The cement sector across the Middle East is currently being heavily impacted by the twin factors of general global major over-supply and the geopolitical situation.

The cement utilisation figure in the UAE, Algeria and Egypt is running at around 50% of that produced, Saudi Arabia is at 60%, while in Morocco the utilisation rate is 80%, according to Amr Nader, CEO of the A³&Co consultancy, and an expert on the Middle East cement sector.

“Everywhere you look in the Middle East there is over-supply with price constraints and some sort of price war taking place,” says Nader.

He adds that the Middle East market should be looked at in two different contexts. There are the oil-rich countries and the population-rich countries.

“In oil-rich countries development is driven by an excess of money for infrastructure, and new megaprojects are being government funded,” he says.

“Consumption revenue is driven by government investment. These countries have a young and well-educated population, and there is a focus on making processes faster, more efficient and automated.

“In the high-population countries like Egypt, Morocco and Algeria development is driven by expansion of the population and the requirement for housing. It’s more private sector-driven.”

Saudi Arabia has the highest percentage of state ownership of cement manufacturers in the region at just under 35%. “With the exception of perhaps Algeria, most countries are private sector-driven with around 90% of companies being privately-owned,” Nader states.

He adds that a major opportunity for the Middle East cement sector is being driven by the decarbonisation efforts in response to climate change commitments. The carbon credit schemes in Europe and the USA are leading to a reduction in cement and clinker production, which is driving higher export levels from Middle East countries, particularly the UAE, Saudi Arabia, Egypt and Morocco.

In terms of cement sector sustainability and decarbonisation efforts in the region, Nader highlights the UAE, Saudi Arabia, Egypt and Morocco as being at the forefront, all being driven by their net zero commitments and quite aggressive 2030 targets.

“Morocco is way ahead and has about 40% green [renewable] energy with quite a resolute framework for decarbonisation,” he says. “Then you have the UAE and Saudi Arabia. The UAE’s goal is to have 60% renewably-generated energy from its grid by 2030 and it has recently set out an ambitious long-term strategy.”

Saudi Arabia has committed to have 50% of its power generated from renewable sources by 2030.

Egypt clinker reduction

Nader says that Egypt is stepping up efforts to move to lower clinker cement, in addition to a drive towards energy efficiency, and has recently released a hydrogen law to boost hydrogen production driven by solar energy.

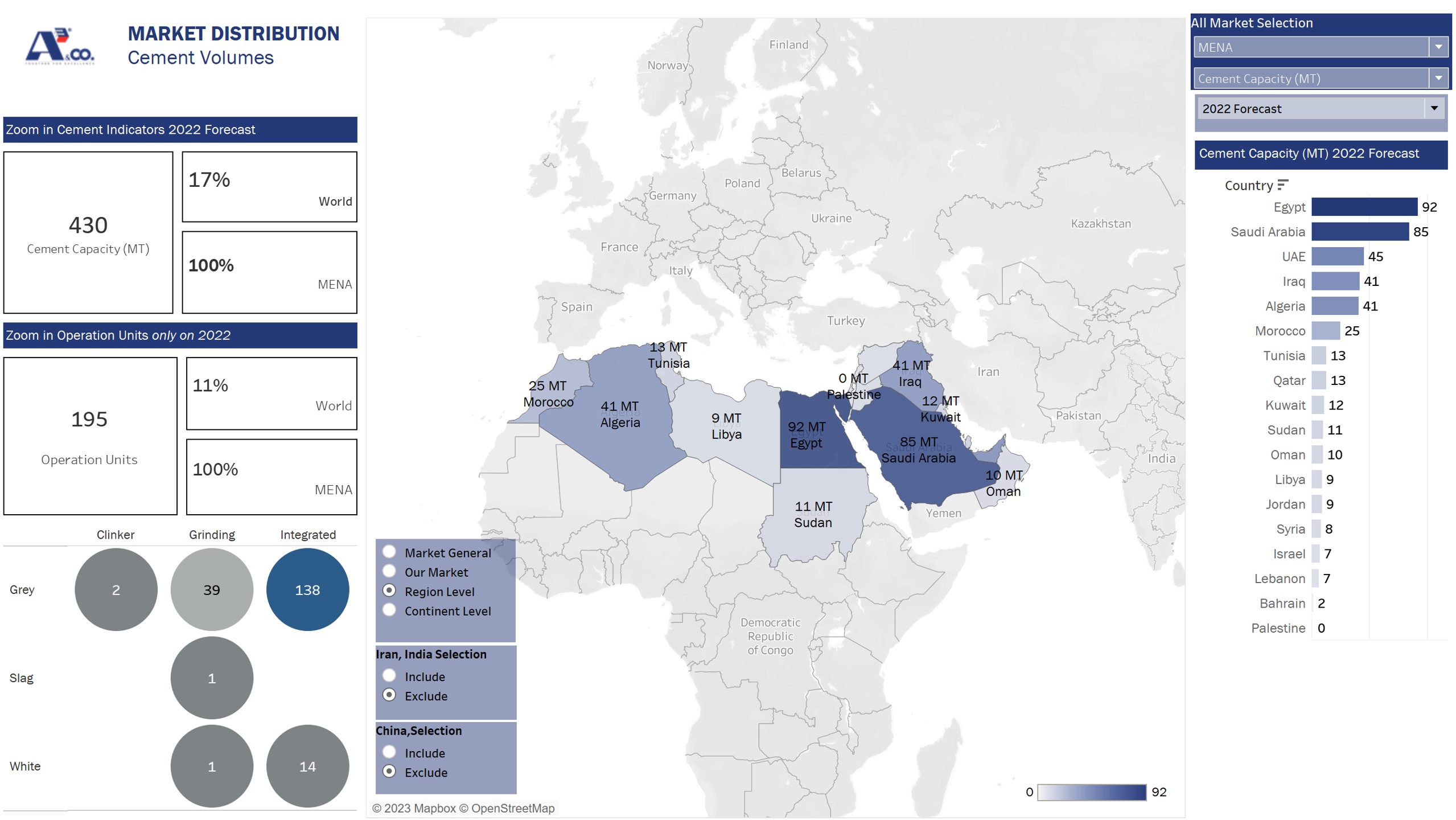

Egypt is the largest cement producer in the MENA regions with an estimated production of 92 million tonnes in 2022, followed by Saudi Arabia with 85 million tonnes and UAE with 45 million tonnes, according to data from A³&Co. Other major MENA cement producers in the year were Iraq (41 million tonnes), Algeria (41 million tonnes), and Morocco (25 million tonnes).

The MENA region had a total cement production capacity of 430 million tonnes in 2022, accounting for 17% of the global figure, excluding China and India. The countries with the highest cement consumption in 2022 were Saudi Arabia (62 million tonnes), Egypt (50 million tonnes), Iraq (31 million tonnes), Algeria (24 million tonnes), Morocco (13 million tonnes), and UAE (11 million tonnes).

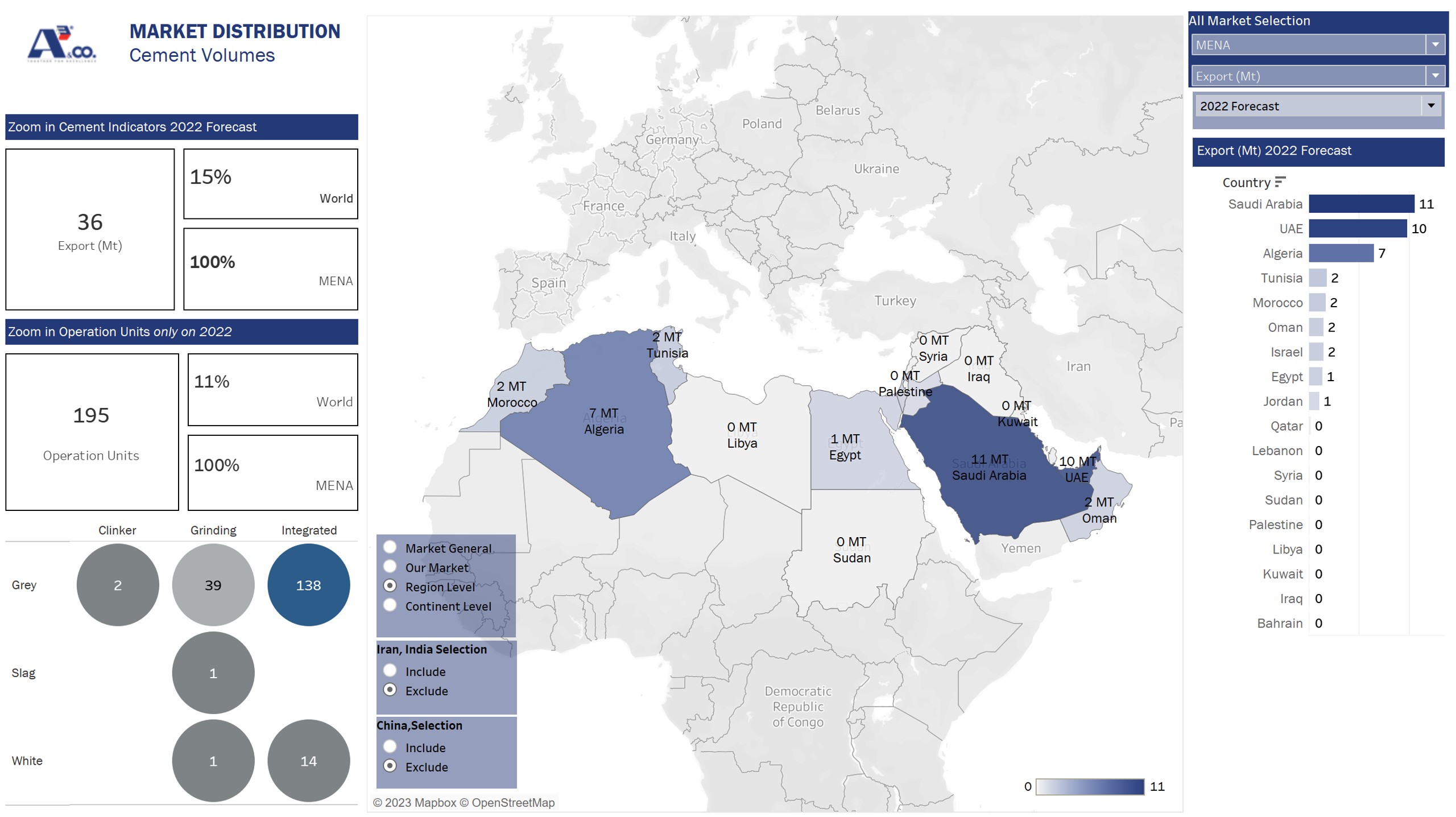

As well as being the biggest cement consumer Saudi Arabia was also the biggest cement exporter in 2022 (11 million tonnes), followed by UAE (10 million tonnes), and Algeria (7 million tonnes).

Nader says that the levels of cement production are stable across the Middle East. The over-supply means that there is little potential for smaller production countries to expand their production levels, and Egypt and Saudi Arabia will remain comfortably the largest producers going forward.

Nader says that there are a number of eye-catching cement sector sustainability projects from SME players in the region that are not part of the major cement producing groups such as those by CIMAT (Ciments de l’Atlas) in Morocco, Arabian Cement in Egypt, Arkan Cement in the UAE, and a number of producers in Saudi Arabia (including Yamama Saudi Cement and AlSafwa Cement).

“CIMAT is embarking on a large scale decarbonisation roadmap with over US$100m investments, and Arabian Cement and Arkan Decarbonisation are also making decarbonisation roadmap efforts, in addition to Yamama Digital,” says Nader.

The move to sustainable cement production in the Middle East and North Africa (MENA) region is largely driven by incentives rather than regulations, Nader says. “Morocco is investing in maximising green power utilisation, and Egypt is supporting the use of local materials and reducing imports of coal for use in cement production,” he adds. “Saudi Arabia and the UAE also provide incentives to companies that ‘go green’.”

Mega-projects

A number of huge infrastructure initiatives are acting as major drivers for cement demand in the MENA region. In Saudi Arabia there are two current giga-projects, the Neom and the Red Sea initiatives.

The US$500bn Neom Project on the northwest Red Sea coast of the Kingdom covers 26,500km (almost the size of Belgium) and is designed as a sustainable region for living, working and leisure. Around 20% of the project has reportedly been completed so far.

The Red Sea Project, started in 2018 and promoted as the ‘Maldives of the Middle East’, is claimed to be the world’s most ambitious luxury tourism development and encompasses an archipelago of 90 islands, desert and mountains. The project is scheduled for completion by 2030.

In Egypt, the New Administrative Capital (NAC) project for the country’s new capital city, part of the larger Egypt Vision 2030 initiative, is a major provider of demand for cement. The project includes the 400m-high Iconic Tower, set to be Africa’s tallest skyscraper.

In the UAE major projects that have been driving materials demand are the infrastructure development in Abu Dhabi including a new airport terminal, and the expansion of the downtown and marina areas of Dubai.

Other major infrastructure projects in the region include the Bismayah Residential City in Iraq, the East Sitra Link Road Project in Bahrain, the Lusial Future City Project in Qatar, and the Sohar Titanium Project in Oman.

Nader predicts the UAE construction market will offer huge opportunities for material suppliers going forward and is expected to be worth US$134bn by 2028, up by 34% on its present value.

In terms of the important technologies driving innovation in the Middle East cement market, Nader says that sediment treatment units which improve the utilisation of refuse derived fuel (RDF) waste can improve productivity by around 40%.

In addition, the use of ‘green’ power is rapidly increasing in the Middle East cement sector, in particular solar and wind-derived energy.

CCUS tech

CCUS (carbon capture utilisation and storage) technology to decarbonise cement production is not currently used in the Middle East, which is particularly due to the typically large size of cement plants in the region. “The smallest cement plants are around 2,000 tonnes in production per day, and the current model for carbon capture only works with very small plants. It takes eight or more years for CCUS projects to be implemented so it will take at least that long for it to become a solution in the Middle East.”

He adds that this reflects the current global situation regarding the use of CCUS in the cement industry, with the total amount of carbon stored being just 4% of the total that is produced in the sector.

The large size of cement plants in the Middle East provides advantages for producers in the region in terms of economies of scale and increases in efficiency. “The plants are all relatively new and only date back to the late 1990s. Most have dry process kilns and have the advantage of state-of-the-art technology, and there are no plants going back to the 1950s like in Europe,” Nader says. “They are mostly highly-automated plants. The abundance of sun, wind and land across the region also provides advantages in the adoption of green power, and there is a very good opportunity in the Middle East cement sector to drive adoption and become a global leader in this area.”

In terms of future trends in the region, he says there will be a focus on sustainability and decarbonisation, with an increase in green products going forward.

He also predicts that cement exports out of the Middle East are likely to double over the next two to three years. Saudi Arabia, the UAE and Algeria are currently the biggest exporters.

“Algeria has announced that they want to move to being an export hub”, he adds. “They have the advantages of lower costs and greener plants and most of their plants are powered by natural gas, which is 10% greener and has a lower carbon footprint than other plants at the same efficiency. They have huge capacity and around 40% of their plants are on the Mediterranean coast, so well suited to enter the export market.”

Cement exports

Nader says that 40% of current cement exports from the region go to sub-Saharan African countries, a further 40% to Bangladesh, and remaining 20% to the US and Europe. He anticipates that exports to the US and Europe will increase in the coming years as high carbon taxes in these two territories mean it will often be cheaper to import cement from the Middle East.

Based in the Sharjah Media City business park in Al Batayih, United Arab Emirates, A³&Co. offers strategic and operational advisory services for the cement industry. Its advisory portfolio spans across the full value chain of cement manufacturing, throughout the key processes of the cement lifecycle; horizontally from quarry to dispatch, and vertically through the industrial, human capital, finance, sales & marketing functions.

The consultancy operates across the Middle East and also has projects in North and sub-Saharan Africa, Canada, the US, UK, Spain, France and central Asia. Amr Nader has worked in the global cement sector across 62 countries, with the only region he has not been involved in being South America.

Nader says there are three main current drivers for A³&Co’s business: decarbonisation, digital maturity, and efficiency driven solutions to reduce companies’ costs and provide them with a competitive edge.

A³&Co is mainly focused on small and medium-sized cement industry companies, although it has conducted projects with larger players including Cemex, CRH and Holcim.