There are positive signs for the quarry products industry in the UK and Ireland. Patrick Smith reports.

Quarry products are big business in the UK, with construction market demand for mineral products being higher in the first-quarter of 2017 compared with the previous quarter. The

Now many companies are looking ahead to an increase in infrastructure spending by the government following the general election (held on 8 June), and an increase in housebuilding and other projects.

The MPA emphasises that mineral products such as aggregates and ready-mixed concrete (RMC) are major elements of the construction supply chain, particularly in the earlier stages of projects, so its results point to a sustained level of construction activity on the ground.

MPA’s membership is made up of most of the independent SME quarrying companies throughout the UK and nine major international and global companies, and it covers 100% of GB cement production; 90% of aggregates production; 95% of asphalt, and over 70% of ready-mixed concrete and precast concrete production.

Each year the industry supplies £20 billion (€23.5 billion) worth of materials and services to the economy and is the largest supplier to the construction industry, which has annual output valued at £144 billion (€168.5 billion).

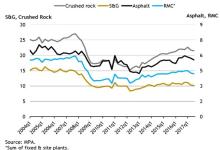

In its report, MPA says that sales of aggregates grew by 2.1% in 2017Q1 compared to the previous quarter, and RMC by a positive, but more subdued 0.7%.

Mortar sales accelerated further, with volumes up 6.6% in 2017Q1. Mortar sales are closely linked to housebuilding and the rapid growth of this market since last summer suggest that housing remains the primary driver suggests of construction activity.

The volume of asphalt sales by contrast declined by 0.8% in 2017Q1.

Overall, sales volumes for the year finishing in March 2017 revealed healthy rates of growth across all major MPA construction minerals, with asphalt up 5.2% compared to the previous year; 5% for aggregates volumes, and 4.3% for RMC. Mortar sales, the strongest market, grew by 6.9% over the period.

The organisation says that nearly a year after the outcome of the EU referendum, and the UK’s decision to leave the union (Brexit), it is clear MPA markets and the construction sector have shown more resilience than expected.

However, while the overall annual performance in asphalt sales is positive, the quarterly profile points to a very uneven level of activity. In its latest assessment on the progress with the Road Investment Strategy, the National Audit Office found that Highways England was struggling to deliver planned projects, a situation that makes it very challenging for the industry to gain a clear understanding of the asphalt market going forward and the timing of further increases in demand arising from Highways England’s road programme.

“We welcome the positive results in our markets in the first quarter of the year as a clear indication that construction activity still has some impetus. Whilst mineral products producers remain relatively optimistic, their prospects for growth in the coming months may be dampened by the anticipated slowdown in both the general economy and in private construction activity this year,” says Aurelie Delannoy, chief economist at MPA.

“Post-election, government’s policy development and implementation, as well as swift and constructive progress in the Brexit negotiations, will be central to the future health of the UK economy, the construction sector and ultimately, the mineral products sector.”

MPA says that negotiating a good deal on Brexit, in order to maintain UK competitiveness will be vital, and it has outlined what it sees as six main priorities, which it believes will help government deliver continuing prosperity for the UK. These are building confidence for investment; boosting growth; improving productivity and UK supply chains; promoting industrial competitiveness; easing the tax burden, and cutting and improving ‘Red Tape’.

Nigel Jackson, chief executive of the MPA, says: “Given the essential role mineral products play in underpinning the delivery of housing, transport and energy infrastructure, schools, hospitals, food, water and agriculture, we hope that the new government will take account of the practical measures we are proposing to help deliver their agenda and the continuing prosperity of the UK.”

One project that has proved a boost for the industry is the £14.8 billion (€17.35 billion) Crossrail railway project (the Elizabeth line) to link west and east London. Started in 2009, it is currently Europe’s biggest infrastructure project, and is now over 80% complete.

An even bigger project that will require a vast amount of materials is the planned High Speed 2 (HS2) railway, linking London and heading north to Birmingham, the East Midlands, Manchester and Leeds.

At an estimated cost of £56 billion (€65.5 million), work is scheduled to start soon and to be fully completed by 2033.

However, the scheme is not without controversy, and while the pre-8 June parliament approved the first two phases of construction, details of the plan and route are still open to negotiation and change.

Looking to equipment, Gavin Clark, business manager for Great Britain and Ireland,

“A day does not pass without Brexit in the news in some form or another, but as much as this hesitation exists, we are entering this period of uncertainty with large infrastructure projects either already begun or set to come to fruition. Providing these remain in place then supply requirements will continue,” he says.

“Further to the large projects that have become household names over the last couple of years, the main positive is the number of smaller projects on the horizon. This is not only in regards to housing but other areas such as transport, energy and flood defence. As an industry, our hope is that we continue to see investment in infrastructure to help drive the economy through this period of change.”

Over the last year, Clark says

At the Mountsorrel Quarry in county Leicestershire, central England, one of Europe’s largest granite quarries,

The

The group, which operates nearly 60 quarries, 27 asphalt plants, just under 200 ready-mixed concrete and mortar plants, and three concrete block plants throughout England, Wales and Scotland, employs more than 2,300 people, and says it has been transformed by the acquisition of Hope Construction Materials with integration well advanced and synergies accelerated.

It says a strong platform for growth has been established, with an encouraging outlook for 2017 on the back of expected increases in infrastructure and housing investment.

Recently, Irish-based group

A leading global diversified building materials group, employing some 87,000 people at 3,800 operating locations in 31 countries worldwide, CRH has a market capitalisation of around €27 billion (April 2017), and is the largest building materials company in North America and the second largest worldwide.

In the UK, CRH says it had a positive start to the year as volumes and prices of aggregates, ready-mixed concrete and asphalt were ahead of 2016, with cement volumes marginally behind

Meanwhile, speaking at the recent CQMS’17 exhibition in Tullamore, County Offaly, Ireland, David Mullan,

“There is a lot of investment in Ireland. A lot of the money is going into commercial construction but that tends to go hand in hand with residential construction,” says Mullan.

“There is a lot of building going on in commuter areas, satellite towns around the major cities like Dublin. Two or three of Ireland’s large quarrying groups are investing in equipment.”