Demand for construction mineral products in Great Britain was lower in 2017Q3 compared to both the previous quarter and 2016Q3 across all materials, except for mortar.

Demand for mortar increased by 1.6% in 2017Q3 compared to the previous quarter, but sales volumes were down by 1.1% for aggregates, 1.8% for ready-mixed concrete (RMC) and 2.9% for asphalt, says the Mineral Products Association (

The weaker trend in mineral products sales provides evidence of further weakening in general construction activity in recent months, and corroborates messages highlighted in other data sources, including from ONS (Office for National Statistics).

Mineral products such as aggregates and RMC are major elements of the construction supply chain, particularly in the earlier stages of projects. In addition, the bulky and comparatively low cost nature of these materials means that they are not usually stocked for future use on project sites.

This means that MPA sales volumes, which represent between 70%-95% of total GB markets for these materials, can be used as a reliable and straightforward indicator of construction activity.

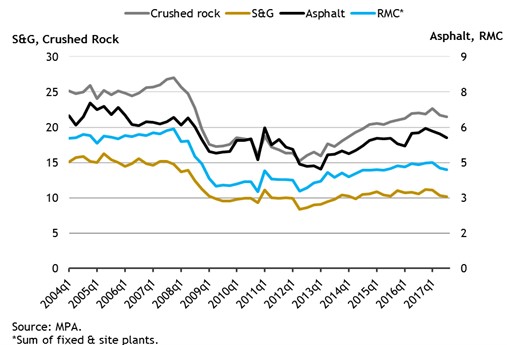

Taking a longer-term view, the pattern of demand for mineral products this year so far also suggests that there is more than one trend within construction activity.

Sales volumes for first three quarters of 2017 were positive for both mortar and asphalt, up 10.5% and 2.3% respectively compared to the same period in 2016, whilst aggregates remained flat and RMC declined by 1.9%.

Mortar sales show that construction activity is heavily skewed toward housebuilding, while asphalt sales are being supported by road activity in England, partially offsetting declines in Scotland.

Meanwhile, continued reductions in RMC sales, notably in London, point to emerging weaknesses in commercial office building work.

Looking forward, slower economic and construction growth expected for next year will drag on mineral products sales.

Muted activity alongside weaker sales volumes in the past six months and a degree of uncertainty on the timing of delivery for roads and major infrastructure projects means that MPA expects aggregates and RMC markets to remain flat during 2017-19, with marginal growth for asphalt, while mortar sales should continue to grow steadily, reflecting continued momentum in housebuilding.

“Two consecutive quarters of weakening demand for mineral products confirm the general slowdown in construction, despite the strong growth seen in housebuilding,” says Aurelie Delannoy, Chief Economist at MPA.

“Domestic pressures on commercial and industrial construction means that businesses are now very much looking forward to a boost from planned infrastructure projects, with work expected to gather pace on the Thames Tideway Tunnel, Hinkley Point C power station and Highways England’s road programme, and the start of HS2 high-speed railway next year.

“Delivery and the pace of delivery on these projects is crucial; without them, the prospects for mineral products producers and the wider construction industry could be more negative.”

“The Chancellor will have the opportunity during the Autumn Budget this month to address some of the issues. A focus on policy measures to boost business confidence and investment, whilst alleviating concerns over the outcome of the Brexit negotiations, would support domestic economic activity, including construction.

“In addition, there is also an opportunity to speed up the delivery of infrastructure projects, including Highways England investment which, to date, remains heavily back loaded toward the end of the five year 2019/20 Road Investment Strategy period and beyond.”