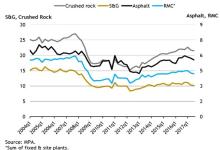

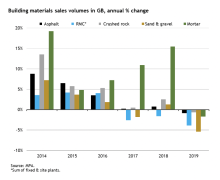

Following a broad-based weakening in the first half of 2019, UK construction market demand for mineral products, including aggregates, asphalt, ready-mixed concrete (RMC) and mortar, improved in Q3 2019 compared to the previous quarter. Growth in mortar sales was the strongest, up 5.2% compared to Q2 2019, followed by asphalt (4.1%), aggregates (2.7%) and ready-mixed concrete (RMC) (1.4%).

Whilst welcome, this improvement has not been sufficient to lift the market performance for 2019 so far. In the first nine months of the year, markets for asphalt and mortar remained broadly flat compared to the same period in 2018, while sales of aggregates and RMC declined.

The Office for National Statistics (ONS) estimates that construction output increased by 2.6% over Jan-Aug 2019 compared to the same period in 2018, with growth driven by housebuilding and new infrastructure work. Work on commercial sites, including retail and office buildings, continues to decline.

Aggregates and RMC are ubiquitous to any type of construction work, and are usually used early in a construction project timeline. Hence, given the weakness of these markets, it suggests that recorded construction output reflects continuing activity on existing sites rather than new sites. Following two years of subdued mineral products market conditions in 2017 and 2018, flat to negative sales volumes this year are precursors to a further slowdown in construction in the near term.

Despite initial expectations of work planned to pace up on Highway England’s roads programme this year, asphalt sales volumes saw a marginal decline by 0.6% over Jan-Sept 2019 compared to the same period in 2018, with falls particularly pronounced in the South West and East Midlands.

Simultaneously, the RMC market remains decisively weak and is heading for a third consecutive year of decline in 2019. Sharp declines in sales volumes continue to be recorded in both London and South East, which together account for a third of the total (GB) market. The general decline is closely tied to falling investment in commercial buildings, which have been impacted by the ever-increasing domestic uncertainty surrounding Brexit and the economy. It also reflects slower housebuilding activity in the capital.

Mortar sales are a straight forward indicator of housebuilding activity, especially in regions outside London where constructions are more likely focused on ‘bricks and mortar’ rather than high-rise towers. After a year of consecutive quarterly falls, mortar sales volumes resumed growth in 2019Q3, up 5.2% compared to the previous quarter. Yet again, the annual trend for 2019 remains weak: sales volumes increased by just 0.4% in the first 9 months of 2019 compared to the same period in 2018, a significant slowdown from two years of double-digit growth in 2017 and 2018.

Current construction forecasts, such as from the Construction Product Association, suggest housebuilding will pick up again from 2020, given continued support from Government’s Help to Buy scheme. Weakness in the commercial sector is expected to remain until at least 2021, as investment in the sector is being hindered by the ongoing Brexit negotiation process. More realistically, any growth prospects for construction and its supply chain is more dependent on what happens in infrastructure. If delivered as planned, major infrastructure projects in roads, rail and energy should boost activity on the ground over the next few years, but concerns are rising over the delivery of these projects, notably in the rail and road subsectors. The government-commissioned review into HS2 is likely to add further delays to a project already beset by them, whilst work on RIS1 looks unlikely to be delivered as planned, even after the revisions made by Highways England.

Aurelie Delannoy, director of Economic Affairs at the MPA, explains: “Government cannot overestimate the significance of the current infrastructure pipeline of work for both construction and its supply chain, and for the UK economy as a whole. At a time of great reckoning for the UK’s political and economic future, repairing local roads, building houses, schools, hospitals, and upgrading major rail and energy networks provide the means to lift both short-term and longer-term productivity and growth prospects. It is a great opportunity to put our own house in order.

“Government often asks how they can help businesses; the answer is simple: provide clarity over future policy and investment and stick to it. Regardless of any Brexit outcome, it is in the power of the UK Government to ensure planned infrastructure investments are being delivered in a robust and timely manner.”