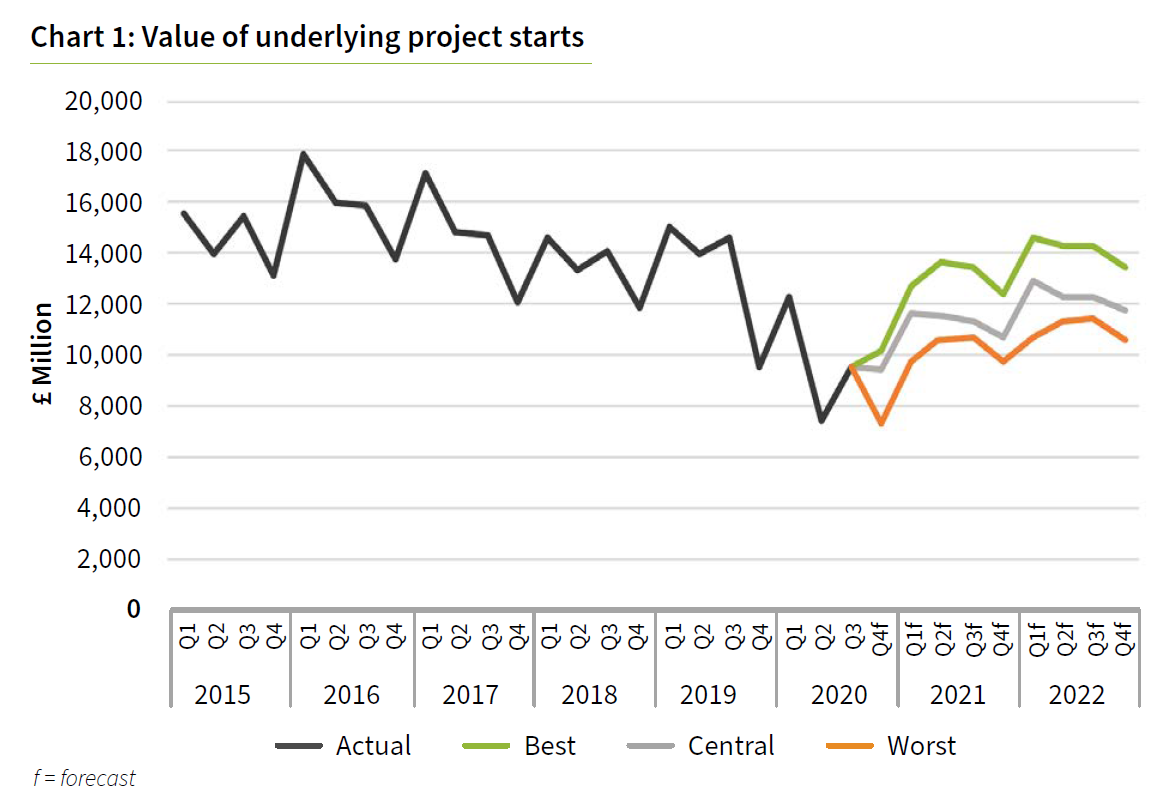

The value of underlying project starts (projects with a construction value of less than £100m) dropped by 46% during the second quarter of 2020 against a year earlier.

The second quarter marked the low point for the industry. In addition, whilst severe, the decline in quarterly starts was not as great as initially feared. Contractors were quick to adjust site working practices and suspended sites in England and Wales were re-opened more rapidly than initially anticipated, with a revival in new project-starts following in their wake.

The third quarter saw a sharp rebound in construction output and project-starts. The value of underlying project starts rose by 19% during the third quarter, although they were still 35% down on a year ago.

A more gradual, but sustained recovery was seen during the closing months of 2020 and is anticipated for the next two years; a period during which the UK economy will be gradually recovering from the COVID-19 pandemic whilst also facing Brexit related disruption to trade and growth. By 2022, the value of underlying starts is forecast to total £49.3bn, just 3% below 2019 levels.

A sluggish UK economy is expected to constrain construction activity over the 2021-2022 period, with private sector workload especially weak.

UK manufacturing faces weak domestic and overseas demand. In addition, although a free trade agreement with the EU is now in place, UK manufacturers will have less favourable access to the EU single market, increased border and administrative costs and potential disruption to EU source supply chains. Against this background the report anticipates a continued weakening in manufacturing investment over the forecast period.

In contrast, warehousing and logistics premises are forecast to remain a growth area, bolstered by long-term growth in online retailing which is driving the demand for logistics space. Although growth in this area was initially disrupted by the Spring lockdown, the pandemic has accelerated the growth in online sales and this will help ensure the further expansion of warehousing and logistics activity during 2021 and 2022.

Whilst the pandemic and repeated lockdowns have boosted the demand for logistics space, Glenigan says that it has exacerbated the woes faced by more traditional retailing. In the retail sector, activity is forecast to decline as weak consumer spending and the growth in online retailing accelerate the restructuring of the retail industry and depress the demand for retail premises.

The leisure and hospitality industries are being especially hard hit by the pandemic. The collapse in the number of overseas visitors to the UK and the COVID-19 regulatory restrictions on facilities’ operations have damaged the financial viability of many operating in the sector. Project-starts are estimated to have fallen by 30% last year and investor confidence will be slow to return to the sector.

Greater public sector investment is expected to be a major driver for construction growth over the next two years, although the immediate priority of tackling the pandemic and the deferral of the Spending Review to later in 2021 are likely to temper the increase in government capital funding.

The Government has pledged to significantly increase investment in the UK’s infrastructure. While civil engineering project-starts, along with other sectors, have been disrupted and delayed by the lockdown, the sector is set to recover strongly over the forecast period.

Additional public sector funding is potentially available in areas such as roads. It may take time before additional projects are ‘shovel ready’. Therefore, Glenigan says that it anticipates that, initially, the additional funding increases will be directed at starting smaller improvement schemes and areas such as tackling the maintenance backlog on UK roads.

Existing major infrastructure schemes, including Thames Tideway, HS2 and Hinckley Point, are also forecast to lift civil engineering output over the forecast period. The £1.4bn Stonehenge Tunnel is now scheduled to start in 2022, although important planning and contracting hurdles have yet to be cleared.