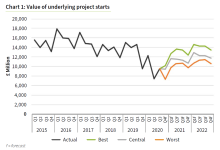

Despite generally poor performance, market analyst Glenigan says economic indicators suggest this period of general decline is a relatively short-term situation, exacerbated by global material shortages and supply chain issues.

Forecasts, including Glenigan’s own, point to construction start figures surging in the New Year, should these issues be overcome. Strong planning approvals and contract awards registered in the November Construction Review predict a strong pipeline of upcoming work to help the construction industry back to pre-pandemic levels of output.

Glenigan's analysis found that the value of residential work on-site was particularly hard-hit in the September-October period. It fell by more than a third (34%) against the same three months in 2020, and 15% against the preceding three months to November 2021.

Private housing construction starts performed poorly, dipping by a fifth (21%) against the preceding three months to stand 37% lower than 2020 levels. Although social housing starts increased 1%, the value dropped more than a quarter (-26%) against the previous year.

Glenigan says this is indicative that supply chain issues continue to negatively affect the sector.

Other sectors also saw sharp falls in start output in the three months to November 2021, when measured against the same period in 2020. This includes: Civils (-31%), Infrastructure (-36%) and Health (-40%).

Slightly less impacted, office project starts fell 20% against the preceding three months to November, however they did show an increase of 14% on the previous year. Likewise, although Health and Leisure starts declined 10% against the preceding three months, they increase 25% against 2020. Both continued to remain lower than 2019 levels.

Bucking the downward trend, Industrial project starts were by far the strongest performer in this edition of the Index, increasing 11% against the preceding three months to stand 22% higher on 2020. This made it the only sector to experience dual growth against the previous three month period and a year ago.

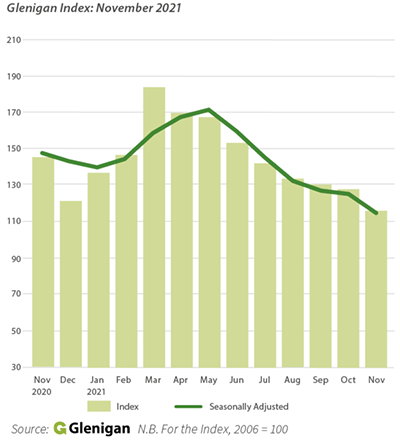

Commenting on the latest figures, Glenigan senior economist Rhys Gadsby said: “Following a relatively stable third quarter for starts on projects under £100m, the first two months of Q4 have fallen sharply, especially in November where starts were at their lowest level since May 2020.”

“Anecdotal evidence suggests that some builders are delaying starting new projects due to the schedules of existing projects, already on-site, being severely disrupted by material and labour issues. These issues are likely to hold back project-starts in the near term, however, with main contract awards and detailed planning approvals strengthening, and as material and logistical constraints ease, it is expected that project-starts will start to lift during 2022.”

Regional performance was decidedly mixed in the three months to November. Only a handful of regions experience growth, including the East Midlands where project starts increased 3% against hr previous year and 7% against the preceding three months. Northern Ireland was the only other area to witness growth against both the previous year (20%) and the preceding three months (10%).

Although the North East witnessed 4% growth against the previous year, value has fallen 19% against the preceding three months. Vice-versa, London fell by 8% against the previous year, but increased 2% against the preceding three month period.

It was a bleaker picture across the rest of the UK. Scotland experienced the worst three months to November, with the value of project starts falling by over a half (58%) against the previous year, and 48% compared with the preceding three months to November. It was a similar story in Wales, down 51% against 2020 figures. This was echoed in the East of England (-25%), North West (-22%), South East (-24%) and West Midlands (-20%).