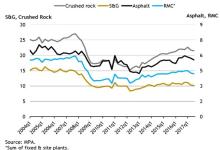

Following some improvement in demand towards the end of 2017, UK mineral products markets started the year slowly, hit by weak construction activity and the impact of the particularly cold weather. Sales volumes for asphalt and aggregates fell by 4.8% and 4.9% respectively in Q1 2018 compared to the previous quarter, and ready-mixed concrete (RMC) by 7.7%. Mortar sales, which last year received a significant boost from new housebuilding, also contracted by 3.8% in Q1 2018, the biggest quarterly fall since early 2013.

Weak sales volumes in the first quarter of the year can be partly explained by the impact of the unusually severe weather in the UK in late February and early March. Official statistics released last week show construction output declined by 3.3% over the quarter, the biggest quarterly fall since mid-2012. Feedback from

However, longer-term trends in construction demand for mineral products confirm the underlying weakening in construction activity, beyond the weather impact. Sales volumes for aggregates were 3.6% lower in the 12 months to March 2018 compared with the previous year, 4.5% lower for asphalt, and 6.7% lower for RMC. Over the same period, mortar sales volumes increased by 8.7%. Whilst mortar sales are closely linked to housebuilding, materials such as aggregates and RMC are ubiquitous to all types of construction work and are not usually stocked for future use on project sites. The sale of these materials can therefore be used as a reliable and straightforward indicator of ongoing construction activity. The continued weakening in these markets, not only at national level, but also across all regions in Great Britain suggest that, outside new housing construction, there are limited sources of growth.

The trend in asphalt sales shows that more road work in London, the East Midlands and the South West in the past year was offset by declines in most other regions in Britain, and most particularly in Scotland, where some major projects, including the Forth Replacement Crossing, came to an end last year.

Sales of RMC declined by 6.7% in the 12 months to March 2018, driven by a sharp decline in London, which accounts for 22% of the total GB market. The majority of RMC is used in non-housing new construction, as well as general repair and maintenance work. Demand from infrastructure construction in London is currently being supported by projects such as Thames Tideway, so the weakness in the London market since mid-2016 most likely reflects a sharp slowdown in commercial office building and repair and maintenance work in the capital.

Aurelie Delannoy, director of Economic Affairs at MPA, said: “Further growth this year in terms of new housing and infrastructure construction work should support mineral products markets. However, this will be offset by the sharp decline expected in commercial work, the third biggest construction sector. Should greater clarity emerge on the Brexit negotiations over the next few months be achieved, this would help unlock stalled investment decisions since the Referendum, although it would still take time new investment decisions to translate into new market demand. This means mineral products producers are expecting a generally flat market this year.

“Markets will have to wait for 2019, when a boost in demand should come from the planned acceleration in the Road Investment Strategy spending plans and work underway for HS2 and Hinkley Point C. It is therefore essential that there are no further delays on the delivery of these projects, and that any new and unnecessary sources of economic and political uncertainty are averted, to boost confidence and encourage positive investment decisions.”