The

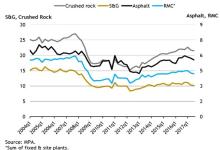

Sales volumes of ready-mixed concrete (RMC) in Great Britain improved by 4% compared to 2015, matched by a 4.2% increase for aggregates, and 4.6% increase for mortar. Asphalt sales remained broadly flat compared to 2015 (+0.1%).

On a quarterly basis, sales volumes for these materials in Q4 2016 were also positive, and improved compared to the weaker markets observed over the summer. Sales of RMC and aggregates grew by about 1.5% in the final quarter of 2016 compared to the previous quarter, and 2.4% for asphalt. Materials such as RMC and aggregates are used across all major construction sectors, particularly in the earlier stages of projects, and therefore provide hard evidence of sustained activity on the ground. In addition, mortar sales, underpinned by strong housebuilding activity, increased by 4.3% over the same period.

Despite the positive volumes evident since the EU Referendum, the regional picture is more mixed, and lower demand in Wales in particular indicates, the MPA says, declining construction activity there in 2016. While the GB asphalt market was flat in 2016, sales volumes in England dropped by 1.7% for the year and, the MPA argues, confirmed industry concerns about lower and slower Highways England spending on renewals work and constrained local authority budgets.

Overall, it is clear that MPA markets, construction and the general economy in the UK in 2016 have been more resilient than anticipated, but some slowdown is still expected by the MPA for 2017, when the impact of the depreciation of sterling and the start of the process of leaving the European Union is likely to impact on overall economic activity. The weaker outlook for both business investment and household real incomes in 2017/18 will, the MPA believes, constrain general construction activity and mineral products sales in the medium term.

Aurelie Delannoy, chief economist at MPA, said: “Our data show that construction activity remains resilient, but as inflationary pressures build up, housebuilding and construction of commercial offices and retail, the two sectors that supported activity last year, will be the most vulnerable if the risks of a general economic slowdown materialise. Meanwhile, infrastructure spending is likely to be a more positive feature of construction, but only from 2018. This raises concerns about construction activity and related mineral products sales in 2017.

“In times of great uncertainty about the future UK economic model and our relationship with our major trading partners, building and maintaining confidence is key to investment in construction and related markets. Accelerated delivery of smaller scale infrastructure projects would send a strong signal to the industry and investors.”