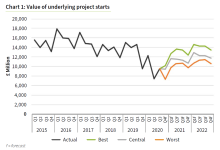

In 2019, equipment rental companies and other firms providing rental services generated a total rental turnover of more than €27.7bn in the 15 countries (EU-EFTA-UK).

The ERA says that 2019 was a year of growth for all the markets covered. This growth, however, was at different stages, with some markets already slowing down (France, Belgium, Sweden) and others still reporting robust growth (Germany, Poland, Italy). The first quarter of 2020 reflected these dynamics.

The COVID-19 pandemic, however, hit European economies over the second quarter of this year. The immediate impact differed from country to country. The Nordic countries, which did not lockdown and had almost no site shutdowns, have performed differently to southern Europe and the UK, which faced severe lockdowns and disruptions to activity. The UK has been further impacted by the uncertainty surrounding the Brexit negotiations.

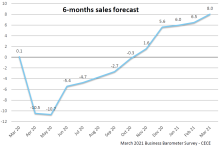

The forecasts included in the report are based on assumptions at the end of September. The hypothesis is that there will be no further lockdowns across Europe apart from local and temporary restrictions, and the forecast also does not factor in the development and mass availability of a vaccine.

The ERA commented: "It is important to stress the extreme conditions of 2020, which have been analysed with the forecasts for 2021. Large drops are expected this year, but significant rises – some of them due to technical rebounds – are expected in the short-term, as well as in the medium- to long-term."

The ERA was created in 2006 to represent national rental associations and equipment rental companies in Europe. The ERA Market Report, compiled with IHS Markit, contains detailed market information for the years 2016 to 2022 and key indicators, including rental turnover, fleet value and investments. It covers equipment that is rented by an operator.