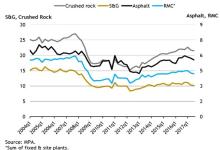

Following broadly flat markets in Q1 2016, sales of aggregates, ready-mixed concrete (RMC), mortar and asphalt improved in the second quarter. Compared to the first quarter of 2016, aggregates sales volumes increased by 1.5% in Q2 2016, RMC sales volumes by 3.3% and asphalt, which was the strongest market, increased by 11.5% over the three-month period. Mortar, a material mostly influenced by housing activity, remained broadly flat (0.2%) for the second consecutive quarter.

Annual sales volumes are also generally positive in the 12-months to June 2016, with aggregates and RMC sales volumes up by 3%-4% compared to the previous 12-months period, and mortar sales up 2% over the period. Asphalt, which is suffering from workload materialising at a slower pace than suggested by Highways England’s spending plans, fell by 1% over the period in spite of the second quarter improvement.

The overall positive trend in these markets indicates an improvement in general construction activity, as these materials are used across all major construction sectors, particularly in the earlier stages of projects. Our information, based on actual sales volumes of materials, therefore conflicts with the official ONS data on construction output for 2016Q2, which we would have anticipated to be positive.

Looking forward and given the current economic and political uncertainty that affects the UK economy, the Mineral Products Association (MPA) expect RMC sales to remain relatively flat over the next 18 months, rather than seeing the 3%-4% growth pa previously anticipated, due to slower housing activity and commercial construction.

Aggregates and asphalt are expected to see some declines, reflecting continued constraints on local authority road and transport investment, and workload from Highways England being delivered more slowly than previously expected.

In the longer term however, the MPA said the current pipeline of infrastructure work is positive for the industry, but the Association believes a confirmation of Government’s commitment to these projects is urgently needed to reinforce business confidence and encourage continuing investment.

Aurelie Delannoy, Chief Economist at MPA, said: “Demand for aggregates and RMC grew in the second quarter and still has momentum. These materials are ubiquitous in construction, so we are very surprised that the ONS construction figures for the quarter were negative. We do not think that construction declined in the second quarter in spite of some negative commentaries about the sector although over the year growth will remain muted. The 2016Q2 output was strong and everything needs to be done to sustain positive momentum.”

“Whilst it is difficult at present to understand the full implications of the Brexit vote for construction activity, longer-term needs for increased housing supply and greater infrastructure investment remain and will need to be delivered. Clear and continued Government support in these areas and measures to encourage private investment will be necessary to help counter any potential adverse economic effects of the Brexit vote. This is needed to ensure the adequate supply of essential materials to the UK economy and support growth.”