Demand in the UK construction market for mineral products recovered in the second quarter of 2018 after a very poor first quarter.

Activity in Q1 had been hampered by the cumulative effect of exceptionally bad weather and the collapse of construction company

Despite the rebound, the

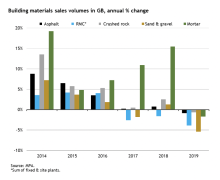

Mortar sales recovered strongly in the second quarter, up 20.9%, underpinned by continued momentum in housebuilding where this material is primarily used. The volume of mortar sold in Q2 was the highest quarterly total since MPA records began in 2004. Meanwhile, sales volumes for every other material monitored remain well below their pre-recession peak in 2007.

After accounting for seasonal variations, sales volumes for aggregates and ready-mixed concrete increased by 9.2% and 9.8% respectively in Q2 compared to the previous quarter, and by 11.3% for asphalt. Materials such as aggregates and ready-mixed concrete are used across all types of construction work, primarily earlier in project timelines. The MPA says the recovery in sales volumes for these materials is a clear indication that general construction activity also rebounded from the slow start of the year.

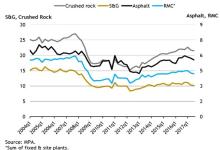

The association adds that, while the improvement in construction market demand in Q2 was very welcome, the underlying longer-term trends remain subdued. Sales volumes for all materials except mortar were lower in the first half of 2018 compared to the same period last year, as well as on an annual basis. In the year to June 2018, sales volumes of aggregates were 1.7% lower than the previous year, 3.1% lower for asphalt, and 5.4% lower for ready-mixed concrete. By contrast, mortar sales volumes grew by 12.7% over the same period. The longer-term weakening in mineral products markets suggests construction activity outside housebuilding remains subdued.

There are also some interesting regional disparities. Sales volumes for asphalt in the first half of 2018 point to positive road activity in the South East and South West. This was offset by declines in the West Midlands, the northern regions of England, and most particularly in Scotland, where some large transport projects came to an end last year. Ready-mixed concrete sales by contrast were weaker across all regions of Great Britain compared with the first half of 2017. The biggest decline took place in London, which had seen very strong post-recession growth, and most likely reflects a slowdown in commercial office building.

Aurelie Delannoy, director of economic affairs at the MPA, commented: “Sales volumes weakened in the past year, in line with general construction work. Outside housebuilding, there are limited sources of growth. Major infrastructure investments such as High Speed 2, Hinkley Point C and Highways England’s road programme should provide a boost, most noticeably from 2019 onwards, if momentum is sustained.”

She added that the heightened level of economic and political uncertainty is having an adverse impact on private investment, particularly in some areas of construction such as commercial office building. This is not helped by continuing uncertainty about the delivery of infrastructure projects and related timings.

"The potential ‘No Deal’ Brexit would further threaten construction investment," said Delannoy. "In such a scenario, the mineral products industry and other sectors in the construction supply chain would become early victims of the economic fallout. As such, the negotiating parties need to maintain focus on economic realities to avoid such an outcome.”