UK construction market demand for mineral products was lower in Q2 2017 compared with the previous quarter, providing evidence of a more general slowdown in UK construction activity in recent months.

Mineral products such as aggregates and ready-mixed concrete (RMC) are major elements of the UK construction supply chain, particularly in the earlier stages of projects. In addition, the bulky and comparatively low cost nature of these materials means that they are not usually stocked for future use on project sites. This means that Mineral Product Association (

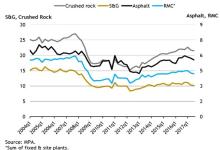

After three quarters of generally positive activity across MPA markets post the EU Referendum, demand for construction mineral products declined in Q2 2017 compared to both the previous quarter and Q2 2016. Sales of aggregates and RMC fell by 5.1% and 5.3% respectively compared to Q1 2017, the fastest quarterly rate of decline since Q3 2013 for RMC, and Q2 2012 for aggregates. Asphalt sales fell by 2.4% over the quarter, although overall results for the first half of the year remain 5.2% up compared to the first half of 2016. Mortar sales, which had accelerated significantly post-referendum in line with housebuilding, also weakened in Q2 2017, down 2.5% compared to the previous quarter.

A slowdown in overall markets activity was expected this year, given current forecasts for softer economic and construction activity in the medium term. A big driver for construction activity and British mineral products’ markets going forward is expected to come from infrastructure, including Highway England’s roads programme and the start of big projects such as Hinkley Point C and HS2. However, in roads for instance, anecdotal reports of continued delays in Highways England’s renewals projects continue to hold back asphalt sales in England, whilst activity on Scottish roads is now winding down markedly.

Simultaneously, sales volumes of RMC in London have now declined for three consecutive quarters, suggesting the market may have peaked last year, although volumes remain at very high historic levels.

On an annual basis, and despite the weaker performance in Q2 2017, sales volumes for the year finishing in June 2017 remained positive across all major MPA construction minerals, with asphalt up 4.8% compared to the previous year, 2.9% for aggregates volumes and 1.4% for RMC. Mortar sales, the strongest market, grew by 8.4% over the period.

Aurelie Delannoy, chief economist at MPA, said: “The weakening of demand across all major construction mineral products markets provides evidence of a general slowdown in construction activity, which was also highlighted in other data sources. Mineral products producers find themselves facing something of a dilemma, with construction activity in housing and commercial building expected to slow down this year, whilst the big infrastructure projects are only expected to come to full capacity in 2018/19.

“Given the current macroeconomic and political uncertainties, it is of the utmost importance for business confidence that planned projects do not see any further delays, as this may have a detrimental impact on future industry investment and the supply chain.”