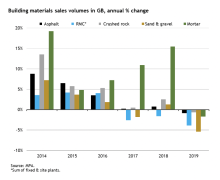

Sales volumes of construction-related mineral products weakened in the third quarter of 2018 across all British markets monitored.

The Minerals Products Association says that, following a comparatively strong catch-up during the spring after poor weather in Q1, demand failed to pick up in Q3 in sectors including aggregates, asphalt, ready-mixed concrete and mortar.

Seasonally adjusted sales volumes for asphalt saw the sharpest decline, down 4.6% in Q3 compared to the previous quarter, followed by mortar (-4.0%), aggregates (-2.0%) and ready-mixed concrete (-1.5%).

The

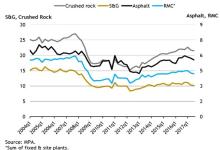

Within aggregates, growth in crushed rock sales (1.5%) over the same period was offset by falls in sand & gravel (-1.0%), a market that is particularly affected by the weakness of ready-mixed concrete, its dominant end-use. In addition, despite quarterly falls across all materials, sales volumes in 2018Q3 remained above historical averages (since 2004Q1) for aggregates, asphalt and mortar, but not for ready-mixed concrete.

The MPA says the results reflect the nature of construction work currently taking place. Evidence from MPA members suggests that some 40% of ready-mixed concrete sales are used in commercial, industrial and public construction projects such as schools and hospitals, and a further 20% is used in housing, whereas mortar is mainly used in housebuilding.

Strong growth in mortar sales this year to date show that construction work continues to be skewed towards housebuilding. The fall in ready-mixed concrete sales has been driven by London, where volumes stood 5.4% lower in the first nine months of the year compared to the same period last year, and volumes in Q3 2018 were down 14% compared to their recent peak two years ago, reflecting a slowdown in housebuilding and commercial offices in the capital. At national level, latest ONS data confirm that construction output has been primarily driven by housebuilding so far this year, offset by falls in output in public construction projects and private commercial buildings.

Looking forward, the

MPA director of commercial affairs Aurelie Delannoy commented: “From a mineral products’ perspective, the weak market performance this year so far, alongside a subdued outlook for construction, means that we are expecting sales volumes to fall in 2018 across all our markets, except mortar. The long-awaited boost to major infrastructure projects and the Road Investment Strategy previously planned from 2019 is now forecast to feed through more slowly given the continuous delays in the roads programme and main works on HS2.

“Mineral products producers outside mortar are now facing the prospects of markets remaining flat to marginally negative for an extra year, in 2019. Modest growth is only expected to resume from 2020, depending on the Brexit negotiations progressing as the year ends, with a transitional period agreed as part of the Withdrawal Agreement. The prospects of a ‘No Deal’ Brexit is not one that would be desirable for businesses in our industry, and is causing great concern.”