Market activity in the UK and Irish aggregates sectors is currently fairly flat, but industry representatives are bullish about long-term prospects in both countries. Liam McLoughlin reports

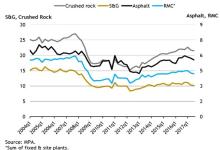

Following an unexpectedly strong performance at the end of 2018, UK sales volumes of mineral products across markets including aggregates, asphalt, ready-mixed concrete (RMC) and mortar declined in Q1 2019.

Seasonally adjusted sales volumes for aggregates had the sharpest decline, down 4.2% compared to the previous quarter, followed by RMC (-4.0%), mortar (-2.8%) and asphalt (-1.9%).

The UK

The MPA says the decline in asphalt sales in the first quarter of 2019 is disappointing given the Autumn Budget 2018 commitment of an additional £420m of funding for local road maintenance in 2018/19, which the Department for Transport said in April had all been spent on local authority “general highway maintenance”. Following positive asphalt sales in the fourth quarter of 2018, which may have been impacted by the additional Budget funding, the MPA results do not suggest any significant overall improvement in local road maintenance activity in the first quarter arising from this funding.

Although mortar sales remain at historically high levels, the recent decline in quarterly sales points to a slowdown in housebuilding since mid-2018.

In the longer term, the MPA says that trends in mineral products sales suggest, nonetheless, that markets have remained reasonably robust, as volumes across all materials increased moderately in the 12 months to Q1 2019, compared to the previous 12 months.

Aggregate sales were 5.5% higher in the year to March 2019 compared to the previous year, whilst asphalt and RMC sales were up 4.3% and 3.9% respectively. Mortar sales by contrast, closely linked to housebuilding, continued to increase strongly, up 16.2% over the same 12-month period but with sales declining in recent quarters. Whilst the industry will welcome these positive annual results, the MPA cautions that they include a strong catch-up effect in Q2 2018, following the major negative impact of the bad weather on the industry’s output early 2018. Therefore, the association says the improved 12-month trends should be viewed in the context of a distorted sales pattern, as the poor Q1 2018 results have fallen out of the current 12 months into the previous 12 months.

Looking ahead, the latest spring 2019 forecast from the

The MPA says the medium-term outlook for mineral products and construction markets will depend critically on the speed of delivery of infrastructure projects. For example, Highways England’s national Road Investment Strategy indicates a significant increase in work and investment in 2019/20 and 2020/21 which industry is not only eager to supply but has invested in capacity to do so. However, the MPA says there continue to be industry reports of major concerns about delays in key road projects, and a clear lack of confidence that the programme will be delivered as planned.

Nigel Jackson, chief executive of the MPA, said: “There is little doubt about the outstanding need for investment in infrastructure and housing, but private investment throughout the economy, including construction, is being impacted by the current political chaos and economic uncertainty.”

The MPA says that revenues from the £400m per year Aggregates Levy should be used to help finance the operation of the UK’s mineral planning system.

The association made the call in a submission to HM Treasury’s Comprehensive Spending Review (CSR). It said that using part of the levy to support the mineral planning system would provide a foundation for future housing, infrastructure and other development.

The MPA highlights the fact that the UK mineral products industry is a key enabling industry which provides the products and services which allow plans to invest in housing, infrastructure and other development to be realised. To ensure that this supply chain continues to function efficiently it says the planning and regulatory systems need to be modernised and better resourced.

Jerry McLaughlin, director of economics and public affairs at the MPA, said: “There has been notable progress in infrastructure planning and engagement in recent years and it should be a clear objective of the next public spending period to build on this progress with a greater focus on project and programme delivery. Ensuring that adequate funding is in place and that there is better engagement with infrastructure and construction supply chains so that project benefits are seen throughout the UK, is vital.

“An early opportunity to help ensure infrastructure and housing delivery is to use a small proportion of the £400m pa of Aggregates Levy receipts to help finance the operation of the mineral planning system.”

The quarrying and aggregates sectors in the UK and Ireland are currently fairly flat, according to Tony Welch, sales manager, UK & Ireland at

“Aggregate producers [are] having spare capacity as Brexit delay/uncertainty has caused a ‘holding pattern’ for major infrastructure projects like HS2, London rail link & housebuilding which is progressing, albeit at a very reduced pace,” says Welch.

Sales of aggregates and quarrying equipment picked up slightly in the UK during June after a slight dip in the preceding two months, according to Nigel Irvine, sales and marketing director at tracked-mobile crushing, screening and conveying equipment company

Speaking to Aggregates Business Europe at June’s CQMS construction and quarrying equipment show in Kildare, Ireland, he said that uncertainty over the Brexit process could be having an effect on the markets in both the UK and Ireland.

“In the UK we had a fantastic 2018,” Irvine added. “It slowed a little recently in April and May - whether that was Brexit-related, we’re not really sure. Activity has picked up again and 2019 is still looking to be an even better year for us in terms of sales. Halfway through the year we have a healthy order book months out in advance and we are projecting that sales will be up 25% on 2018.

“Demand in Ireland is recovering after several years of low activity. The products that are in demand from our UK and Irish customers are either for aggregates use or for recycling and demolition applications, being compact jaw and impact crushers and 6-series and 8-series screens. The 8-series screens are our biggest sellers.”

Irvine said that plant and equipment management is likely to become increasingly important in the UK and Irish markets going forward for both its economic benefit and health and safety reasons.

“The T-Link telemetry system is now standard on all our crushers and screeners,” he adds. “It provides quarry managers with an increased level of equipment and plant overview, available at the touch of a button from an office.”

Despite lingering uncertainty surrounding Brexit, quarrying and aggregates customers are still making decisions and proceeding with projects according to David Hunter, sales director at Terex Washing & Materials Processing Systems.

“We are continuing with our direct sales approach in the Irish market and completed more than 20 installations in the UK in partnership with Duo Equipment and Blue Machinery Scotland last year, and there is no sign of that letting up this year,” Hunter says. “Customers are looking for more bespoke equipment, and they want more variations. We are moving into more specialist sand applications using classification technology to separate sand from the unwanted material. As our business grows we are continuing to incorporate other technologies into our product range.”

The population of the Republic of Ireland is predicted to increase by one million by 2040, which has major implications for infrastructure and construction, and from this the level of demand for aggregates and building materials.

Irish Minister of State for Housing and Urban Development Damien English says that the increase in population will require the construction of 500,000 more houses over the next two decades.

In an effort to meet this demand and enable a sustainable construction sector, the Irish government launched the Project 2040 initiative in March this year. It has pledged €170bn in funding to support the first ten years of the project.

“In the last two years there has been a move over to housing in the construction sector, and that is what we want to push,” English says. “There has been a major improvement over the last couple of years in the availability of construction machinery.

“We have to get away from the boom and bust that has led to a lot of people suffering over the years. We want to have a sustainable construction sector.”

He added there is a pressing need to expand major construction projects beyond the capital city. “We can’t continually expand Dublin,” English said. “We have to expand Cork, Limerick, Wexford and Galway – there is an awful lot of available brownfield space.”

Seventy-five per cent of the projected one million increase in population will live and work outside Dublin, according to Tom Parlon, director general of the Irish Construction Industry Federation.

He says the completion of projects such as the much-delayed Limerick to Cork motorway – which would cut travel time for the 100km distance between the two cities

to one hour – would reduce congestion and be a counter-balance to the dominance of Dublin.

He adds that there is currently a skills shortage in construction. “If the 2040 plan is to be implemented, we are going to need an extra 100,000 people in the industry and we are not being fully assisted by the government at the moment.”